Start Small, Think Big, and Your Money Will Work for You

-

Kelly Green

Kelly Green

- |

- October 23, 2024

- |

- Comments

Last Friday and Saturday I was invited to speak at the MoneyShow in Orlando. As much as I enjoy communicating with you all digitally, it’s nice to get out and talk about dividends in real life. I had great conversations with some Mauldin readers, other industry pros, and some folks who had never heard of me before.

I got to talk about my dual-dividend strategy and how it continues to work in all markets. I also covered the rotation into dividend stocks that I think we’ll see in 2025.

What surprised me most was how much I ended up talking about dividend reinvestment.

Dividend reinvestment, or DRIP, is when you decide to use the dividend to buy more shares rather than take it as cash. The next time the company pays a dividend, it will be paid on the shares you initially bought and the new shares purchased with the last payment.

It’s the magic of compounding. You are getting paid dividends on your dividends. Quarter after quarter the compounding continues and speeds the growth of your investment.

|

Yield Shark: Your Premium Guide to Building Wealth Through Dividend Investing: Grow your portfolio with reliable income and long-term capital appreciation. Yield Shark offers you monthly dividend stock recommendations, expert insights, and a community of like-minded investors. Led by Kelly Green, Yield Shark helps you navigate today's market with confidence, using dividend investing to build a resilient, income-generating portfolio. |

Inside the boring world of dividends, DRIP is probably the most boring of all. It’s a set-it-and-forget-it strategy, but it takes time to work. The magic of compounding only really kicks in after a minimum holding period of seven years. Ideally, you’d want to hold for 20+ years.

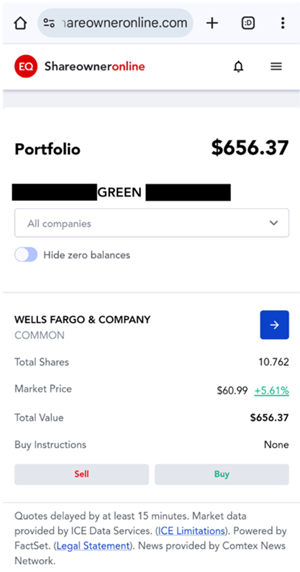

I also found the interest in dividend reinvestment comical, because I had already planned to write about it in today’s issue. My decision followed a conversation I had with my brother after he sent me the following screenshot:

The account info in the image is an interesting story for three reasons:

-

It’s a DRIP account through a transfer agent instead of an online broker;

-

I gifted it to my brother for Christmas the year I started in financial publishing;

-

It has more than doubled in value.

|

Sure, $650 is not a life-changing amount of money, but the math shows us that the DRIP strategy works. This account was worth just $255 when it was opened in November of 2012. Since then, the account has grown in value by 155% without him having to do a single thing in 12 years.

A Strategy that Is Easier than Ever

There was a time when you would see commercials and advertisements for dividend reinvestment accounts.

When I first opened this account for my brother, it wasn’t common to set up dividend reinvestment in your brokerage account. This was prior to commission-free trading, so commissions would have eaten up your strategy. Instead, you would open an account with the transfer agent and pay nominal up-front fees of around $15.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Remember that reinvestment makes the most sense for your longer-term positions. If you still have 10 or more years until retirement, this is a great way to build your retirement nest egg even quicker. It’s also a great strategy if you have money you plan to pass down to your kids or grandkids. Let compounding do the work for as long as possible.

After a Decade of Experience

Twelve years later, that Wells Fargo DRIP account is not the worst place I could have put some money for my brother. But it also wouldn’t be my top choice today.

First and foremost, at the time I bought the shares, WFC only paid a dividend yield of 2.6%. This is below my minimum yield requirement of 3.5%. You deserve to get paid a decent return on your money. That is especially important if you want to set up an investment and not have to monitor frequently.

Ideally, any company you put in a DRIP should have a long history of raising its dividend. To ensure a future of higher dividends, you’ll also want to choose companies with products that are deemed necessities, both today and in the years ahead. Good places to look for these holdings are in the consumer staples sector or a list of Dividend Aristocrats or Kings.

So, if I were going to do it all over again and open a DRIP plan for my brother, what company would I choose? My two favorites right now are Enterprise Products Partners (EPD) and LyondellBasell (LYB). Both companies are in “necessities” businesses that will be around for a long time. These companies currently yield 7.2% and 5.9%, respectively. EPD has 25 years of dividend increases and LYB has 14 years.

EPD trades for just $29 a share. So, you can set up an online brokerage account and start your DRIP account for just $29 without any fees or commissions. It doesn’t take a lot to get started. And I promise reinvesting your dividends is one of the most efficient ways to get your money working for you.

|

For more income now, and in the future,

Kelly Green

Kelly Green

Kelly Green