Volatility. Don’t Fear It. Gain an Edge from It.

-

Kelly Green

Kelly Green

- |

- September 18, 2024

- |

- Comments

Last week, I took the opportunity to hang out in the heart of Chicago’s financial district. I spent most of my time writing and drinking coffee sitting at the edge of the Chicago River. And of course, I did not miss the chance to snap a photo of me in front of both the Chicago Federal Reserve and the Chicago Board of Trade Building.

I’ve been interested in options since I started studying for my Series 7 exam in 2010. My interest grew exponentially when I took my first job in financial publishing. My senior editor at the time had just launched an income-generating options newsletter. So, you can understand how excited I was to be staying just steps away from the Chicago Board of Trade (CBOT) building.

The CBOT was born in 1848 as a central location for commodities trading. This landmark Art Deco building and gateway into the financial district was completed in 1930. The CBOT merged with the Chicago Mercantile Exchange in 2007 to form the CME Group, the largest derivatives exchange in the world.

That’s a nice history lesson, but you’re probably asking why it matters to yield investors. Stick with me here.

A Volatility Star Is Born

Inside the CBOT building, the Chicago Global Markets (CBOE) new trading floor occupies 40,000 square feet. This is the home of the original 1973 trading floor that brought exchange-traded options to retail investors.

Now we get to the important part.

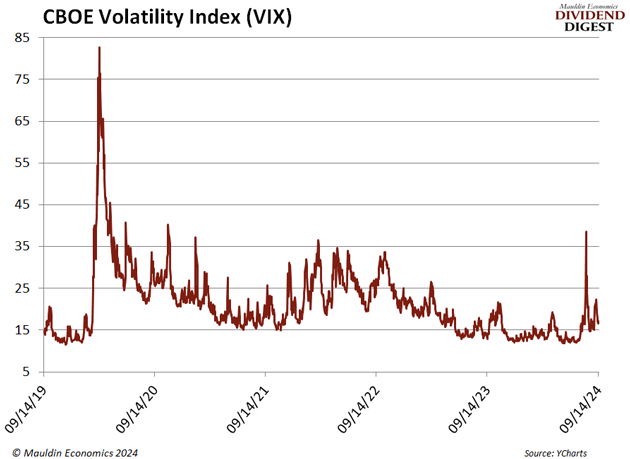

In 1993, the CBOE Volatility Index, or the VIX, was introduced. It was originally designed to measure the market’s expectation of 30-day volatility of certain S&P 100 options prices. At the time, these were the most actively traded options on the market.

Today, the VIX looks at a weighted price of S&P 500 puts and calls over a wide range of strike prices. And it’s still one of the most watched measures of volatility today.

A VIX in the range from around 12–20 is considered normal. Anything under 12 is extra low, and above 20 should get your attention. In practice, investors don’t start to really panic until the VIX gets closer to 27–30. The index hit 89 back in 2008 and 85 in 2020. But, despite the Index currently sitting in a normal range, we are certain to see higher volatility through the end of the year.

|

Keep the VIX in Your Market Monitor Toolbelt

This afternoon we will hear the Fed’s decision on interest rates. We’ll know whether the rate cut is a quarter or half percent… or maybe no cut at all. Whatever the decision, it will certainly move the market. The Fed will have the same opportunity again in both November and December.

Don’t forget that we’re also in an election year. And like the Fed’s decision, investors are going to react no matter who wins.

I’ve talked about the VIX before, and you all know that I watch the CNN Fear & Greed Index. I tend to use the latter more because it uses 7 different indicators to calculate a value between 0 and 100. The VIX is one of those indicators.

Currently, this Index is showing a 54—almost dead neutral. This isn’t surprising as investors wait to hear the Fed decision.

It doesn’t really matter what indicators you use to measure volatility. Decide which ones work best for you and keep an eye on them. Knowing the overall sentiment of the market will keep you from being swept up in emotional momentum.

The VIX will tell you the level of volatility in the market. As volatility rises, there can be more opportunities to buy low and sell high, depending on the stocks. The CNN Fear and Greed Index also gives you a sentiment reading with the volatility. Investor sentiment will tell you when others are greedy, and buying at that time probably means you’re going to overpay.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

For us, that is going to mean great opportunity as well.

|

For more income now, and in the future,

Kelly Green

P.S. We are just one month away from the Orlando MoneyShow where I’ll be speaking on Saturday afternoon. If you haven’t gotten your ticket, you can still lock in early-bird pricing here. I hope to see some of you there.

Kelly Green

Kelly Green