Did You See That?

-

Kelly Green

Kelly Green

- |

- November 29, 2023

- |

- Comments

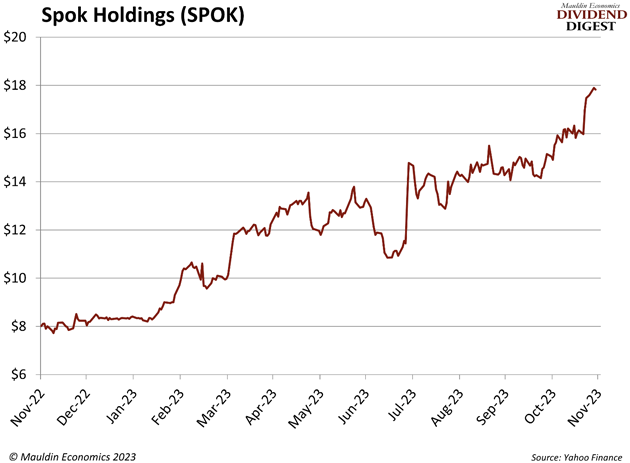

Was it a bird? A plane? No, it was our shares of Spok Holdings (SPOK) taking off.

Last Tuesday, SPOK shares opened at $15.97, then they spiked to $17.39 before closing the day at $16.98. That’s a 6% gain for a single day. Shares have since given back some of their gains, with the stock closing yesterday at $17.17.

If you remember, this was one of the stocks I recommended to you in our October 25 one-year anniversary issue. Had you bought shares that day, you would have paid around $14.59, giving you a 19% gain. And we also qualify for the next dividend payment of $0.3125 per share that will hit your account on December 8.

-

If you had acted on my guidance, you’d have a total gain of 21.7% in just 33 days—that’s 240% annualized.

I hope you acted on this position since I don’t always recommend specific stocks in Dividend Digest. I’d love to hear how you did and what your entry price was. You can reach out here.

That’s a cool gain in your portfolio, and I will talk about different holding and exit strategies you can use with this position. It’s also a great example of what I’ve been talking about the past few weeks.

I searched high and low to find out what got investors so hyped up about the stock and came up empty-handed. But someone somewhere knows something…

When Trading Volume Matters

Generally, I don’t pay much attention to stock volume. Volume is simply the number of shares traded in a particular stock over a period of time. Sites like Yahoo! Finance will typically show the day’s volume for a stock and the average daily trading volume for the past few months.

Most companies that I recommend and that we talk about here are big blue chips. For those, we never have to worry about volume because there is plenty of it—with millions of shares traded every day. If you’re buying preferred shares, exchange-traded debt, or something on the OTC (over-the-counter) market, you probably want to keep an eye on the volume.

Stocks with an average daily trading volume of less than 10,000 shares tell me I definitely need to use a limit order when buying and that it might take a few days for my order to get filled. It might also be a good idea to place a good-til-canceled (GTC) order with my broker. Using a GTC order keeps it open until the stock hits my desired price, or I change my mind and cancel it.

SPOK’s average daily trading volume is 186,357 shares. Sure, that’s dinky compared to, say, Apple’s (AAPL) average volume of 58 million. Still, 186 thousand should give investors plenty of room to get in and out of the stock without pushing the price around too wildly.

-

The Tuesday price jump perfectly aligns with the day’s unusual volume spike.

Take a look:

Source: StockCharts.com

If you aren’t familiar with stock charts, the vertical bars at the bottom of the chart show each day’s volume, and the number of shares is indicated on the left-hand scale. An even closer look tells me that trading volume really took off around 12:30 on Tuesday.

Again, I can’t find anything that happened around that time or on that day. It looks like pure investor sentiment… and it was the sentiment of someone—or several someones—with a lot of money to throw around.

So What Do We Do Now?

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

I didn’t recommend the company because I thought it was going to be a quick winner. I did so because I wanted to snag its 8%+ dividend yield for a year or two.

When a stock pops higher, we have the opportunity to bank a quick, unexpected profit. But selling comes at the expense of no longer collecting that income. Here are our three options:

-

Sell now: we lock in our profit and still collect the dividend on December 8. We’re done with this position and have nothing to worry about.

-

Do nothing: we ignore the gains and continue to collect our 8.5% income stream.

-

Use a trailing stop strategy: we keep the stock, protect our gain, and continue to receive a stream of dividend income.

Option 3 is the way to keep collecting dividends and protect most of the gain if shares start to fall. For stocks with a lower share price, like SPOK, I tend to use a 7% trailing stop.

What does that look like?

Shares are currently trading at about $17. A 7% trailing stop would instruct my broker to sell these shares if the price drops to $15.81. If the stock hits that price and is sold, I would lock in a gain of around 10.5%, including my dividend. If shares move higher than $17, the trigger price will move up 7% off that new price. The trigger price only changes when the share price rises.

If shares don’t hit the trigger, we keep our shares and keep collecting dividends. If it does, we pocket a profit equal to 1.25 years of dividends and redeploy that money elsewhere. Just remember to choose a good-til-canceled (GTC) order so it stays open past market close today.

You have to pick which strategy meets your needs, but I recommend adding a 7% trailing stop to your position. That’s exactly what I’m going to do with my personal shares as well.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green