Should We Get Prepared for Market-Wide Dividend Cuts?

-

Kelly Green

Kelly Green

- |

- February 22, 2023

- |

- Comments

The financial media went nuts last week after rumors that Intel Corporation (INTC) will have to cut its dividend. And today those rumors were confirmed.

This Dividend Aristocrat announced it will reduce its quarterly payout from 36.5 cents to 12.5 cents. That’s one third of the previous payment!

INTC has been on my watchlist for over a decade. I’ve recommended it to past readers who collected a solid 4% yield for many years. And locked in some share price gains as well.

It’s not the only “royalty stock” making this decision.

Two weeks ago, V.F. Corp (VFC) announced it had cut its dividend.

You may not recognize the company name, but I know you’re familiar with some of its brands: Vans, The North Face, Dickies, Jansport, and Timberland, are just a few.

The company has earned the title Dividend Aristocrat for years—meaning it has raised its payout every year for at least 25 straight years.

In fact, V.F. Corp. was just 2 years away from being crowned a Dividend King—a higher dividend every year for 50 straight years. Instead, it cut its dividend.

-

In the third quarter of 2022, 60 companies slashed their dividends, more than double the number in the same quarter the previous year.

Companies are still coping with the aftermath of the pandemic while the economy struggles to find its post-COVID new normal. Even those companies that have managed to navigate the last 20 to 50 years without a cut.

Should we get prepared for a steady climb higher in the number of dividend cuts?

No.

I think we should, however, expect to see some familiar names announce cuts to their dividends.

All Dividend Cuts Are Not Equal

It’s easy to heap criticism on a company for a dividend cut. But a closer look may reveal that things aren’t as bad as they seem.

One example can happen to dividend-paying stocks that are actually ADRs (American Depositary Receipts). ADRs are issued by American banks and represent shares of a foreign company listed on a US exchange.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

Currency exchange fluctuations can make it appear that a non-US company has cut its dividend.

Your dividend in US dollars can drop while the dividend in the foreign currency remains steady or actually rises.

The best way to know if the dividend in the primary currency was cut is to visit the company’s website. The information will appear under a tab labelled “Investor” or something similar.

Another example is when the payout amount is calculated based on a variable dividend strategy.

I got readers of my Yield Shark newsletter into Eagle Bulk Shipping (EGLE) last year after it announced it would begin paying a dividend.

The dividend policy calls for a quarterly cash dividend equal to 30% of net income, but not less than $0.10 per share.

So far, we’ve collected quarterly payments of $2.05, $2.00, $2.20, and $1.80.

I informed readers that the payments would be variable. And now that shipping rates have settled, I expect we will sell our shares at some point this year.

Had we panicked at that first “cut” from $2.05 to $2, we would have missed out on a lot of high-yield income.

A Dividend Cut Can Make Long-Term Sense for a Company

There are really only three things a company can do with its profits:

-

Invest back into the business (R&D, new hires, share buybacks)

-

Hold it as cash

-

Reward the company owners (aka shareholders) with payouts

A commitment too large in any of these directions can create other problems.

And if a company is contemplating a dividend cut, it could also signal a problem within the company.

- Or it could signal the company’s intent to invest that money back into the business for future returns.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

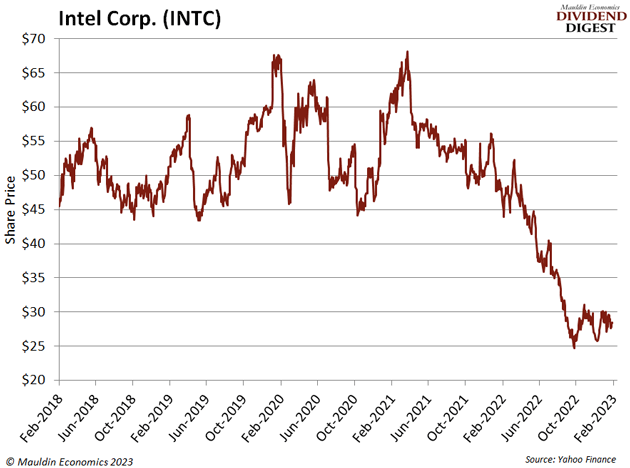

The last week in January, Intel gave one of its bleakest forecasts ever.

The company sees further deterioration in the PC market and continued macroeconomic effects bearing down on its business.

Analysts now question whether it’s hefty dividends over the years may have been better spent on research and manufacturing advancement.

INTC’s previous yield of 5% was one of the highest among large tech companies. But the “high yield” was mostly due to a collapsing stock price.

Shares ended last week 47% off their 52-week high. Investor worry is prevalent in its lower share price.

However, it’s important to watch how shares react today and through the end of the week.

If Intel can deploy its cash in a way that sparks a growth phase, I think it will be a great investment long-term. But that’s a big if for me right now.

-

Intel’s share price movement today and tomorrow should give some insight if investors believe the dividend cut will help achieve its growth targets.

Flat or slightly higher shares will tell us investors are on board with this cut for the long-term strategy. If they continue down, investors are skeptical and waiting for more proof.

I urge you not to make decisions based on rumors. Instead, take a step back, do your own research, and understand what the facts could mean for a long-term commitment.

Then, decide how much you need to get paid for your investment and set your yield target. Stay nimble, though, and be willing to adjust your expectations as you acquire more information.

Had you taken these steps, you would know your yield target in advance and been ready to act quickly.

The new payout brings Intel’s current yield to just under 2%. While that’s not enough yield for me, the growth plan offers a much brighter future for Intel and its investors.

Without a solid business and future success plan behind it, even a 5% yield isn’t worth our time and money.

For more income, now and in the future,

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Kelly Green

Kelly Green

Kelly Green