- November 6, 2024

Spotting Lucrative Current Yield Stocks

Discover how to spot lucrative Current Yield stocks. This two-pronged dividend strategy delivers both long-term growth and immediate cash flow.

Read moreDiscover how to spot lucrative Current Yield stocks. This two-pronged dividend strategy delivers both long-term growth and immediate cash flow.

Read moreI love it when a company raises its dividend. For most of the big companies we hold long-term, it happens like clockwork after four steady payments are made.

Read moreThe magic of compounding can turn a dividend stock into a wealth-building machine.

Read moreThe markets saw a fifth straight week of gains last week.

Read moreI’ve gotten a lot of inquiries recently about energy stocks—specifically, companies helping to build the future of energy.

Read moreInvestor sentiment will play a key role in market reactions, while consumer spending patterns ahead of the holiday season are under the microscope.

Read moreDiscover undervalued dividend stocks as the market shifts in 2024.

Read moreLast week, I took the opportunity to hang out in the heart of Chicago’s financial district.

Read moreGiant consumer staple companies like Tyson Foods make great Bedrock Income holdings.

Read moreIt’s been a while since I’ve done a mailbag edition.

Read moreMany recent studies have been done on the economics of different generations. Researchers want to know if Millennials and Gen Z are in fact worse off than their Boomer and Gen X parents. There are quite a few ways to look at this data.

Read moreI was just in Boston enjoying the sights and spending time with a friend. I don’t want to say that he was vaping all the time… but he was always vaping. And that got me thinking about how “smokers” are switching to alternative ways to consume nicotine.

Read moreAs much as my two-pronged dividend strategy works in all markets, we still need to acknowledge that politics influences the market.

Read moreWe’re halfway through earnings season, and more data is still flooding into the market.

Read moreDiscover how tracking the "RV Index" and other unconventional economic indicators can reveal insights into the 2025 economy.

Read moreDiscover the lucrative potential of exchange-traded debt, offering higher yields and ease of trading.

Read moreGet ready to buy your favorite dividend stocks. Cooling inflation and potential rate cuts could spark a market rotation and lower prices on great dividend stocks.

Read moreWhat happens to the stock market during summer?

Read moreInvestors want to know where the market will go in the second half of 2024.

Read moreWe live in a data-dependent world. We also live in a world vulnerable to cybercrime, which can cut our access to technologies we rely on every day.

Read moreLearn how to craft a profitable stock-selling strategy to complement your buying tactics.

Read moreI was a landlord once and it didn’t turn out how I expected. I think it mattered that I didn’t set out to be a landlord.

Read moreThe holiday weekend marked a shift in how the market functions.

Read moreIt’s been a while since we looked at the mailbag. Today, I wanted to answer a question that has been waiting for space in our publishing schedule.

Read moreSome of the biggest names in tech started paying dividends this year. This includes Alphabet (GOOG), Meta Platforms (META), Salesforce (CRM), and Booking Holdings (BKNG).

Read moreDividends are more than extra income. They can pay all your bills if you follow one simple plan. With gas prices headed higher, this unique type of energy company can help relieve some of the pain at the gas pump.

Read moreHave you ever been curious about angel investing or venture capital investing?

Read moreI hate to burst your bubble, but the joyride is over. It’s time to bring the car into the garage and deal with the repercussions. I’ve been pounding the table for weeks warning that it was going to happen.

Read moreThe best thing about these elite dividend stocks is that there are no special hoops to jump through to buy them.

Read moreIt’s earnings season… again. It always feels like we just finished reviewing the earnings from companies that report late, and we’re onto the next round.

Read moreI wish I had a dollar for every time I read some advertorial about side hustles or claims of “easy” passive income to pay your bills.

Read moreThe wealth of the top 1% hit a record $44 trillion at the end of 2023. That was an increase of over $2 trillion due to the year’s stock market rally. Yes, $2 trillion in added wealth simply from owning stocks.

Read moreThere’s a lot to be said for investing in things you know or like. It lets us connect a little more with our investments.

Read moreTwo weeks ago, I did something I’ve never done in my career. I ignored my publishing schedule.

Read moreSo, what do I think about Bristol-Myers Squibb (BMY)?

Read moreLearn how to evaluate stock valuations using P/E ratios and annual yield percentages. Uncover the secrets to getting the best deals and maximizing your returns.

