Every Dividend Investor Needs This in Their Portfolio

-

Kelly Green

Kelly Green

- |

- July 24, 2024

- |

- Comments

I almost exclusively talk about stocks here in Dividend Digest because dividends are at the root of my strategy. But most income investing includes some level of exposure to debt.

Remember, when a company needs to raise money, it has two options: equity (sell more shares of stock), or debt (notes/bonds). Equity is what we’re usually looking at. When we buy shares of stock we’re buying a small slice of ownership in a company.

Buying a corporate bond is a loan to the company, just as buying a Treasury bond is a loan to the US government.

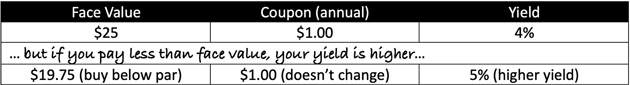

Notes or bonds have a set face value known as “par value.” The most common par value of a traditional corporate bond is $1,000. However, some can have a par value of $10, $25, or $100. Although you may buy a bond for less than its face value, you’ll get paid back the full face value at maturity.

They also have what’s called a coupon. This is the amount of interest you’ll receive every year. The bond’s yield is calculated using the coupon amount and the par value. But the buyer’s actual yield can vary.

That’s the other great part of bonds. A bond’s face value is set, and is not subject to the whims of the market like stock prices are. It’s a similar deal for the coupon rate. The amount of interest income you receive does not change and is not subject to the whims of the management team.

You can trade bonds with many online brokers, but they aren’t always the easiest to find using their search tools. If you want to really get into the nitty gritty of bonds, I recommend finding a good master class. My favorite is Jared Dillian’s, which you can check out here.

Lucky for us, there are simple ways to add bond exposure to your portfolio.

Bond ETFs Give You Access to a Basket of Bonds

Many of you know I’m generally not a fan of ETFs (exchange-traded funds).

ETFs own a basket of investments and are designed to spread out the risk. This essentially means at any point some of the investments are going up… and some of them are going down. The losers are offset by the gainers and vice versa.

The result may be a “safer” investment, but it also limits the potential gains of just picking the right investments yourself.

|

ETFs have what is called expense ratios, which are the fees charged to pay for portfolio management and other administrative costs. These fees have trended significantly lower over the past 20 years and are generally under 1%. The fees might be lower, but you’re still paying them. A more actively managed fund will have a higher expense ratio and I’ve seen some as high as 10%!

There are times when an ETF is the right choice. Foreign stocks, for example, can be difficult to trade and an ETF will give you easy access. It’s the same story for bonds.

There are hundreds of bond ETFs on the market today. If you want quick and simple debt access a bond ETF might be the way to go. However, I still don’t think it’s the most profitable way to own debt.

My Favorite Way to Add High-Yield Debt to Your Portfolio

I like to use exchange-traded debt—sometimes called baby bonds. These are bonds/notes with smaller par values of $10, $25, or $100 like I mentioned above. And buying them is as easy as buying a stock.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

We have some notes in the Yield Shark portfolio that pay a 6.7% annual yield based on the par value of $25. But we bought them below par value and locked in a 10% yield. And we will collect the full $25 face value when the notes are redeemed.

We bought these when the company had just started to transform its business. Investors were not convinced it would be successful and sent the value of the notes lower. Now, the market has more confidence in the company and the value of the notes has climbed higher. You can’t lock in a double-digit yield today.

Exchange-traded debt can be difficult to find through your broker. But it can end up being super lucrative and definitely worth the effort.

The higher yields make them great additions to the income-generating part of your portfolio. Plus, the safety of the coupon means you know exactly how much you’ll receive with every payment.

The feedback I’m getting from readers tells me they are a crowd favorite. So, I am always on the hunt for the best deals. And that’s exactly what I did in our July issue of Yield Shark that went live yesterday. I recommended notes that are trading below par, giving us an inflation-beating 9% yield. Plus, we’ll pocket a double-digit gain when the notes are redeemed.

You still have time to get in before the next coupon payment. You can check out all the details with our money-back guarantee. Just click the link above.

|

For more income, now and in the future,

Kelly Green

P.S. Don’t forget I’m presenting at the virtual MoneyShow this afternoon. If you want to hear about my strategy and my favorite tickers, you can join me absolutely free by clicking here.

Kelly Green

Kelly Green