Are You Ready for the Rotation?

-

Kelly Green

Kelly Green

- |

- March 12, 2025

- |

- Comments

It was inevitable. Certain pieces of the market roared to insane valuations last year. Investors poured money into the markets and speculated stocks would keep rising forever. But, sentiment has shifted.

Last week was the worst week for the market in six months. Politics are now front and center as we wait to see the true impact of tariffs. Nvidia (NVDA) lost nearly 10% last week, and it saw $1 trillion in market cap wiped out since its January high. At that time, shares were trading at 55 times earnings. Now the forward P/E is around 36.

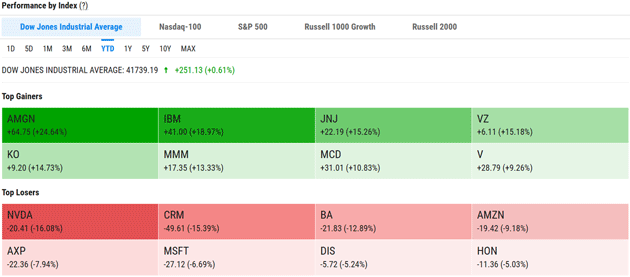

Take a look at some of the top gainers and losers in the Dow Jones Industrial Average (DJIA) so far this year.

Source: YCharts (Click to enlarge)

In the red, we’ve got tech companies NVDA, Salesforce (CRM), and Microsoft (MSFT). You’ll also see companies like Amazon (AMZN), Disney (DIS), and American Express (AXP), which foreshadow a bleak outlook on consumer discretionary spending in 2025.

In fact, Information Technology and Consumer Discretionary are the only two market sectors in the red year-to-date. The top-gaining sectors are Health Care, Consumer Staples, Real Estate, and Materials.

This is clear evidence that the market is not crashing… it’s rotating.

Investors are trading tech stocks for recession-resistant companies. They’re also trading the search for capital gains for solid, boring, and stable dividends. This doesn’t surprise me as uncertainty will be the major market trend in 2025.

While none of this changes our strategy, we need to make sure we’re ready to use this rotation to our advantage.

Update Your Watchlist and Wish List

My watchlist has two parts. The top half are stocks I have a realistic chance of owning… the bottom half are stocks I would love to own if something fantastical happens—my wish list.

I add companies to my lists for three main reasons:

-

I’m waiting for the company to make a specific change

-

I’m waiting for a macroeconomic change

-

I’m hoping the price drops for no company-specific reason and hands me a great yield

Now is the time to update your list(s). Uncertainty in the market means we’ll see market movement. Armed with an updated watchlist, you’ll be ready to trade more effectively and with purpose.

Google news will let you set alerts. If you’re waiting for something to happen with the company or watching a macroeconomic trend, you can set an alert. I like to enter these themes into a Google search and add that search to a bookmark folder. Then a few times a week I can check in on these trends.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

There are plenty of tools out there to help you once you have done your research and your lists are ready.

|

Know Your Worth

Don’t settle for friends that always take you for granted and never seem to be there for you when you need them. In general, that’s pretty solid advice. But it’s also the foundation of my dividend investing strategy.

Your money deserves to earn a good yield. You’re making the choice to park your money in the stock of a company. You have faith in the company and want to own a piece of it. In exchange, you should be rewarded by that company’s management.

During this rotation, we should expect to see investors gravitating toward some of our favorite Bedrock Income positions. That makes it more important than ever to not overpay due to the market hype.

As investors rotate out of tech and consumer discretionary companies, we will look for opportunities to grab better yields.

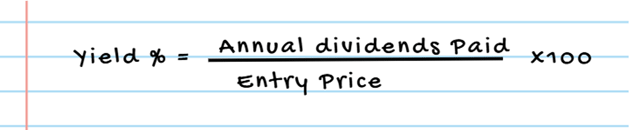

Yield and share price are inversely related. As share prices go up, yield goes down… and vice versa.

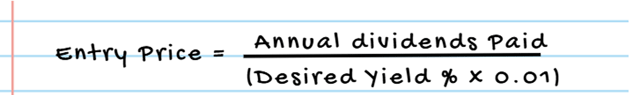

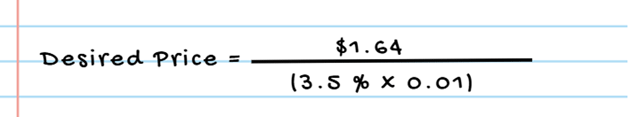

We can rearrange the formula to calculate the stock price we need to lock in the yield we think we deserve.

Let’s use my wish list company Cisco Systems (CSCO) as an example. As much as I’m bullish on the future of the company, I really wish it paid a dividend yield of 3.5%. I can use this formula to calculate the share price needed in order for me to lock in that yield.

Cisco currently pays $1.64 in annual dividends. To get my wish, shares need to fall 24.5% to $46.85 to lock in a 3.5% yield. Now, that’s not impossible… but you can see why I have this one on the wish list instead of the more realistic watchlist.

I know it’s easy to log into your trading account and panic when you see the markets turn red. Keep reminding yourself that you’re looking at market indexes or other similar arbitrary measures of the whole market. Some stocks will be moving up, while others are moving down. Use it to your advantage for a successful 2025.

|

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green