Read moreDiscover the lucrative world of short-term special situation plays in stocks amidst the evolving post-COVID landscape.

Read moreI’m writing you from the first day of the MoneyShow TradersEXPO in Las Vegas. I figured since I’m in Sin City I have to talk about my favorite sin-vestment to keep on your radar.

Read moreValentine’s Day is the second biggest holiday after Christmas for exchanging greeting cards. It’s also one of the most popular days for marriage proposals. That means consumer discretionary dollars flowing out of wallets and into the economy.

Read moreMost of the stocks that you’ll see here and in the mainstream financial news are common shares. They aren’t, however, the only kinds of shares out there. Some companies issue preferred shares.

Read moreI am incredibly bullish on telecoms. Literally everything we do revolves around data. It’s all made possible by data whizzing from one point to another through the datasphere.

Read moreI was recently talking to my mentor about why I “stuck with” dividend investing.

Read moreDid you see that Walgreens (WBA) cut its dividend nearly 50% earlier this month? And just like that, the Dividend Aristocrat’s 47-year streak of annual dividend increases came crashing down.

Read moreThe investing world uses a lot of abbreviations and acronyms. We describe the financial status of companies using EPS, P/E, P/S, and a slew of other measures. Even ticker symbols are just shorthand for the company name.

Read moreI’ve been hooked on dividends for over a decade. And like most things, dividend stocks go in and out of fashion with investors.

Read moreUnderstand why labeling yourself a “beginner” will hinder your investing success and how the journey from novice to expert is built on experience. Watch a four-part video investing course for practical tips on opening a brokerage account, organizing investment goals, and trading two of my favorite dividend stocks.

Read moreIf you’re trying to buy or refinance a home, you definitely want interest rates to head lower.

Read moreHave you seen the price of gold lately?

Read moreWere you standing in line to grab a new television on Black Friday? How about sitting at your keyboard on Cyber Monday?

Read moreWhen your favorite dividend stock shoots higher, it’s tempting to sell and pocket your profit.

Read moreThe #1 thing you should know is how investor sentiment drives stock prices.

Read moreSome of you are proud EV owners and nodding in agreement. And some of you are shaking your head vigorously with your arms crossed ready to close this email.

Read moreWhen you see a slew of losses in your brokerage account, it’s easy to get an itchy trigger finger for that sell button. There’s not much that’s certain about the market, but I’m positive that stocks go up and down every day.

Sometimes, there’s a good reason why a stock spikes—the rollout of a blockbuster new product—or it crashes after a dividend cut. Most of the time, it’s nothing more than investor emotions du jour that sends a stock climbing or falling. And because of how market dynamics...

Read moreI actually see two reasons why lots of people are not succeeding in the stock market.

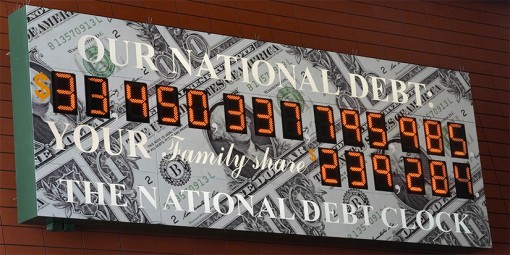

Read moreThe line from Tennessee Ernie Ford’s hit Sixteen Tons is actually “Another day older and deeper in debt.” But today, we are talking about a year instead of a day because it’s Dividend Digest’s first birthday.

Read moreIf you’re looking to buy a house, you’re in a pretty difficult spot right now. Home prices remain high, although there are signs of cooling.

Read moreAs inflation eats at household budgets, shoppers are weighing their choices between value and price.

Read moreOver $130 billion rushed into ETFs during the second quarter. It was $80 billion for the first quarter and closer to $200 billion for the fourth quarter of 2022.

Read moreYou check your brokerage account and see that the market, and your stocks, are dropping. Panic can set in if you don’t have a plan.

Read moreWhen I recommend a stock for its dividend, I always try to ensure that I’m not overpaying. I don’t, however, try to time the market.

Read moreEveryone has some sort of a vice: snack food, alcohol, coffee, yoga, or collecting something. These are not consumer staples by the traditional definition. However, when the purse strings get tightened, these habits are often considered an essential part of the budget.

