Can Outrage Create Opportunity for Dividend Investors?

-

Kelly Green

Kelly Green

- |

- July 12, 2023

- |

- Comments

These days, the internet and social media make it incredibly easy to voice outrage and link with like-minded individuals. I might argue that outrage keeps the cogs of the social media machine steadily moving.

Because of this ease, more and more companies are finding themselves the target of boycotts—and its countermovement, “buycotts”—many of which have been fueled by political and ideological ideas.

I’m not here to get political. Yes, I have my own beliefs, and I do believe that consumers should vote with their dollars.

But overall, research has shown that boycotts and buycotts generally have temporary impacts. Sure, they can damage a company’s reputation, at least in the short term. Overall, though, they tend to do little to the bottom line of these large companies.

This short-term fallout can create a yield-boosting opportunity for investors. Remember: When share prices go down and dividends are unaffected, our yield increases.

This Giant Retailer Is Still Just That

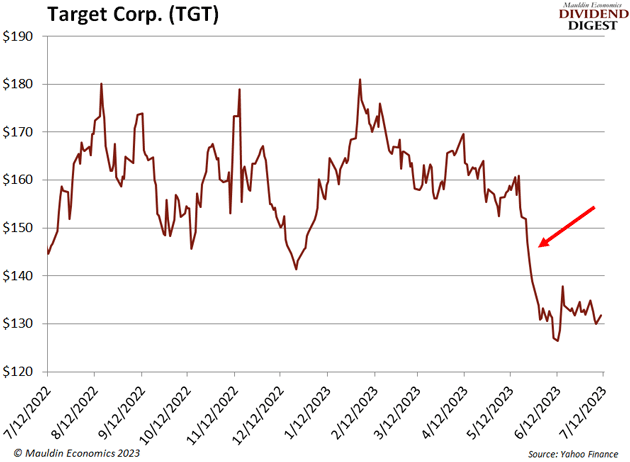

Target Corp. (TGT) faced backlash over merchandise that appeared on shelves at the end of May… then again faced backlash after reacting to the first round of backlash. The stock saw nine straight days of losses.

I’ll be honest with you: I don’t really shop at Target, but I can understand the consumer appeal.

As a dividend investor, I’ve kept an eye on Target for many years since it has increased its dividend for the last 52. That means it’s considered both a Dividend Aristocrat and a Dividend King.

It’s a company that I’ve had sitting on my wish list. Yes, this is different than my watchlist, which is a little more practical. My wish list has more fantastical expectations. Here, I was hoping for a yield of 3.5%—or at least 3% from the retail giant.

Before the pandemic, Target saw 11 straight quarters of growth. And I thought it would be a great bedrock holding if the dividend was over 3%. Then, during the pandemic, TGT saw record-breaking quarters. Share prices followed and, despite a dividend increase, yielded under 1%.

A Buying Opportunity in Disguise

Shares had been settling post-COVID. On May 15, shares were $100 less than pandemic highs, with a dividend yield of 2.7%. But this outrage-driven slide was the last bit to push TGT’s yield over my 3% requirement.

At current prices of around $134.74, the $1.10 quarterly dividend is a yield of 3.3%. This is closer to my wish-list goal of 3.5% than my minimum requirement of 3%. So, I do think now is the time to seriously consider shares of TGT.

If you bought shares over the past two years, you’re not a happy camper right now. But if you’ve been sitting on the sidelines, this just might be the opportunity you’ve been waiting for. As far as share price, we’re back to pre-COVID levels. And this time we have a much higher dividend.

We should consider that the macroeconomic landscape for retailers is more challenging right now. The company does sell consumer staples, but 55% of its sales are discretionary products. Meaning, as consumers feel the squeeze on their wallets, TGT will see that effect.

I know too many people who can’t walk into TGT without blowing $100. And I think it’s important to remember that the company has been around since 1962. It’s seen all sorts of changes in consumer spending and lived to talk about it.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green