One Number Proves You Should Invest Like Warren Buffett

-

Kelly Green

Kelly Green

- |

- May 24, 2023

- |

- Comments

Clearly, he’s doing something right…

At age 92, Warren Buffett remains the CEO of Berkshire Hathaway, and his net worth of $116 billion makes him the fifth-richest person in the world.

I have a lot of respect for Buffett, aka the Oracle of Omaha. There are several quotes from the investing legend that I repeat frequently, such as:

-

“Price is what you pay. Value is what you get.”

-

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Many of the same criteria used by Buffett are on my checklist for companies in the Bedrock Income section of the Yield Shark portfolio. This section of the portfolio shares Buffett’s favorite investing timeline: forever.

One of my favorite reminders from Buffett is that it’s important to buy businesses and not stocks. It’s critical to understand what a business does and how that product or service fits with consumer demand. Plus, the company should have a competitive advantage in meeting that demand.

After all that, you must get the company for a good price. This price is the key to Buffett’s long-term success… but it’s also why I won’t be adding Buffett’s favorite stocks to my portfolio anytime soon.

The Most Important Number to Dividend Investors

Whether you’re investing in gold, crypto, speculative stocks, or dividend stocks, it’s important to know your numbers. It’s the only way to compare your actual returns to your investing goals and know how much money you’re making.

Buffett’s original 2016 investment in Apple Inc. (AAPL) cost $36 billion. Since then, he has received $775 million annually as dividends and pocketed an additional $11 billion by selling a small portion of his position.

Still, Apple makes up a whopping 47% of Berkshire Hathaway’s portfolio.

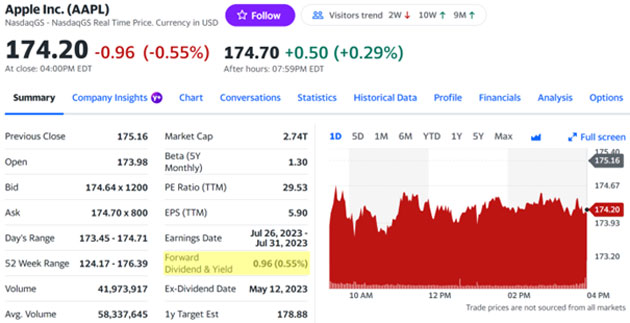

I’m not inclined to add AAPL to my portfolio anytime soon. A quick look on Yahoo! Finance shows that it only yields 0.55%. That’s less than I was making on my savings account before interest rates went up.

Source: Yahoo! Finance

Warren Buffett has a much higher yield than 0.55%, though. Adjusted for stock splits in the first quarter of 2016, the cost would have been around $25 per share.

AAPL currently pays out $0.24 per quarter, or an annualized $0.96. That means Buffett makes 3.8% on this tech giant. Plus, he’s made around 600% in capital gains.

The same goes for The Coca-Cola Company (KO). It was one of Warren Buffett’s largest holdings in 1988 when he first bought it, and Berkshire Hathaway now owns over 400 million shares—that’s over 9% of KO’s outstanding shares.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Both stocks (AAPL and KO) have been wildly lucrative for Buffett, but neither look appealing to me right now.

That said, these numbers prove that entry price and longevity are important. It pays to know and understand your numbers.

Do You Know Your Effective Yield?

That easily accessible yield number on Yahoo! Finance or your online broker quote is the “current yield.” It’s calculated by annualizing the last-paid dividend and dividing it by the current price. It would be the yield you’d lock in if you bought shares right now at that price.

The effective yield is the percent that you actually collect based on your unique entry price. It’s calculated by annualizing the last-paid dividend and dividing by the price paid for the stock.

This is perhaps the most important number for any dividend investor or income seeker. It tells you how hard your money is working for you (in a percentage for easy comparison to other opportunities).

In the Yield Shark portfolio, we note the current yield and the effective yield for each of our recommendations.

If a stock’s current yield is higher than your effective yield, it means shares are currently cheaper right now. If you’re planning on holding long term, this is the opportunity to add shares and raise your average effective yield.

Because of current market volatility, many of our Bedrock Income players are yielding higher-than-normal current yields.

Remember, these are companies to hold for years, even decades. Again, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

For more income now and in the future,

Kelly Green

Kelly Green

Kelly Green