Inflation Is Over

-

Ed D'Agostino

Ed D'Agostino

- |

- March 14, 2025

- |

- Comments

Last week I asked you to reconsider the prevailing narrative that tariffs are inflationary. Our friend Jared Dillian noted that tariffs slow economic activity, and in doing so, ultimately push prices down.

Today’s guest on Global Macro Update, QI Research founder Danielle DiMartino Booth, takes that argument a step further. Danielle notes that after President Trump started his first trade war with China in 2018, the Consumer Price Index fell from April 2018 until April 2019.

Here’s Danielle:

We are a world that revolves around trade. At the time, 24% of every US automobile, 24% of the pieces, the components, the parts came directly from China. So slowing down global trade in the year 2019 ended up costing jobs in the United States… Any year global trade contracts, the US economy cannot and has not avoided recession… That was exactly where the US economy was headed in… the fall of 2019. We were heading towards a recession predicated on the slowdown in global trade.

Then the pandemic response brought the global economy to a halt. But through trillions of dollars in stimulus, the US managed to avoid a recession. Instead, we triggered a wave of high inflation, peaking in June 2022.

Today, inflation is dropping quickly, and other concerning trends are developing. But you wouldn’t know it from reading the headlines.

Danielle has been calling attention to underreported recession signals since our last interview in May, when she highlighted rising store closures and job losses. As she said then, “There is no greater drag on inflation than job loss.”

My concerns about a recession are rising by the day. The number of major employers laying off workers is moving higher and spanning industries. It includes marquee names like Chevron, BlackRock, Boeing, Southwest Airlines, Hewlett-Packard, Kohl’s, Meta, and Starbucks. Last week I mentioned that auto loan delinquencies of 90-plus days rose to 4.83% in Q4 2024. Now Fitch Ratings is reporting that 6.56% of subprime auto borrowers were more than 60 days delinquent in January, the highest since it started tracking the data in the 1990s.

|

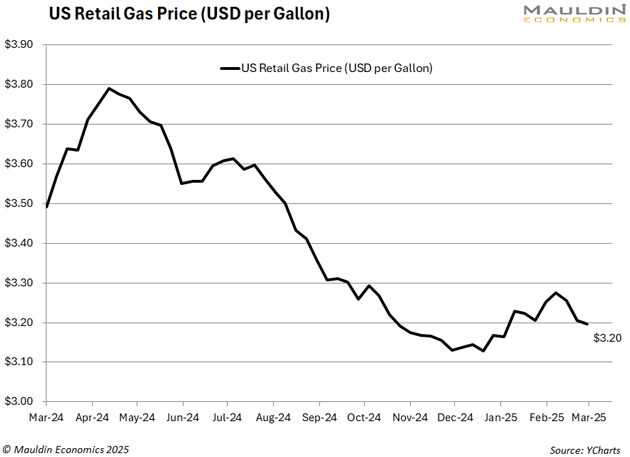

Signs that we’re in the middle of an economic shift are getting harder to brush aside. And despite the uproar over egg prices, it is not going to be an inflationary one. Danielle argues that the inflation narrative has been overblown for some time, and that the data, including prices at the pump, now point in the opposite direction.

Where does this leave us? Danielle believes the Fed will wait too long to cut rates, because it always does. Then it will have to cut rates deeper to compensate down the road.

The good news here is that recessions rarely last long—10 months, on average, since the 1950s. With that, I’ll turn it over to Danielle… Just click the image below to watch our interview. I also encourage you to check out Thoughts from the Frontline tomorrow—John is handing the reins over to Danielle for a special edition of his weekly letter.

A full transcript of my interview with Danielle DiMartino Booth is available here.

Danielle publishes her thoughts in The Daily Feather. She also offers an institutional-level service, The Weekly Quill. You can learn more about it here, and if you subscribe, be sure to enter our code, QIFrontlinePro, to get a 20% discount. Thanks, Danielle!

|

And thank you, Global Macro Update readers, for your support.

Ed D’Agostino

Publisher & COO

If you prefer to listen to Global Macro Update, you can do so here:

Ed D'Agostino

Ed D'Agostino