The Dividend Yield “Sweet Spot”

-

Kelly Green

Kelly Green

- |

- June 7, 2023

- |

- Comments

Every time I talk to someone about investing, this scenario plays out…

After I explain what I do for a living, I find them listing off the stocks they have bought (or would like to buy) that pay dividends.

As much as I try to bite my tongue, I can’t help but say, “Doesn’t that only pay [insert number between 0.5%–3%]?”

It’s always something like Microsoft (MSFT), Visa (V), or Apple (AAPL). Although all three are great companies that have made investors a lot of money over the years, their current yields are just 0.81%, 0.79%, and 0.53%, respectively.

I’m not hating on investors who have been holding these shares for a longer period (their current yield is much higher). It’s quite the opposite…

You’ll hear me bring up effective yield time and time again. Remember from our issue two weeks ago, effective yield is how hard your money is working based on your specific entry price. Current yield is how hard your money would be working for you if you bought shares today.

So, if you’re holding shares of MSFT, V, and AAPL with an entry price lower than today’s, which means a higher yield, keep collecting that yield. But if you’re looking to buy today, there are much better opportunities (if you know where to look).

|

It’s been nearly impossible for Americans to keep up financially over the last year. It’s no wonder 74% of Americans are now looking for extra income. Here’s a simple way to earn a second income as often as every 14 days. |

Avoid Current Century-Low Yields

Last year, companies in the S&P 500 allocated a record $561 billion toward dividend payments for shareholders. And we’re poised for another record year of dividend spending in 2023.

Here’s the bad news:

-

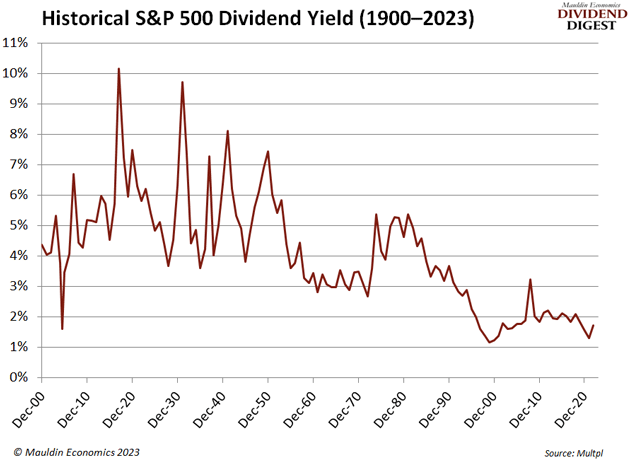

Dividend yields from blue-chip US companies are sitting at all-time lows.

Since 1900, we’ve never seen a time when the dividend yield has been below 3% for an extended period. We haven’t even seen 3% since 2008!

Even though the current form of the S&P 500 didn’t appear until 1957, it’s clear that investors are getting paid the lowest they ever have for holding large-cap equities.

The average for the elite group of blue chips labeled Dividend Aristocrats (companies that have increased their dividends in each of the past 25 consecutive years) is slightly higher at 2.7%. Dividend Kings, with their 50-year track records, average 2.8%.

Even REITs, which have a legal requirement to pass through 90% or more of their taxable profits, have an average yield of only 3.49%. That’s not enough for the additional risk of these types of investments.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

You Deserve Above-Average Yields

There’s no doubt about it, especially when you can find rates on short-term CDs that are above this average. I want your money working for you to create the life you want.

-

My dividend yield floor is 3%. I won’t look at a company that pays less than that.

Okay, I’ll look at it. I’ll put it on my watchlist. But I will not add it to my portfolio or recommend it in Yield Shark. It’s just not worth your time.

Generally, I’m looking for companies that pay out 3%–13%. Once we get around 13%, I start to get nervous. Again, these are just guidelines. A special situation might offer a higher yield, but I would want to watch it closely.

Getting even more specific…

A good guideline for big, stable blue chips that you could hold forever and still get paid would be 3%–5%.

Right now, there are 18 stocks marked “buy” in the Yield Shark portfolio. They have an average current yield of 6.7%. That’s over 3X the current S&P dividend yield.

To see all the stocks I recommend, you can try Yield Shark risk-free for 90 days.

For more income now and in the future,

Kelly Green

Kelly Green

Kelly Green