A Dividend Portfolio “Must Have” No Matter What Lies Ahead

-

Kelly Green

Kelly Green

- |

- April 23, 2025

- |

- Comments

I’m not completely adverse to speculation. I like sitting around with friends and talking about what might happen in the markets. And occasionally I’ll slip a dollar or two into a slot machine at the local casino. But at the end of the day, I want to know there is stability in my portfolio.

Our dividend stocks are not entirely immune to the fluctuations of the market—no stock is. Their share prices are still exposed to the day-to-day whims of the investing masses. Just remember that we’re here for the power of dividends.

It all comes back to our dual goals:

-

Building wealth for the future with our Bedrock Income stocks

-

Creating above-average streams of income using our Current Yield positions

Macroeconomic changes and financial media hype can move share prices and even uncouple them from logical valuations. Through it all, we will collect our dividends and march toward our financial goals.

We could speculate about whether we’re headed for recession, or if markets will find new equilibriums. Either way, there are certain investments you want in your portfolio no matter what.

Consumer staples are the best example. People will still buy groceries and toilet paper through whatever the economy throws at them. Kimberly-Clark (KMB) is one of my favorites. Utilities also fall in that category. If consumers start to cut costs, the water and electric bills aren’t going to be at the top of the list.

“Sin-vestments” such as tobacco and alcohol should continue to do well in all markets. Big tobacco has expanded to include vapes and nicotine pouches, boosting sales. And, last but certainly not least, I always want to have some oil exposure in my portfolio.

|

Black Gold, Texas Tea

You don’t have to take my word for it. Legendary investor Warren Buffett has over 10% of his portfolio in Occidental Petroleum (OXY) and Chevron Corp. (CVX). Both companies have raised their dividend for over 25 years, earning them Dividend Aristocrat status. They yield 2.4% and 5.1%, respectively.

Buffett has been accumulating OXY since July 2018 and his stake currently stands at roughly $78 billion. If I was a billionaire, I’d probably continuously buy all my favorite shares, too. But I’m not, so I have to be way more strategic. And right now, I think we’re at the perfect time in the oil market cycle to add oil positions.

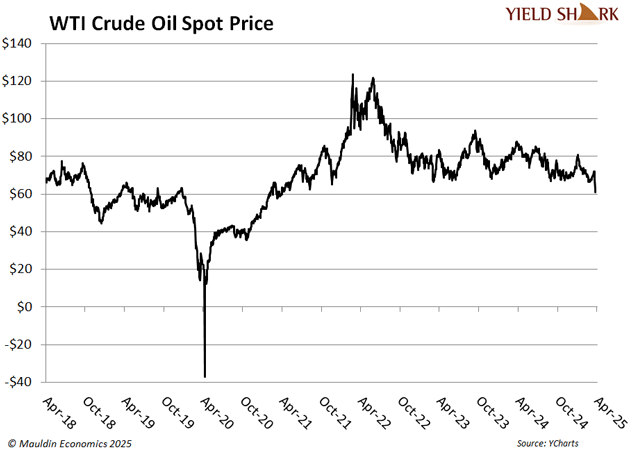

The International Energy Agency says the world is swimming in oil. Supply is up and demand is down. The ramp higher in US production since the COVID lows is sure to plateau. And oil prices have already dropped back to pre-COVID levels.

This is the downswing, the slow down. But it’s all about cycles. Supply is up and demand is down, so the oil price and production fall. Demand still exists; the market will find equilibrium for a short period of time. Then demand starts to catch up to that slower production. When it does, prices rise and production follows.

I know that’s wildly oversimplified, but it’s still how these cycles work. And I will always grab shares on the downswing and lock in a better price.

|

This Is No Ordinary Market Cycle—It’s a Reset

|

Buying Market Cycles Is Not Speculating

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

These pipeline companies collect profits all through the oil process: from the ground to refineries to storage facilities. Generally, the price of oil does not impact profits because these companies operate with long-term fixed contracts.

Pipelines also get special tax treatments. Operating as Master Limited Partnerships, they receive tax breaks in exchange for paying out 90% of their income to their “unitholders,” aka shareholders.

My favorite company is Enterprise Products Partners (EPD).

Keep in mind that you should not hold any MLP, including EPD, in a tax-advantaged account. And if you hold an MLP in a regular account, you’ll receive a K-1 instead of a 1099. These are generally not released until March and can create a tricky tax situation.

If you’re interested in collecting that “toll income” without the extra tax homework, you could use an MLP-focused ETF. The Global X MLP ETF (MLPA) has a low expense ratio (what you pay the fund manager) and EPD is its second-largest holding at 12.7% of net assets.

Whether you agree with me or not about the pipeline angle, I firmly believe you should be adding oil dividends to your portfolio right now. I turned my belief into action and recommended a new oil play to my Yield Shark readers just yesterday.

Yep! I finally recommended something other than a pipeline company for oil exposure. I haven’t done that in over a decade. As always, if you want all the details and access to my complete dividend portfolio, you can try Yield Shark with our 90-day, money back guarantee. I’m sure you won’t be disappointed in the dividends you could be collecting during this choppy market.

|

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green