How to Use Volatility to Your Advantage

-

Kelly Green

Kelly Green

- |

- July 19, 2023

- |

- Comments

“If you fail to plan,” Benjamin Franklin once said, “you are planning to fail.”

With earnings season ramping up, it would behoove us to listen and form a plan. More data is flooding the market, which means more volatility as analysts and investors react to it.

If you’re prepared, though, you can use this movement—positive or negative—to your advantage. The key to success is simple planning.

If you don’t plan, it’s easy to get swept up in market movements. This is a surefire way to buy high and sell low. And it’s especially true in the current market, where the S&P 500 is hovering above 4,500 and working toward its 2022 record high of 4,796.56.

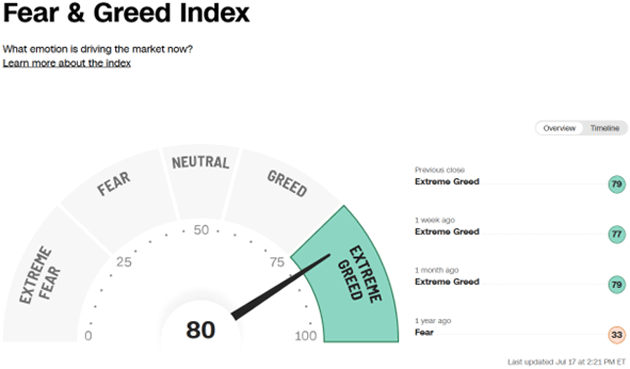

As you can see, the market is in an extreme greed state right now:

Source: CNN Business

The Fear & Greed Index is my favorite quick gauge because it’s a combination of seven different indicators that measure various aspects of the market. This includes market momentum, volatility, and the ratio of stocks hitting new 52-week highs to those hitting yearly lows.

So, how should you plan with the market’s meter at such an extreme?

First, Know Your Limit Price and Stick to It

If you don’t know the maximum you’re willing to pay, it’s easy to pay too much. That’s why I always establish the maximum I’m willing to pay for any stock. Since I’m an income investor, I generally come up with this figure based on how much yield I’m targeting from that stock.

When there is more risk involved, I want a little more dividend yield to compensate for taking on that risk. If a company is a boring and stable stock to buy and hold, I might be okay with a lower dividend yield. Still, you deserve to get paid on the money you’re parking in a stock.

Remember that:

-

Dividend Yield = Annual Dividends Collected ÷ Share Price

So, if you’re looking for your limit price, you can rearrange that to be:

-

Share Price = Annual Dividends Collected ÷ Desired Dividend Yield

Make sure that your desired dividend yield is in decimal form (e.g., 5% would be .05).

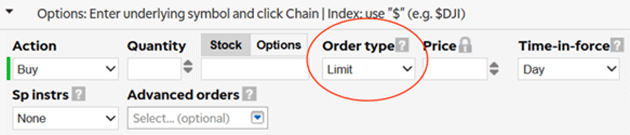

If you enter the minimum yield that you’re willing to accept, you’ll be able to find the maximum price that you’re willing to pay. You’ll then have this number for your brokerage limit order.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Also remember that when share prices decline, yields rise. Don’t be afraid to utilize dips to add to your positions. Remember: The goal is to buy low and sell high. So, when there is a bargain, don’t be afraid to go against the grain if you like a company.

Once you’ve made sure you’ve gotten a good entry price… then you have to protect your profits.

Use Stop-Losses When Markets Run Up

Once you’ve gotten in at a good price, then we hope for those share prices to increase. So, how do we know when to sell?

If it’s a Bedrock holding, I plan to buy and hold for years… maybe even decades. These are the shares that I will most likely pass down to my nephews as wealth. I reinvest these dividends and leave them alone.

However, Current Yield holdings need a closer look. These are companies that I want to collect yield from right now. I will hold some for the long term, but for many I will add a trailing stop-loss as share prices increase.

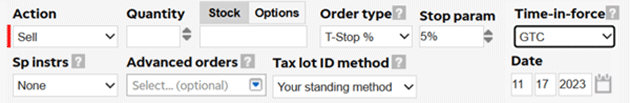

A trailing stop-loss will adjust as share prices climb. Generally, I will implement this strategy when shares have increased at least 20%. After that, I use a 5% trailing stop.

From the time this order is placed, the trailing stop will move with share prices. Every time shares hit a new high, the stop-loss order changes to 5% below that price. It’s worth noting that this is a pretty narrow order. I only use this when I want to lock in gains—and on shares that I’m ready to sell.

Remember that volatility in the markets is certain. But if you have a plan, you can use the fluctuations to your advantage.

In Yield Shark, I give a buy-up-to limit for each position. And then I go through every earnings call so we can adjust and deploy stop-losses accordingly.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green