The world is out of balance

-

Ed D'Agostino

Ed D'Agostino

- |

- February 24, 2023

- |

- Comments

The world is out of balance. The disruptive changes that were already rewiring the economy, geopolitics and U.S. culture accelerated over the past 3 years, and a predictable backlash began. But we are nowhere close to a “new normal”.

—Bruce Mehlman, Mehlman Consulting, from his latest presentation, Disequilibrium

Dear Reader,

Today’s economy is nothing like the economy we enjoyed pre-pandemic, but we’d be getting ahead of ourselves to say we are already in a “new normal.” There are massive changes still underway.

The cost of capital is soaring. Mortgage rates have gone up ~250 basis points in a year. Credit card debt is climbing faster than ever, with total debt approaching $1 trillion in the US, and credit card interest rates are now around 20%.

Global conflict is intense. Ukraine just entered its second year of war with Russia. A presidential election cycle just started… China… I could go on. Suffice it to say we are in a period of extreme transition, which hopefully leads to a better equilibrium. I have my doubts on the hopeful part.

What does a new normal look like? That’s the topic I covered with Bruce Mehlman in this week’s Global Macro Update interview (link at the bottom of this letter).

Bruce suggests the US and China are in a new type of cold war. We’ll be wary adversaries—but adversaries who continue to trade out of necessity. The US will sell soybeans to China, and Foxconn will send us new iPhones. The kids might say we’ll be “frenemies.”

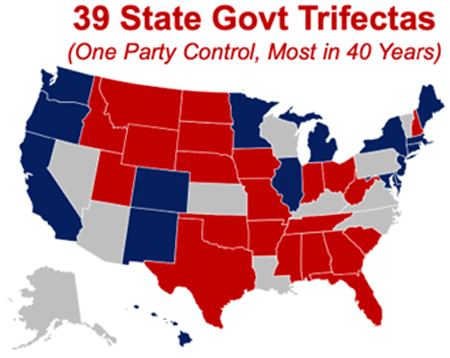

In the US, the federal government will continue to cede power to the states. The US is split evenly at the federal level, but the red vs. blue state map is much more definitive.

Source: Mehlman Consulting

Geopolitics will continue to evolve. Future conflicts will focus on points of vulnerability. As an example, think about the US and Europe marching toward full electrification. Battery-powered cars for all, of course, but that’s just the start. States are mandating electric heat and even electric cooktops.

Have you been to Upstate New York? The power goes out in the winter. Same for much of the US, and I’m sure Europe as well. I bought the last gas-fired hot water heater with a pilot light available in my state. When the power goes out in my neighborhood, the neighbors come to my house for a hot shower after a couple days. And I’m in Connecticut!

What happens when your nation is almost entirely dependent on electricity for everything, and we suffer a major cyberattack? Can you unlock your front door, drive your car, access cash, heat your home, prepare food, or call for help?

If you saw my interview with author and Wired Magazine contributor Andy Greenberg, you know the US is unprepared to defend itself from a sophisticated, government-sponsored attack on our utilities.

We are marching toward electrification, arguably with the best of intentions (I, myself, am thinking about putting down a deposit on a Rivian SUV), but we do so without addressing the unintended consequences. That will leave us vulnerable in ways we’ve never experienced.

Culturally, this is where I am pessimistic. I believe the polarization we are enduring today will continue until something forces us—I’m speaking of Americans now—to forget our differences and come together. It happened after 9/11. Everyone became a New Yorker. What will it take to make that happen again? I fear something equally tragic. I hope I’m wrong.

How do you prepare for the new normal? Be careful where you get your information. Bruce has a word for the state of today’s media. He calls it “angertainment.”

Be careful with your investments. Maybe don’t chase the highest yield or the sexy stock pick you heard from (some other) newsletter publisher. Risk-free investments are yielding as much as the projected annual stock market returns for the coming year. Dry powder is something you’ll want to have. US bonds will once again have their day.

Focus on resiliency and listen to a variety of voices. You don’t need to dig a bunker and buy canned beans… but do look at your portfolio and give it a stress test.

You can catch my full interview with Bruce Mehlman here:

If you prefer to read rather than watch, you can access a transcript of this interview here. Or, listen as a podcast – just search your player for “Global Macro Update”.

This format is a departure for Global Macro Update. Do you like it? Please reply to this email and share your thoughts either way.

In other news, John Mauldin and I are hard at work planning the next Strategic Investment Conference. It will again be virtual, with live presentations airing May 1, 3, 5, 8, and 10. We’ve got an impressive lineup for you—more news to come soon!

Thank you for your support of Mauldin Economics. The world is overflowing with content, and I appreciate you sticking with us. We do our best to honor that trust.

Sincerely,

Ed D’Agostino

Publisher & COO

P.S. If you have not had a chance to watch my interview with Keith Fitz-Gerald, you can catch it here. Keith covers his approach to investing, explains why he’s so optimistic (the markets have a proven upward bias), and gives a few of his do and don’t buys. It’s worth a watch.

If you prefer to listen to Global Macro Update, you can do so here:

Ed D'Agostino

Ed D'Agostino