Read moreLearn key insights into Q2 earnings, dividend trends, the looming threat of dividend cuts, and how to build a robust dividend strategy to secure your income. Don’t miss out on this essential guide for dividend investors.

Read moreI see these claims all over social media: I just paid all my bills with my dividends. It’s usually accompanied with a hashtag like #financialfreedom, #passiveincome, or #FIRE (financial independence retire early).

Read moreThe reason we invest boils down to two motives: building wealth for the future, and generating income right now.

Read moreThis is not the first time I’ve been blindsided by a dividend cut. After all, I’ve been in this industry for over a decade. And since I plan on being a dividend investor for many years to come, this likely won’t be the last.

Read moreIt’s earnings season, and I find myself tied to my computer, looking through numbers until I feel dizzy. No matter what industry or type of stock I look at, one thing is certain: It’s not all sunshine and roses.

Read moreI would love to have a stock portfolio like the late Ronald Read, Grace Groner, or Anne Scheiber. Wouldn’t you?

Read moreI went into the bank a few days ago and was talking to the teller about putting my nephews as named beneficiaries on my accounts.

Read more“If you fail to plan,” Benjamin Franklin once said, “you are planning to fail.”

Read moreTarget Corp. (TGT) faced backlash over merchandise that appeared on shelves at the end of May… then again faced backlash after reacting to the first round of backlash. The stock saw nine straight days of losses.

Read moreI always keep an eye on Dividend Aristocrats and Dividend Kings, as these companies have proven dividend track records.

Read moreSome of the world’s largest firms have been in the crosshairs of activist investors.

Read moreArtificial intelligence (AI) is taking over the internet.

Read moreOne of my favorite pieces of investing advice became the reason for many of my successes… but when followed too literally, it also fueled some of my biggest losses.

Read moreThese companies aren’t worth your time. You deserve above-average yields.

Read moreThe Ford Motor Co. (F) and Tesla Inc. (TSLA) announcement last week was huge, and Ford may just be the EV exposure that your dividend portfolio is missing.

Read moreThis is perhaps the most important number for any dividend investor or income seeker…

Read moreAs I head to my home office, I look out the living room window to check the sky. More than once, I’ve been tricked into thinking we’re due for torrential rain when I spot the gray wall of the recently erected CubeSmart, a monstrosity that towers over my neighbors’ homes.

Read moreCatchy phrases don’t make for sound investing philosophies.

Read moreHere’s how to gain VIP status with dividends…

Read moreSpeculation can be fun… but be informed.

Read moreThe numbers and studies are there… don’t sacrifice your wealth.

Read moreThese opportunities will pay for years, maybe even decades.

Read moreDividend royalty companies are staples in any income-focused portfolio.

Read moreThere are many reasons why I turn to income investing.

Read moreFirst, we have to start at the beginning. Because your opinion on stock buybacks is going to be directly tied to how you view stocks.

Read moreAs inflation hangs around like a freeloader house guest, the search for income becomes more pressing.

Read moreYield is a great way to measure your money’s horsepower. The more you have, the harder it’s working for you.

Read moreI’ve been writing about the “cord-cutting” trend for the last decade. During that time, I haven’t watched cable television except when staying in a hotel.

Read moreThe financial media went nuts last week after rumors that Intel Corporation (INTC) will have to cut its dividend. And today those rumors were confirmed.

Read morePeople love to ask me about Disney.

Read moreYou don’t need an options account or any special trading access. You don’t even need a lot of money to score this opportunity. All you need is about $25.

Read moreIt happened again. Another road trip expanded my stock watch list.

Read moreIt’s important to have the right stocks in your portfolio at the right time. It’s equally important to take a pass on certain stocks as well.

Read moreIt’s earnings season… and not just any earnings season. We’re getting the fourth-quarter and full-year earnings for one of the most interesting years I’ve seen in my career.

Read moreWhen is the best time to invest?

Read moreAs I hinted last week, I spent a few days in the “triple cities” of Binghamton, Endicott, and Johnson City, New York.

Read moreAs you’re reading this, I’m out exploring Binghamton, NY.

Read moreThere are just seven trading days left in the year.

Read moreThe announcement of a special dividend can feel like a second Christmas.

Read moreUncover the tips and tricks to navigate the income investing landscape... find the yield you deserve and add income to your pocket today and in the future! Get this free newsletter every Wednesday!