You Really Can Pay Your Bills with Dividends

-

Kelly Green

Kelly Green

- |

- August 30, 2023

- |

- Comments

I see these claims all over social media: I just paid all my bills with my dividends. It’s usually accompanied with a hashtag like #financialfreedom, #passiveincome, or #FIRE (financial independence retire early).

I’ll admit it’s an attractive idea. Sit on a beach with a blended drink while your investments pay all your bills! Yes please. But can you really pay your bills with your dividends?

The short answer is yes. In practice, the answer depends on the size of your expenses and how much money you have to invest. As with any financial goal, the first step is to pencil out the math and a plan.

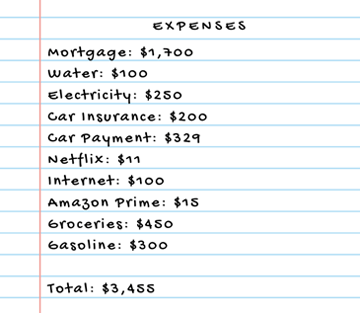

Let’s start with monthly expenses. We’ll use some hypothetical but not unrealistic numbers:

Be honest and thorough, because you can’t cover your bills with your dividends if you don’t know the amount you need.

If nothing else, this exercise can be a wake-up call. The lower you can get your living costs the easier it will be to hit your sand-and-sandals dream life. So, if you have a lot of debt and bills, there are tons of ways to get yourself out of that hole. Figure out a plan that works for you and start hacking away at those excess expenses.

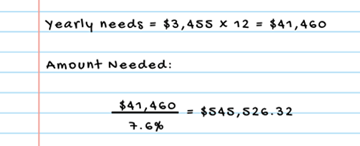

The next step is to calculate how much investment money you will need to generate the needed amount of monthly income. To do that, you need to know how much return—or yield—you think you can get on your money.

My favorite long-term holding is Enterprise Products Partners (EPD), and it currently pays a dividend yield of 7.6%. So, we’ll use that yield for our calculations, as follows:

After doing some simple math, you would need a little over $545,500 earning a 7.6% yield to pay those hypothetical bills. That’s a big number, but don’t let it discourage you. A half million dollars can seem incredibly out of reach today, but you have to think long term.

How Do You Eat an Elephant?

Although not the most pleasant image, you probably know that the answer is “one bite at a time.”

Confucious offered similar advice, saying, “The man who moves a mountain begins by carrying away small stones.”

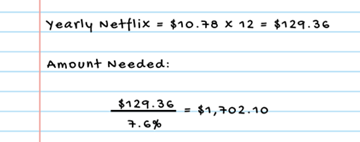

Both lessons convey the same message—start small but think big. For most people, starting is the hardest part. So if your dream is to someday pay all your bills with dividends, start by saving and investing what you need to pay smaller ones.

A Netflix basic subscription is about $10.78 per month after tax, or $129.36 per year. How much EPD stock would I need to cover that bill?

At its current share price, you would buy about 65 shares of EPD.

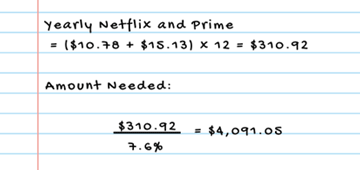

How about Netflix and Amazon Prime?

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

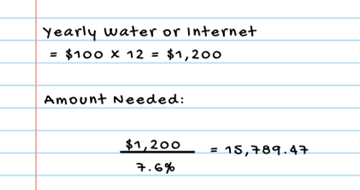

Or what about $100 per month to pay that water or internet bill?

Owning 596 shares of EPD would cover either of those bills.

That’s how you get started. Take care of those smaller, more attainable numbers first, and you will eventually hit your goal. And remember that you will collect these dividends for years and years to come.

|

Did you know that the most powerful brands in America are dishing out billions in extra income each year? No need for a second job or side hustle—there's a straightforward strategy to put extra cash in your pocket every month. The best part? This income rolls in, no matter how the stocks perform. As long as they keep offering this opportunity, you keep cashing in. No extra hours needed, just a few smart moves. Click here to learn how you can start collecting your extra income today. |

Lather, Rinse, Repeat

Paying your bills with dividends is possible… and it becomes possible for you by following a few simple steps.

-

Start building your stack of investment cash. Maybe skip your $8 latte just one day a week and make your coffee at home. Or find another luxury you can cut back on just a little bit. One share of EPD costs just $26.50.

-

Reinvest your dividends. Doing this will grow your money faster and reach the number of shares you need to pay the bill you’re targeting. Use the power of compounding to your benefit.

-

Once you have enough shares to pay your desired bill, stop reinvesting. Take those dividends as cash and they will be deposited into your brokerage account and are available for paying bills.

-

Start again with the goal of paying the next bill.

Financial freedom won’t happen overnight, but that doesn’t mean it’s not possible. To set yourself up for success the most important thing you can do is start now.

For more income now and in the future,

Kelly Green

Kelly Green

Kelly Green