I’m Not Buying SCHD or JEPI… and You Probably Shouldn’t Either

-

Kelly Green

Kelly Green

- |

- October 4, 2023

- |

- Comments

Over $130 billion rushed into ETFs during the second quarter. It was $80 billion for the first quarter and closer to $200 billion for the fourth quarter of 2022.

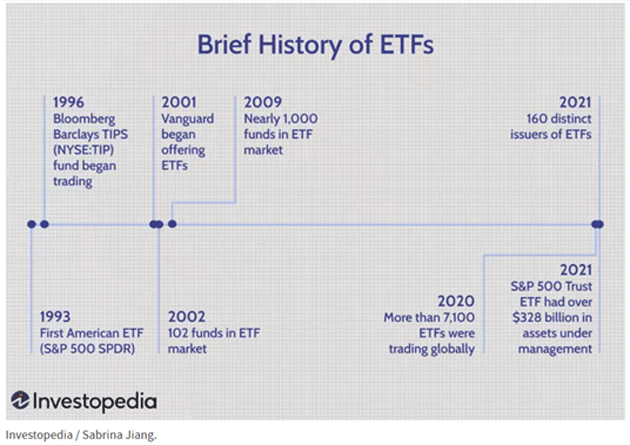

Since 1993, ETFs have enabled investors to get exposure to a variety of asset classes without having to purchase individual stocks or bonds. This new fund structure was similar to mutual funds, but you could buy and sell an ETF during the trading day just like a stock.

Source: Investopedia

Today, there are thousands of ETFs available. Their themes or objectives can range from tracking an index to investing in a specific industry. Many investors use ETFs for their diversified holdings and affordable entry prices.

Why I’m Not a Fan of ETFs

I understand the argument that a basket of stocks can lower your risk. However, it can also limit your upside. The gains of stellar performers can be watered down by other mediocre companies.

Personally, I don’t want to own a basket of stocks. I prefer to pick my own. The goal of most ETFs is to track an index or some sector of the market. To make my money work hardest for me, I look for stocks that will beat the yield of the overall market.

ETFs also charge fees for running the fund, which I don’t like to pay. Most ETFs are passively managed, but fund managers still incur expenses. This is reflected in the fund’s expense ratio. Even though most funds have an expense ratio less than 1%, I’m trying to keep as much yield in my account as possible.

All that said, I’m not totally against all ETFs. But I only use them when they deliver something that I can’t get elsewhere. Specifically, my favorite ETFs are those that give me instant exposure to a geographic region where it might be hard or expensive to grab individual stocks. Or those that let me test the waters with an up-and-coming technology where I’m not yet sure who the winners (and losers) will be.

And naming names, I don’t think funds like the Schwab US Dividend Equity ETF (SCHD) or JPMorgan Equity Premium Income ETF (JEPI) offer a benefit that I couldn’t do better myself. Let’s take a closer look…

Why I Don’t Want to Track an Index

SCHD’s goal is to track the total return of the Dow Jones Dividend 100 Index before fees and expenses, which are super low at 0.06%. To know what we’re actually getting, we have to take a look at the index references.

The Dow Jones U.S. Dividend 100 Index is designed to measure the performance of US stocks with high-dividend yields. To do this, it starts with the Dow Jones US Broad Stock Market Index, excluding REITs. This is a major bummer to me because REITs are some of my favorite investments, and they tend to have above-average yields.

From this universe, the stocks for the index must have:

-

Minimum 10 consecutive years of dividend payments

-

Minimum $500 million market cap

-

Minimum three-month average daily trading volume of $2 million

The stocks that pass all three filters are ranked in descending order by annual dividend yield, excluding any special dividends. This sounds like you should be getting some decent yield… however, it doesn’t end up that way.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Out of SCHD’s top five holdings, only one pays a yield above 3.5%. Expand that to the top 10 holdings, and it’s only four of the group.

Is this the worst ETF you could put your money in? No. Are we doing better in Yield Shark? Yes.

Using Options to Boost Yield Should Get You More Than 10%

This isn’t the first time I’ve looked at JEPI. In March, I concluded that any number of unfavorable market conditions could cause it to underperform. I’m sticking with that conclusion because JEPI’s yield has been dropping since.

At that time, JEPI had a trailing 12-month dividend yield of 11.45%. That has since dropped to 10% and is getting worse. If you annualize the last six monthly payments, the yield drops to 8.4%. And if you just take the latest payout of $0.3382 and annualize it, your yield dips to 7.6%.

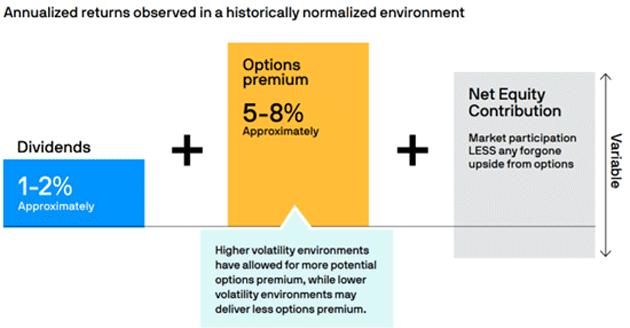

That shouldn’t be a shock to anyone, as the fund’s fact sheet says the expected annual yield is 6%–10%, shown in the graphic below:

Source: JPMorgan

The double-digit yields the fund has been paying out were an anomaly based on the favorable market conditions. Looking ahead, I wouldn’t count on a return to that high yield. The graphic shows a big chunk of the fund’s profits are from options premiums earned by selling covered calls.

Market volatility has allowed JEPI’s investors to see double-digit yields. As the volatility subsides, so do the options premiums collected.

I don’t talk about it much, but generating income from options is another area where I have considerable expertise. If you’re going to use this strategy, you should not settle for less than a 14% annualized return. So even at its May peak, JEPI wasn’t returning the level of yield I aim for.

If you’re currently holding JEPI for its double-digit yield, keep a close eye on it. I could be wrong, and management may be able to deliver that kind of yield into 2024… but I think you’re more likely to see its yield slide back toward 7%.

For more income now and in the future,

Kelly Green

Tags

Suggested Reading...

|

|

Kelly Green

Kelly Green