Reader Mailbag: What Do You Think About BMY?

-

Kelly Green

Kelly Green

- |

- March 13, 2024

- |

- Comments

I love getting your comments and questions through our customer service team, our Mauldin Economics app, and across all my social media channels. (You can find me on TikTok, LinkedIn, Twitter, Instagram, and YouTube).

I try my best to keep up and answer in a timely fashion. And I will not be offended if you remind me if you feel I’ve overlooked your question, especially during the whirlwind that is every earnings season. This is one of those questions that I’ve wanted to circle back to.

So, what do I think about Bristol-Myers Squibb (BMY)?

Well, right off the bat, solid blue-chip pharmaceuticals are great candidates for the Bedrock Income part of our portfolio. Remember, this is the part of our portfolio where we want to accumulate positions we can buy and hold forever. Then we reinvest those dividends and really let those dividends work for us.

Off the bat, BMY deserves a closer look as a pharma company with a current yield of 4.4% and a track record of increasing its dividend for the last 16 years.

So, let’s take a closer look…

Does It Have the Pipeline to Withstand Time?

The most glaring issue that can happen when holding a pharmaceutical company is its pipeline could run dry. This is an extreme example. In reality, a pharma company needs to make sure its pipeline keeps up as generics for its other drugs come into the market.

Most drugs are developed under patent protection for up to 20 years. But you can bet as soon as that patent expires, generics are waiting to flood the market. Patent cliffs are not a surprise to the company. They must always be working on the next great idea so new drugs can step up and take over that share of revenue generation.

BMY was the result of two separate companies joining forces in 1989, but the innovation started many years before.

After spending a decade as a surgeon in the US Navy, Edward Robinson Squibb wanted to fight against the impure, unstandardized drugs of the 1840s. He started with a better way to produce ether in 1852.

In 1886, William Bristol and John Myers invested $5,000 to purchase the failing Clinton Pharmaceutical Company. They pledged not to sell any quack remedies and produce quality products for their consumers.

The company now generates annual revenues of $46.2 billion. Its drugs span the fields of oncology, hematology, immunology, and cardiovascular disease. A few names you might recognize are its antipsychotic Abilify, blood thinners Plavix and Eliquis, and cancer drug Opdivo.

Probably more important are the 45 compounds currently in development across 40 disease areas. I also checked that they were spread out in different phases of clinical testing. It’s a red flag when I see a pharmaceutical company’s pipeline that is heavily weighted to Phase III (late stage) testing. We always want to see compounds in the early testing phases of the pipeline.

A heavy Phase III pipeline could also warn that not enough money is being reinvested back into the business. That could lead to lower future revenue and the need to cut the dividend to rectify that situation.

|

Is Now a Good Time to Buy?

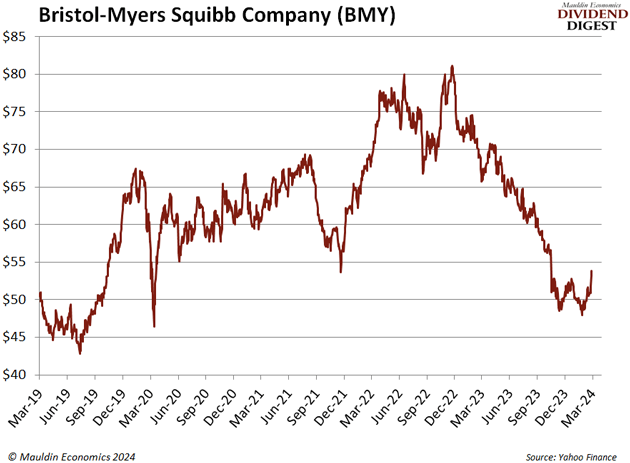

Shares of BMY are currently trading at their pre-COVID levels, which is one of the reasons for the great yield right now. Remember, when the share price goes down, our yield goes up.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

For the full year, total revenues came in at $46.2 billion. This was down 2% from last year and due to lower sales of Revlimid as just mentioned. But this is only one part of the company, and BMY has overcome patent cliffs before.

Looking closer, and excluding new products and Revlimid, revenues were $34.4 billion, up slightly year over year. New product revenues came in at $3.6 billion, up 77% year over year.

BMY also announced it will acquire both Karuna Therapeutics and RayzeBio Inc. and that these should close in the first half of the year.

Management expects full-year 2024 EPS will be down slightly from 2023. However, that does not include the impact of the acquisitions that have not yet closed. Meaning that the real number will most likely come in comparable to or slightly up from 2023.

I think that investors have unfairly punished BMY shares. If you’ve been holding BMY on your watchlist, this is a chance to get a great yield.

I’m not officially recommending BMY, but I am making sure that it’s on our radar right now. As always, if you want my latest favorite recommendations, you can check out my premium research service Yield Shark.

For more income, now and in the future,

Kelly Green

|

Kelly Green

Kelly Green