The Easter Bunny Came Early

-

Kelly Green

Kelly Green

- |

- April 9, 2025

- |

- Comments

I have been enjoying the chance to add to my portfolio over the past few weeks. I ramped up my purchases last week. As a long-term dividend investor, I plan to hold my positions for many years to come.

I’m focused on locking in higher yields as the market sell-off gives me attractive entry prices. Knowing our dividend yield means knowing the horsepower of our investible dollars. Yield is inversely related to entry price. The lower the entry price we can lock in, the higher the yield—and the harder your money is working for you.

I’m always selectively adding to my portfolio, and today is no different as share prices across most of the market are sliding.

I started with positions I regretted not adding before they hit my recommended buy-up-to price. My buy-up-to prices are determined using a combination of fundamental analysis and my experience in the market. Unless there are company or industry-specific concerns, I’m sticking with this buying guidance.

If shares of a company are above that price, I won’t add them right now. But when shares slide, it’s a great time to erase the feeling that I missed out on these stocks.

Next, I turned to companies on my watch list. Again, check for any company- or industry-specific problems that would eliminate the stock. Next, confirm that your reasons to own the stock are still valid.

Finally, I turned to my wish list. These are companies I would like to own, but only if something drastic happens. I would call last week’s market panic pretty drastic… and I am finding opportunities I don’t want to miss.

Polishing Up My Wish List

Last week, the S&P 500, Dow Jones Industrial Average, and Nasdaq were down 13.7%, 9.9%, and 19.2%, respectively. But the entire market very rarely goes down all at the same time. There are usually sectors that do well even during times of market turmoil or recession fears.

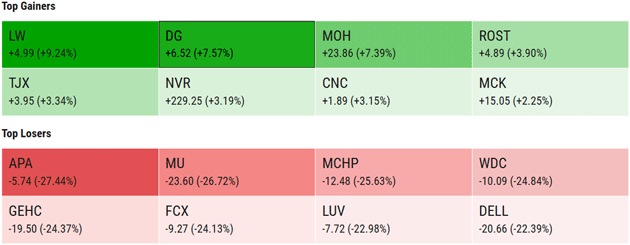

I like to take a closer look at some of the biggest gainers and losers when the market has a big week, up or down. Here are a few as of last Friday:

Source: YCharts

Some of the top gainers last week were Lamb Weston Holdings (LW), Dollar General Corp. (DG), and Molina Healthcare Inc. (MOH), up 9.2%, 7.5%, and 7.3%, respectively. A frozen potato product giant, a discount retailer, and a healthcare company top the list. No coincidence all three are consumer staples and will continue to profit in times of economic hardship.

|

But I’m looking for good deals on stock prices and am more interested in the top losers. Last week those were APA Corp. (APA), Micron Technology Inc. (MU), and Microchip Technology Inc. (MCHP). These are companies in energy, semiconductors, and electronics.

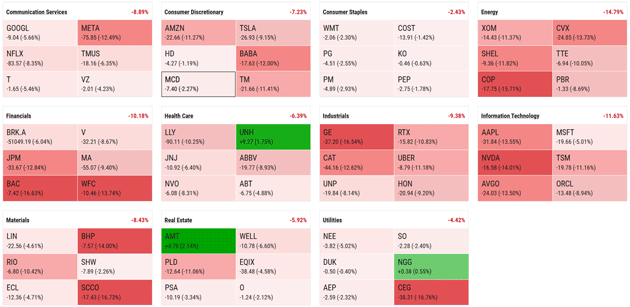

Zooming out, we can see that all sectors were in the red for the week.

Source: YCharts (Click to enlarge)

No surprise that the best performers were consumer staples and utilities. Energy and Information Technology were the worst performers overall. Info tech is the one that interests me the most.

Rare Opportunities in Tech Dividends

When a company makes money, it only has three things it can do with the profits:

-

Save it for a rainy day

-

Invest it back into the business

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

Pay it out as dividends to shareholders

Technology companies have to lean heavily on option number two. There’s always research and development to be done to stay ahead of competitors. Tech is continually changing and improving.

That’s why many tech companies don’t pay a dividend and why ones that do generally pay a measly 1%–2% yield. However, when shares crash—yields rise when shares fall—we could find opportunities to lock in above-average yields

In our March 12 issue, I said I would love to own shares of Cisco if shares fell 24.5% to $46.85. We’re about halfway there with a yield now above 3%. The market just might put Cisco in my Easter basket after all!

Here are two other companies I’m watching:

-

Data storage company Seagate Technology Holdings (STX). At recent prices, the company pays over 4%. Headquartered in Singapore, I need to view it through the lens of the current global trade climate. But I’m certainly bullish on data storage for many years ahead.

-

Hewlett Packard Enterprise Company (HPE) also boasts a yield above 4%. HP delivers hardware and software solutions for personal computing, 3D printing, and gaming. The company has already factored the tariffs into its 2025 outlook and expects more than 90% of its products to be built outside of China.

I’m not ready to pull the trigger on any of these just yet. But I’ve definitely moved them higher on my list of companies worthy of a deeper dive.

Don’t just start buying companies because you can get a good price. We still need to do our due diligence. I don’t want to miss an opportunity to own some of the stocks on my “wish list.” And I recommend you do the same.

|

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green