How to Avoid Being Blindsided by a Dividend Cut

-

Kelly Green

Kelly Green

- |

- August 16, 2023

- |

- Comments

This is not the first time I’ve been blindsided by a dividend cut. After all, I’ve been in this industry for over a decade. And since I plan on being a dividend investor for many years to come, this likely won’t be the last.

The saving grace is that this company has been sitting on my watch list—because I thought we might see a dividend cut—instead of in my portfolio. What blindsided me was the reason why.

The dividend cut in question belongs to Camping World Holdings (CWH).

I’ve spent vacations in RVs since I was a child. Back then, my parents had the quintessential travel trailer with bunk house. Even today, they’ll make the 1,000-mile trip from Maryland to Florida to visit in their Class C motorhome.

From 2019–2021, I lived in a travel trailer. I’ve been thinking that it might be nice to return to that minimalist life. But that’s a story for another day…

Still, this is an industry I keep an eye on. And Camping World was a stock that had caught my eye, as it came with a double-digit yield.

|

In uncertain times, your portfolio's strength matters more than ever. Income expert Kelly Green introduces the "Inflation Hideout," delivering a steady 8% yield for investors. Shield yourself against market shifts and secure solid yield potential. |

The Importance of Checking Historical Dividends

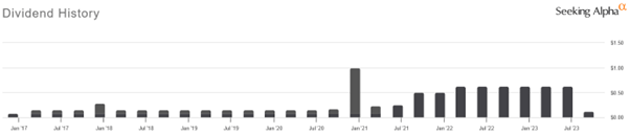

CWH made its way on my watch list after paying a special dividend of $0.91 in December 2020.

Now, in 2020, the global economy saw $220 billion in dividend cuts. But here, Camping World was paying a special dividend 9X larger than its regular quarterly payout.

Source: Seeking Alpha

As you can see from the chart above, special dividends weren’t abnormal. Since going public at the end of 2016, the company has always had a conservative base dividend and a special dividend on top. It was an extra reward for shareholders.

That plan seemed to go out the window in 2022, as the dividend went from $0.09 to $0.63. This was the reason why the company never made it into my portfolio. The dividend increase was simply due to the pandemic-fueled extra income. And I wasn’t sure what would happen when sales inevitably came back down to earth in 2023.

But as it turns out, declining RV sales weren’t the reason for the dividend cut.

It Always Comes Back to Basics

I really thought that the headwinds of the macroeconomy were going to be the catalyst for CWH’s dividend cut. Instead, the company has decided that it wants this money to ramp up business growth.

Remember that when companies make a profit, there are only three options for that money:

-

Keep it as cash

-

Reinvest is back into the business

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

Pay it out to the owners, aka shareholders.

Since the beginning of the year, the company has opened, acquired, or signed letters of intent with over 30 RV dealership locations. The conversation has clearly been about expanding. That means that money from option three needs to be reinvested and utilized for option two.

That’s just how the game is played. And from the historical dividends, we know that there isn’t a long track record of returning money to shareholders. The fact is that the pandemic unlocked extra money, and it was paid out to shareholders. As soon as it was needed for something else, the dividend was cut.

Now, there was no indication here that Camping World would be a great long-term income generator. But it does prove an important point…

If you have companies in your portfolio that you plan to hold for long-term income generation, you should keep tabs on the pulse of their management teams. A quick scan of earnings calls will allow you to keep an eye out for talks of any new plans that would require that money to be siphoned out of your pocket and back into the business.

In my premium publication, Yield Shark, I do all this legwork for you. If you’re interested in learning more about my low-risk, high-yield, dividend-producing portfolio (with a “done for you” approach), just click here to get started.

For more income now and in the future,

Kelly Green

Kelly Green

Kelly Green