The Quantum Hype Machine

-

Ed D'Agostino

Ed D'Agostino

- |

- January 17, 2025

- |

- Comments

Everybody has an opinion about quantum computing lately. Last week Nvidia CEO Jensen Huang suggested we were 15–30 years away from “useful” quantum computing. Mark Zuckerberg joined the chorus, telling Joe Rogan that useful quantum was still “quite a ways off.”

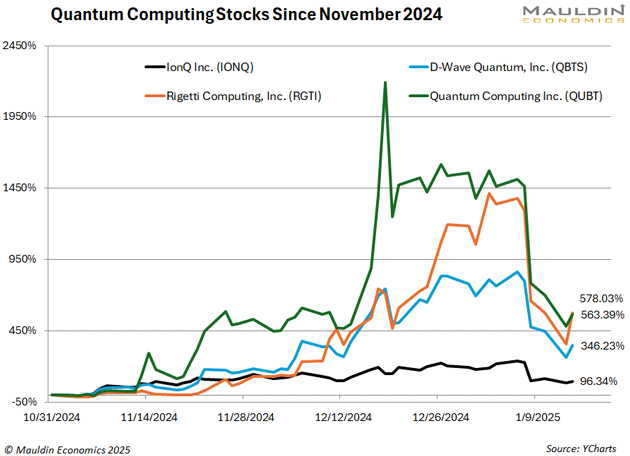

Shares of small quantum computing companies like D-Wave Quantum, Inc. (QBTS), Rigetti Computing, Inc. (RGTI), IonQ Inc. (IONQ), and Quantum Computing Inc. (QUBT) all plunged after Jensen’s negative comments. But they’ve been recovering quickly.

These stocks had been on a tear for the past few months, prior to Huang’s comments. They were riding a massive turnaround in sentiment from early 2024. As recently as October, both Rigetti and D-Wave were at risk of being delisted (for the second and third times, respectively).

The catalyst for quantum computing stocks was Google announcing that its newest quantum chip, Willow, had completed a computation that would take a classical computer 10 septillion years… in 5 minutes.

|

This fed the quantum hype machine, and quantum stocks are all up big since November, even after accounting for the Jensen sell-off.

So, when will quantum computing become useful? After all, these are lofty valuations for businesses generating very little revenue, and no profits.

Rigetti’s CEO, Subodh Kulkarni, shared a refreshingly hype-free outlook on the state of quantum in a recent interview. Kulkarni said that Rigetti is making quantum processing units, available for sale, today. But, he cautioned, their error rates are still too high for broad adoption. Today it is mainly government agencies that are issuing contracts for his QPUs. He estimates we are 3–5 years away from true quantum advantage, when quantum computing will start to make a material difference.

When that happens, he predicts we’ll see quantum computing applied to high-variable problems such as weather forecasting and pharmaceutical development. It could also be used for breaking encryption, which poses serious issues for businesses and governments. But again, quantum will also help solve for that.

Kulkarni was quick to tamp down investor enthusiasm in the short term. If you watch the interview, I think you’ll find him to be credible and focused on the engineering challenges at hand. He is clearly not a former McKinsey consultant or investment banker—he comes from the engineering side of the industry. I found him credible, which gives me confidence in his 3–5-year prediction, which aligns with my findings.

I’m happy to be positioned 3–5 years prior to what I believe will be the biggest technology development of my lifetime.

At this point, there is no real dispute about whether we will reach quantum advantage. A handful of smaller companies are rapidly moving toward it, as are all the major tech firms like Google and Microsoft. It’s only a question of when.

Where does this leave investors? Last summer I said that quantum is “the next big thing.” When I recommended a small quantum computing company in my premium research service, I cautioned subscribers to avoid watching the daily price action. “This will likely be a volatile ride, with the potential for large, but temporary drawdowns while we hold. In two years or so, I believe we’ll be happy we bought in and held on.”

It turned out to be even more volatile than I expected. Our stock rose so quickly, we took a “free ride” when we hit a 200%+ gain, selling the equivalent of our initial invested capital. By the time Jensen Huang spoke about quantum, we were risk free, which made the 50% drop in price much easier to handle. By shaving off enough shares to recoup our initial investment, we took the emotion out of the trade. When the big price drop came, we didn’t feel compelled to sell, which let us stay in the holding and catch the bounce that followed.

I wish I could say this happens to all our positions! It doesn’t, but our themes pointed us in the right direction more often than not in 2024. I like our setup for 2025. If you’d like to see what we are up to in our premium research service, Macro Advantage, you can learn more here. I hope you’ll give us a shot.

Here’s the interview with Rigetti CEO Subodh Kulkarni.

|

Thanks for reading,

Ed D’Agostino

Publisher & COO

Ed D'Agostino

Ed D'Agostino