From the Mailbag: Is Now a Good Time to Buy Retail Pharmacy Stocks?

-

Kelly Green

Kelly Green

- |

- September 3, 2024

- |

- Comments

It’s been a while since I’ve done a mailbag edition. As a friendly reminder, there are several ways to send me a question:

-

The chat area in the Dividend Digest community

-

Through customer service

-

On social media: Instagram, X (Twitter), YouTube, LinkedIn

If I don’t answer your question right away, it probably means I will answer it in a future Dividend Digest so it benefits all readers. This is one of those times.

I got a great question from Will, who is both a Dividend Digest and Yield Shark reader:

I know Walgreens isn't in the portfolio, but I have a half position in WBA I entered around $19.50. I am considering adding more, but would like your thoughts and any from the community.

Walgreens Boots Alliance (WBA) has long been a favorite of dividend investors. It had the coveted title of Dividend Aristocrat and was just 3 years away from being crowned a Dividend King—50 straight years of dividend increases. At the end of 2023, it had one of the highest dividend yields in the S&P 500.

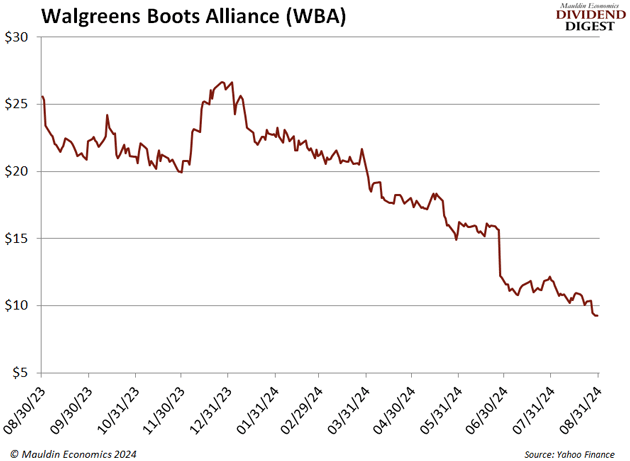

That all changed when the calendar turned to January and the pharmacy chain slashed its quarterly dividend from $0.48 to $0.25. As you’d expect, the stock price dropped on the news. And investors have continued to lose faith in Walgreens as the year has progressed.

Shares fell another 10% last week, and are down 64% so far this year. But Walgreens is not alone. CVS Health (CVS) and Rite Aid (RADCQ) are down 29% and 82% year to date, respectively, as well.

How Long Will Industry Problems Last?

Retail pharmacy chains have seen a shift across the industry. For a long time, new Walgreens or CVS stores seemed to pop up on busy intersections around the US. Now, many of those locations are disappearing at an alarming clip.

The shopping experience has changed in recent years as these chains have had to battle a rise in theft. Many products are now behind locked displays and customers are forced to wait for assistance from already taxed employees. It can be easier to just order these items on Amazon.

|

On top of that, drugmakers are moving to cut out the middleman that is the retail pharmacy.

Last week, Pfizer (PFE) launched its new digital platform PfizerForAll. This will offer same-day telehealth appointments, home delivery of prescriptions, and appointment scheduling for certain vaccinations. Also last week, Eli Lilly (LLY) announced it will cut prices for its weight-loss drug Zepbound by 50% when ordered directly from its LillyDirect platform.

Walgreens is currently a vaccination partner for PfizerForAll. But at the end of the day, these rival platforms will take more pharmaceutical sales from brick-and-mortar pharmacies than vaccinations can make up for.

Can Walgreens Get Back on the Right Footing?

Pharmacy drugs make up over 50% of Walgreens revenues. Its US pharmacy drug sales were up 4.4% year over year last quarter. Low single-digit sales growth won’t be enough to offset the losses expected if platforms like PfizerForAll and LillyDirect really take off.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Walgreens CEO Tim Wentworth is attempting a turnaround. At the start of 2024, he led a strategic review of the business and laid out a plan for the future. The company is on track with its cost-cutting initiatives, but all the changes have yet to rekindle investor optimism. It doesn’t help that the company lowered its fiscal year 2024 adjusted EPS estimates on its last earnings call either.

I’m not saying that Walgreens can’t make a recovery. But I think it’s going to be a longer ride than both Mr. Wentworth and investors would like. I wouldn’t be surprised if we saw yet another dividend cut as the company repositions itself for a changing industry.

All that being said, the current yield is 10%. It’s a question of risk and reward. Can the company complete its turnaround before it has to dip into the dividend money? And how much risk are you willing to take on for 10%?

If the company can successfully complete the turnaround, you could easily double your money in capital gains. So, that would take you back into positive territory. But I think that’s going to take at least a year or two. Adding to your position will of course boost your yield, but I would be hesitant until we see some proof of the plan working.

If you’re simply looking for a double-digit yield, there are better options. If you’re still bullish on WBA or looking for a potential “gamble” on its turnaround, I would not commit more money than you can afford to have tied up for a few years.

|

For more income now, and in the future,

Kelly Green

Kelly Green

Kelly Green