Is Ford the EV Dividend Payer Your Portfolio Is Missing?

-

Kelly Green

Kelly Green

- |

- May 31, 2023

- |

- Comments

The Ford Motor Co. (F) and Tesla Inc. (TSLA) announcement last week was huge, and Ford may just be the EV exposure that your dividend portfolio is missing.

Starting early next year, Ford EV customers will have access to more than 12,000 Tesla Superchargers across the US and Canada. Current vehicle owners will have to use an adapter, but starting in 2025, Ford will equip all new EV models with the Tesla North American Charging Standard.

This is pivotal for the electric future, as non-Tesla cars currently use the “standard” CSS connector. Tesla is light-years ahead of traditional automakers when it comes to EVs, though, so its team-up with Ford (the traditional automaker in the lead of the EV race) could make CSS obsolete.

Ford EV owners currently use the BlueOval network for their charging needs. This encompasses 80,000 chargers spread over 19,500 charging stations and is mostly made up of third-party chargers.

I’m not an EV driver, but I have plenty of time to look around the gas station while my F-250, with its 7.3-liter V8, guzzles nearly 30 gallons of gasoline. I’ve never noticed a gas station or rest stop with non-Tesla chargers.

The reality is that Tesla chargers are front and center and located in convenient areas. There’s also the fact that these chargers tend to be a lot more reliable for drivers.

So, if charging access is your main hurdle for an EV purchase, Ford’s Tesla deal could be the solution.

|

NOW AVAILABLE: SIC 2023: The Collected Transcripts: Through this coming Wednesday, Mauldin Economics is sharing all the insights, takeaways, and analysis from the conference... for a small fraction of what it costs to attend live. With SIC 2023—The Collected Transcripts, you’ll receive the written transcripts for every session and all the presentation slides for just $249. You can read through the materials from select sessions or enjoy all the content from the entire 5-day conference. You’ll have notes, ideas, questions for your advisor, all in hand... physically. Click for details on how to claim your transcript collection before the deadline. |

Can Ford Keep Its #1 Position in 2023?

In 2022, Ford sold a grand total of 61,575 electric vehicles.

Source: Ford Media Center

Broken down, that’s:

-

15,617 Lightning trucks

-

6,500 E-Transit vans

-

39,458 Mustang Mach-E

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

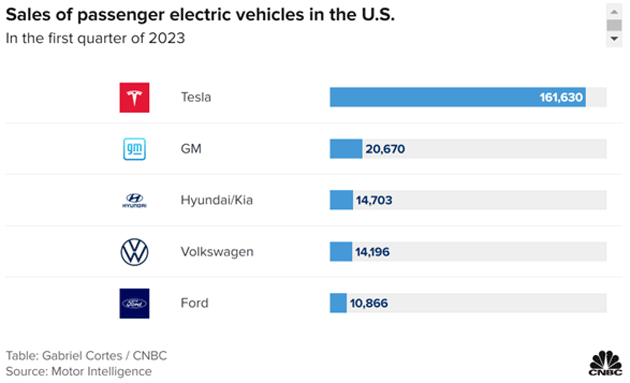

Source: CNBC

These numbers aren’t Ford’s whole story.

Sales of the Mustang Mach-E fell 19.7% during Q1 2023 as the company retooled a factory in Mexico to double its production capacity. Ford also lost about five production weeks of its F-150 Lightning due to a fire.

I will be keeping an eye on these numbers moving forward because, at this point, the #2 spot could be any of the companies listed above. I’ll also be looking for evidence that the agreement with Tesla might just be the final piece to sway fence-sitting consumers into an EV.

Ford Is a Basement Bargain and Pays 4.7%

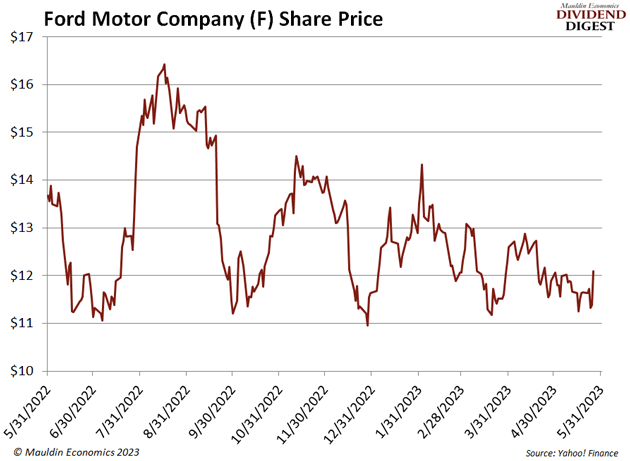

Over the past year, shares of Ford have traded as low as $10.61 and as high as $16.68.

They are currently trading around $12.58 after a 7% spike following the Ford and Tesla announcement. Still, shares look cheap.

A quick look shows that shares are trading closer to their 52-week lows than highs. A better gauge might be that Ford’s forward P/E (price-to-earnings) ratio is just 7. This tells me that the market has not priced in the future potential of EVs… yet.

There’s also the fact that Ford pays out a 4.7% dividend. Please be advised, if you look on Yahoo! Finance, that number will be much higher. That’s because earlier this year, Ford paid out a special dividend.

The extra $0.65 was paid out to shareholders after a profitable gain from the sale of 91 million Rivian shares. This was a one-off event, and it’s important to note that special dividends are really rare in today’s market. Make sure you don’t expect this payment going forward.

Although Ford suspended its dividend for six quarters in 2020 and 2021, it’s now made seven quarterly payments since. And it’s back up to its pre-COVID rate of $0.15.

I personally own 50 shares of Ford and have my dividend set to reinvest.

Really, if you’re looking for some dividends with potential growth from the EV market, Ford looks like it’s set to check all the boxes.

For more income now and in the future,

Kelly Green

Kelly Green

Kelly Green