Buybacks: Stock Manipulation or Useful to Investors

-

Kelly Green

Kelly Green

- |

- March 21, 2023

- |

- Comments

My preferred platform on the internet is email.

Not what you were expecting, but I rely on it every day.

I spend a lot of time doing research and writing. Then someone proofs my work to get the commas in the correct places. And other people get my work prepped and queued so that it arrives in your inbox on the correct day.

The whole process is handled via email.

It’s how I tend to consume information on the internet as well. I subscribe to a lot of emails. It makes my inbox overly cluttered, but Gmail allows me to easily search and keep track of my correspondence.

Lately, I’ve been spending more time on Twitter @YieldShark and LinkedIn.

I’m learning the ropes and making progress on how to use these two services. I’ve added new connections, joined conversations, tweeted twice, and replied to comments on other users’ threads. Hey, you have to start somewhere.

If you’re on either platform, please connect with me. I could use some company as I try and get the algorithm to serve me interesting content.

So far, I’ve read some opinions that warrant a second look. But frequently, I feel like I’m in that Esurance commercial from a decade ago:

Source: Know Your Meme

Anyone can have an opinion on social media. And anything can be made controversial without much effort.

My favorite posts over the past two months are about one thing—stock buybacks.

Back to the Basics

First, we have to start at the beginning. Because your opinion on stock buybacks is going to be directly tied to how you view stocks.

-

Shares of a stock represent equity ownership in a company.

The total number of shares of a company’s stock held by its shareholders is known as “shares outstanding.” You can find this number under a stock’s statistics tab on Yahoo Finance.

Viewing stock ownership through a stakeholder lens is the foundation of investing.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

At Dividend Digest and Yield Shark, we are investors.

When a company buys back its own shares, it lowers the number of outstanding shares by that amount. With fewer outstanding shares, each share is equal to a larger portion of the ownership pie.

A stock’s share price often rises when shares are bought back. This is why buybacks can be seen as a way to return money to shareholders.

So, each share is worth more both in practice and according to the arbitrary market price.

It’s the Motivation that Matters

That’s what it boils down to—motivation. Really, any action taken by a company or individual can be interpreted in different ways.

Reducing the number of shares can be seen as a reinvestment in the business. It can also signal company health, since there must be cash available to buy the shares.

But critics claim it’s a short-term scheme to manipulate the metrics used to value a company. Here’s how it works.

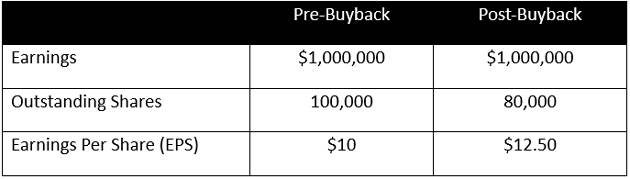

Earnings per share (EPS) is a common valuation measure used especially in quarterly results. It’s a simple ratio of the net income or earnings for a given time period, divided by the number of outstanding shares.

EPS = Earnings/Outstanding Shares

Management teams and analysts will compare the current EPS to prior quarters and years to gauge progress over time.

-

When the number of outstanding shares changes, the P/E ratio also changes.

Here’s an example:

If you just looked at EPS, you might think the company grew its earnings. In reality, earnings were stagnant and divided amongst fewer shares.

Because of this effect, buybacks can be used to make a stock look more attractive than it really is. And executive compensation packages can be tied to earnings metrics, adding greater incentive to pursue share buybacks.

Could a management team be trying to inflate its EPS and share price with a buyback? Yes. Do I think that’s usually the case? No.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

My gripe about a buyback is that it does nothing to help my income. I might own a bigger slice of the pie, but I’m still collecting the same amount per share. And if a buyback raises the share price, it will actually lower the current yield.

Yield is important to income investors. It tells us how efficiently our money is working to generate income.

I’m not going to vilify or commend all buybacks. Personally, I’d rather see a company use its cash to raise my dividend than to buy back its own shares.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green