The Real Reason You’re Not Succeeding in the Stock Market

-

Kelly Green

Kelly Green

- |

- November 1, 2023

- |

- Comments

I actually see two reasons why lots of people are not succeeding in the stock market.

The first reason is that they’re just sitting on the sidelines. The first step is to open a brokerage account and get started. It’s really pretty easy. Last week, I gave you two of my favorite dividend stocks. You can buy one of them for just $15 a share and it yields over 8%. I know you can find $15, so get it in the market and making money for you.

The second reason—and I think the real reason—that most people aren’t succeeding in the market is shortsightedness. There are a lot of examples of this. I still see analysts comparing the 2023 financial numbers of companies to those in 2022. Did we forget that 2020, 2021, and 2022 were weird pandemic years for most companies?

Some companies saw sales soar due to the pandemic lockdowns. Those companies will see lower earnings as we adjust to a post-pandemic normalization. On the flip side, there are companies that faced immense challenges during COVID that are showing small improvements each year. We have to remember what the economic circumstances were when comparing current-year to prior-year numbers.

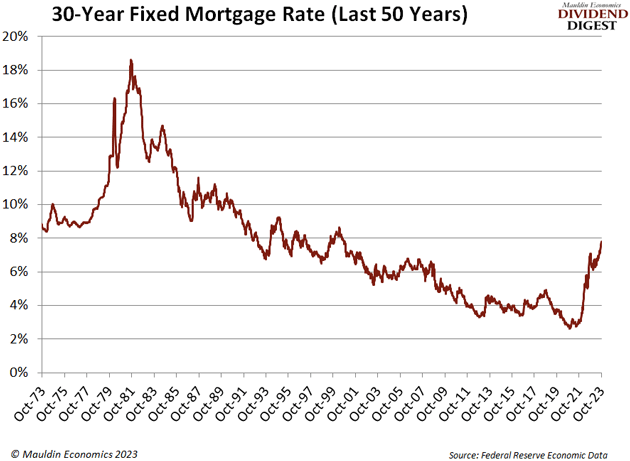

Another great example that is hogging the headlines is mortgage rates. Many people I know are freaking out about today’s 8% mortgages.

It’s higher than in recent memory… but certainly not the highest we’ve seen in 50 years. Economies expand and contract, and interest rates also go up and down. We’ve just been in the land of zero interest rates for so long that many of us have forgotten that rates at or near zero is not normal.

And higher rates aren’t just affecting mortgages. CDs and high-yield savings accounts are now offering yields we haven’t seen in years. But if you think these are more appealing than long-term dividend strategies, you’re again being shortsighted.

Invest, Don’t Trade

Benjamin Graham, considered the father of value investing, is known for saying, “The individual investor should act consistently as an investor and not a speculator.”

What is the difference?

Speculators or traders are short-term thinkers. Generally, they see stocks as simply a ticker symbol and are attempting to predict which way a stock will move and make a profit. To be a successful speculator, you have to time the market exactly right. And the probability of doing that and being consistently right is very low. If you’re going to attempt this it will require hours of your time—time that would be better devoted to long-term wealth building.

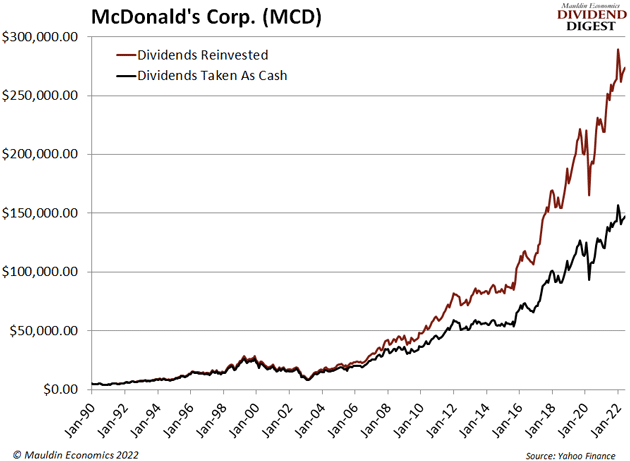

Investors look beyond the ticker symbol to the company that stands behind it. Remember, when you buy shares of a stock, you are buying a sliver of ownership in the company. And when you own the best companies and reinvest the dividends, your ownership stake and income will grow as the company grows. Instead of spending time trying to time the market, we’re allowing time to work for us.

One of the best ways to use time as a wealth-building tool is dividend reinvestment, and McDonald’s stock is a great example of how this works:

McDonald’s is just one stock that shows how reinvesting allows your money to work even harder. We can’t do that by switching to a CD that offers a high interest rate. When rates fall, then what? You’ll be looking at dividend stocks to capture the same yield.

Don’t get in your own way. Use high-quality dividend stocks to amplify how hard your money works for you during all economic cycles. Some of the best companies for these long-term strategies are Dividend Aristocrats and Dividend Kings. As always, if you want my favorite Bedrock Income stocks, please check out Yield Shark and see how it can help you build wealth.

For more income, now and in the future,

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Kelly Green

Kelly Green

Kelly Green