It’s That Time of Year—Avoid This Annual “Advice” and Act Now

-

Kelly Green

Kelly Green

- |

- May 10, 2023

- |

- Comments

Phrases like “righty tighty, lefty loosey” and “birds of a feather flock together” pack practical advice into neat little mnemonics so our brains can remember them.

Rhymes are one of the simplest ways to boost memory—just think about those catchy commercials and jingles that end up stuck in your head.

Well, it’s that time of the year for my least favorite rhyming, so-called-helpful piece of advice. I’ve been in the business for over a decade, and I still think it’s one of the worst pieces of advice for investors.

I’m talking about the investing adage “sell in May and go away.”

I’ve Never Been a Fan of This Advice

Just 10 days into the month, I’m already tired of reading about it.

In its original context, it was recommended that British investors, aristocrats, and bankers should sell their shares in May. They would then be free to escape the London heat on holiday and return to the stock market in the fall.

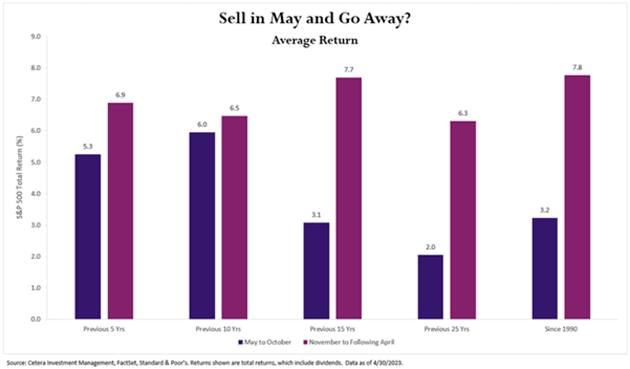

More recently, it’s based on the premise that the stock market tends to underperform from May through October. Alternatively, the best six-month period of the year for the stock market is November to April.

The markets do tend to see lower volumes during the summer. Part of this can be attributed to traders enjoying vacations. There also tends to be less market-swaying information released throughout the summer months.

For several years, “sell in May and go away” would have seemed like a silly strategy simply due to the cost of commissions. But even in a commission-free landscape, I don’t want to time the market. I want to let my dividends work for me.

Still, I took a moment to see if it makes sense to follow this advice, especially this year. And I found two clear reasons that you want to steer clear of it.

The Markets Still Make Money May–October

In all the reasons to make this move, it was noted that the summer months were marked by underperformance. But underperformance is not synonymous with losses.

Source: Barchart.com

There is still money to be made in the summer months over all five time periods shown above. Over the longer periods, the summer months generate about half the average return. But over the past five and 10 years, those numbers have been a lot closer.

I don’t want to miss out on any of those potential gains because I decided to listen to an old rhyming phrase… especially when we know that long-term dividend strategies pay off. I want to allow my money to compound even in the seemingly slower periods of the year.

But I have even more reason to ignore this advice in 2023…

Now Is Not the Time to Sit on the Sidelines

Investors are hoarding cash at record levels.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

The low-risk return of over 4% may be tempting, as many investors are bearish on stocks. But while I wouldn’t call myself bullish on the market, I am bullish on the success of a long-term dividend strategy. And I think that 2024 is going to be a great year for the markets, which means I want to get in now.

So far, 85% of the S&P 500 companies have reported first-quarter earnings. And most of them have reported a positive EPS or revenue surprise.

I spend quite a bit of time looking through earnings call transcripts. Since the bottom of 2020, I’ve been looking for the signs of the new normal.

The excuses are finally clearing, and transformative plans are locking into place. Companies are emerging with a clear view of the future, and 2024 is going to be the year that lines investors’ pockets.

If we wait until then, it will be too late.

Instead of selling in May, use this time to set up for the future. Remember, a lower entry price means a higher dividend yield. That’s our goal as we head into 2024 and beyond.

For more income now and in the future,

Kelly Green

Kelly Green

Kelly Green