Why I Steer Clear of Tech Dividend Stocks

-

Kelly Green

Kelly Green

- |

- May 22, 2024

- |

- Comments

Some of the biggest names in tech started paying dividends this year. This includes Alphabet (GOOG), Meta Platforms (META), Salesforce (CRM), and Booking Holdings (BKNG).

If you’re not familiar with the last two, Salesforce is a powerhouse in customer relationship software that is used by some of the biggest brands around. Booking Holdings is the parent company of multiple travel-related websites including Kayak, Booking.com, and Priceline.

Investors and the financial media were excited about these new dividend announcements. I can’t join the hype as none of these new payments meet my minimum 3.5% annualized yield requirement. In fact, none of them pay over 1% annualized.

This is pretty standard for tech companies and it’s by necessity.

It goes back to the basics of why some companies pay a dividend and some don’t. Although this is a bit of a simplification, there are really only three things a company can do with its profit:

-

Hold it as cash

-

Reinvest it back into the business—R&D, pay down debt, etc.

-

Reward shareholders with a dividend or a stock buyback

Tech stocks have a long history of either paying no or a low dividend. Instead, they need to reinvest in the development of new tech products. Innovation and staying ahead of competitors are literally the goal of every tech company.

Some investors and analysts believe when a company pivots money away from R&D to shareholder return, it marks a transition. The company is no longer a young growth stock, but instead a stable, boring, “mature” company. Some even say that when a tech company declares a dividend it means they have nothing better to do with the money.

Think about some of the biggest dividend companies. Kimberly-Clark (KMB), for example, is a big, boring dividend payer. Although there has been some innovation over the years with toilet paper, Kleenex, and diapers… it’s not much. This is a night-and-day difference from what you’d expect from tech companies.

In the end, it’s all about balancing the needs of the specific company. When that balance isn’t achieved, the dividend gets cut. Now the company has to play catch-up. We’ve seen it before.

Don’t Let Yourself Get “Intel-ed”

Intel (INTC) has historically been a pioneer in the semiconductor industry. It was founded in 1968 and its 1103 DRAM (dynamic random-access memory) chip was the first chip to store a significant amount of data. By the 1980s, IBM PCs were powered by “Wintel,” the combination of Windows software and Intel chips.

This continued for decades. Almost every laptop and PC I’ve owned since 1995 has been a “Wintel” machine. The one exception being my latest purchase (we’ll get there in a moment). Intel was the biggest chip maker by revenue from 1992‒2018.

Then, in 2018, Samsung Electronics took the top spot from Intel. Intel would fight for the crown again in 2019. Today, that spot is held by Taiwan Semiconductor (TSM). In the PC segment in particular, many Windows machines are now running AMD chips and taking market share from Intel.

|

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

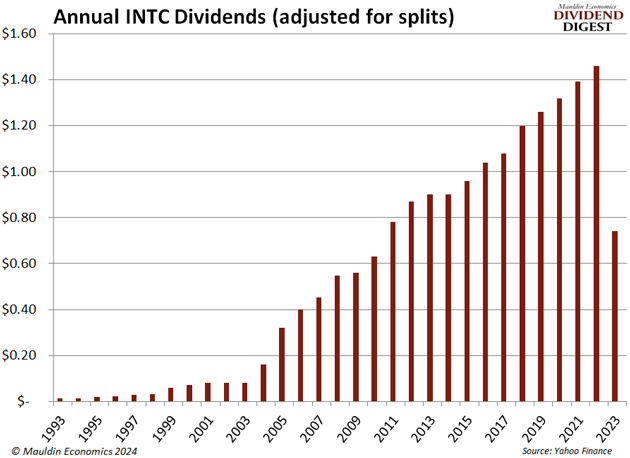

Intel had been raising its dividend every year since 2014. And many dividend investors labeled it one of those stocks that you could buy and hold forever. In the end this focus on returning cash to shareholders caught up with it.

The latest dividend cut puts Intel’s annualized yield at 1.6%, which is more in line for a tech company. It has also paired the lower dividend with plans for a comeback. This tells us Intel is eyeing its competitors and its former top spot, which can only mean it’s looking towards innovation again.

I don’t think GOOG, META, CRM, or BKNG are destined to this fate just because they started paying a dividend. But I’m still not going to add them to my personal account.

A Practical Way into Tech Dividends

The sub-1% yields from these four tech giants is not enough for us dividend investors. Even if these companies manage to raise their dividends at a modest rate, it would take years for the yields to hit my minimum 3.5%.

Unless you’re Zuckerberg raking in millions every quarter on millions of shares, you’re not going to find huge streams of income from tech stocks. If you have another reason to own these shares, go for it. But they shouldn’t be considered part of your income portfolio.

I’m not saying that I never recommend tech stocks. My Yield Shark readers locked in a 29% gain on ASE Technology Holding Co. (ASX) and 47% on International Business Machines (IBM). I’m not opposed to adding tech opportunities if they come our way, but they will probably be shorter-term holdings.

My favorite longer-term tech-related play right now is telecom. No matter what the tech companies are cooking up for the future, it will include handling a ton of data. And that data will need to be transported from point A to point B. That’s what telecoms do.

Verizon (VZ) and AT&T (T) are two of the biggest players in the US. They pay annual yields of 6.6% and 6.3%, respectively. My official recommendation is AT&T. Whatever you decide, I think you need telecom exposure in your income portfolio. And just be extra cautious if you’re considering traditional tech companies as part of a long-term strategy.

|

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green