Join Me in a Conversation as We Continue to Search for Opportunities

-

Kelly Green

Kelly Green

- |

- March 20, 2024

- |

- Comments

Two weeks ago, I did something I’ve never done in my career. I ignored my publishing schedule.

I didn’t set out to ignore it. But there was an opportunity in the market, and I knew we had to take it. If we waited, we would miss the chance to get in at the price I wanted—and the yield we needed.

And I was correct.

When you sign up for my premium research newsletter Yield Shark, you get a monthly issue on the fourth Tuesday of the month. Inside, I share my favorite new recommendation to add to your portfolio. I tell you about the company, why I like it, and if it’s a Bedrock Income or Current Yield holding. I even include a buy-up-to price so we lock in our desired dividend yield.

All other Tuesdays, my readers get weekly updates on the market and the positions in the portfolio. This includes everything from dividend announcements to management changes. And then occasionally, I will send a flash sell or buy alert.

Those are all delivered by email. However, we’ve recently launched a Mauldin Economics app. Users can add additional benefits to their memberships.

This includes a chat board to communicate with me and other Yield Shark members. Plus, I offer video versions of both the weekly updates and monthly issues. And next week, I’m adding yet another benefit.

Once a quarter, I will go live so we can chat about the portfolio and the markets. Yield Shark readers will be able to ask me questions in real time. The first one will take place next Wednesday, March 27, at 2:00 pm ET.

|

Speaking of the New Mauldin Economics App…

… we now have a space in the app for Dividend Digest readers. I encourage you to check it out.

The app gives you access to the latest issues of Dividend Digest and my recently launched Dividend Quick Start Course. There is also a chat area for Dividend Digest members to communicate with each other and with me. Plus, I’m working on some other bonus materials that will only be available in this app.

If you don’t want the app on your phone, you can also access the exclusive community through your browser by signing up, using the link here.

So, What Stock Did We Act Fast On?

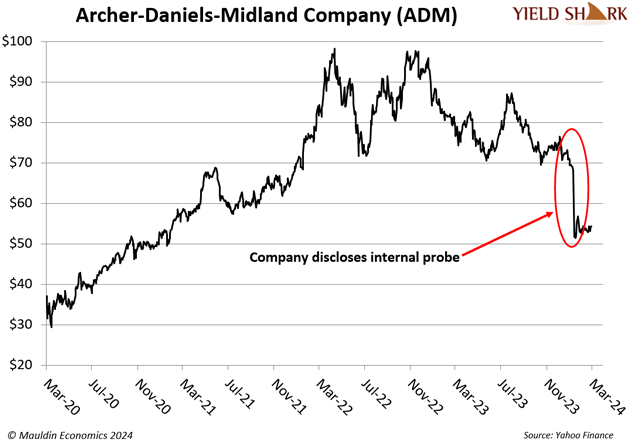

The March Yield Shark recommendation was Archer-Daniels-Midland (ADM). It wasn’t the first time we’ve held the stock in our portfolio. ADM was originally recommended back in February 2021, and we sold it in September 2022 for a whopping 45.7% gain. At the time, there was nothing wrong with the company. We were clearing out some of the lower yields in the portfolio, and ADM had a yield of just 2.7%.

The company has recently found itself the subject of an SEC and DOJ investigation. When the news broke, the market punished the stock… by a lot.

ADM decided to conduct an internal audit of its books, which delayed the release of its fourth-quarter earnings. I knew that investors would soon realize they had priced too much uncertainty into the stock and sent shares higher. When that happened, it would be too late to get in.

I was right. ADM shares have shot up 10% over our entry price on March 8.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

I’m not going to make it a habit of sending out buy alerts. But this is a great example of opportunities that are lurking in the market if you keep your eyes open.

If you’re worried about the economy and the markets... or if you just want to make sure you have a solid, stable portfolio... I highly suggest you take a look at my premium advisory, Yield Shark. I offer a 90-day money-back guarantee if you’re not 100% satisfied. We’ve found so many great opportunities over the past few years… and I don’t plan on stopping anytime soon.

For more income, now and in the future,

Kelly Green

|

Tags

Suggested Reading...

|

|

Kelly Green

Kelly Green