Know These Important Dates that Affect Your Money

-

Kelly Green

Kelly Green

- |

- January 24, 2024

- |

- Comments

I was recently talking to my mentor about why I “stuck with” dividend investing. When he first hired me, he was looking for someone to handle the logistics of his newsletter, track the portfolio, and do some writing. I was qualified and needed a job… but here I am more than a decade later still preaching the dividend strategies that got me hooked back then.

Dividends are frequently put down as boring and for widows and seniors. And that’s exactly why I like them.

In my 20s, I was no stranger to picking up a second job or some freelance work to earn more money. I had a predictable schedule and knew exactly how much money my next check would be.

Today, I get that same certainty from dividends without having to punch the time clock.

The reason I stuck with dividend investing is:

-

I like dividend stocks because I earn money that gives me a flexible lifestyle while being able to do what I actually want to be doing.

I live in sunny Florida. I want to spend the days outside on my motorcycle or at the beach, not watching the market and worrying if I need to make a trade.

Don’t get me wrong, you can’t just ignore the market. But if you own the right dividend stocks, you can really free up the time needed to commit to your investing strategy.

|

What’s next at Mauldin Economics? Join Partner and COO, Ed D’Agostino, as he discusses the latest evolution in Mauldin Economics thinking, research, and investing framework... |

Knowing How to Find Important News

Our dividend strategy is based on owning two types of stocks: Bedrock Income and Current Yield.

Bedrock Income stocks are companies I believe we’ll be able to hold forever. This part of the portfolio is designed to need almost zero attention. That’s why I like to reinvest these dividends and allow them to compound.

The Current Yield section needs a little more attention. These are companies I expect to hold only as long as the outlook for the company and the dividend make sense. But even then, you don’t have to check the market obsessively.

At least once a week, I check the company news on all my open positions. And it doesn’t take that much time. For each company I open two internet browser tabs. In the first one, I go to the company’s press release page.

In the second one, I search the company name in Google and then select the news tab. Then I sort by date to see what I’ve missed since my last check.

When looking at the Google news feed, keep in mind that some of the results will be articles with the opinion of the author.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Dates Are Important Catalysts to Know

We are in the middle of earnings season right now. This means I have a list of when all our companies will release their latest earnings data. We can expect that share prices will move on these dates (in one direction or the other).

Keep any price moves in perspective. The price movement is often short term and a direct result of something in an earnings call that didn’t meet investors’ expectations. And determine if any change in financial data will in fact affect the company’s potential in the long term.

There are other important dates that can cause investors to move the share price.

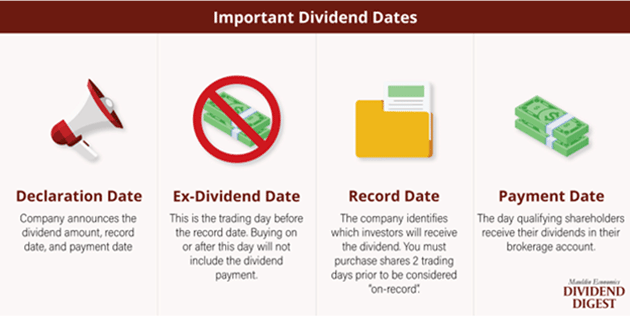

Your online brokerage account makes it super simple to collect your dividends. To do that, your broker tracks certain trade dates to make sure you meet the requirements for a dividend distribution. These dates are:

-

Declaration Date: The day the company issues a press release declaring its next dividend.

-

Record Date: The date you must be “on record” as a shareholder to qualify for the dividend. To be eligible for the dividend, you need to purchase your shares at least two trading days prior to this date.

-

Ex-Dividend Date: The first day that shares start trading without qualifying for the dividend. It is the trading day before the record date. If you purchase shares on or after this date, you will not qualify for the upcoming dividend.

-

Payment Date: This date is also given in the press release and is when you’ll see the dividend hit your account.

You can save this graphic as a handy reference. I also posted these quick definitions to my Instagram today so you could save that post for your reference.

The ex-dividend date is the first date that the share price does not include that dividend. So, it’s not uncommon to see shares drop by the dividend amount on that date.

Dividend investing isn’t a completely hands-off approach, and no investment is without risk. But it’s a great way to make passive income in 2024 and for many years to come.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green