Are bond yields high?

-

Ed D'Agostino

Ed D'Agostino

- |

- October 6, 2023

- |

- Comments

Are bond yields high?

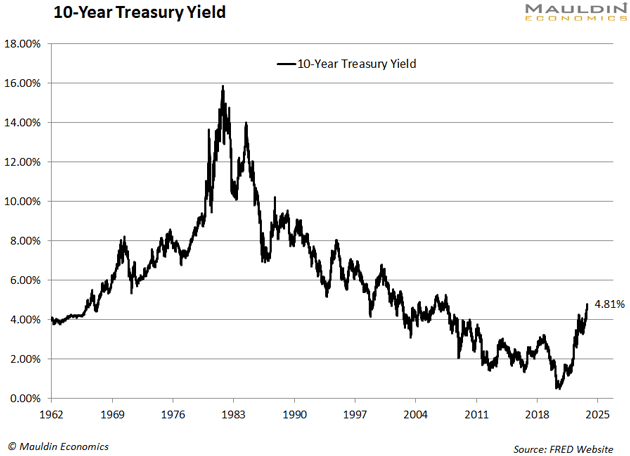

Rates on 10-year Treasuries have been climbing since August 2020. But depending on the time frame, you could argue that yields are still relatively low.

Take a look at this chart of 10-year US Treasury yields going back to 1962. Rates peaked at 15.59% in 1981.

What’s astonishing, though, is their recent rate of change: up 24% this year and 825% since August 2020. As Jared put it earlier this week, rates are going parabolic.

With bond yields reaching levels not seen since 2007, stocks have a formidable competitor for your investment dollars. If you’ve been sitting out of the stock market, you are finally getting paid to wait. But will that last?

We’ve been conditioned to think that stocks always outperform fixed income because, for many years, they did. The S&P 500 has returned 10%+ annually, on average, for 100 years, as Oaktree Capital co-founder Howard Marks, recently noted.

Now bond yields near 5.0% have changed the risk/reward dynamics of stocks versus bonds. Five percent might not be enough for you over the long term, but it’s considerably higher than the 1.048% you would have averaged between 2010 and 2020.

In other words, higher bond yields have raised the bar for stock performance expectations.

Howard Marks says this is part of a fundamental “sea change” in the markets.

Today, instead of sharing one of my own Global Macro Update interviews, I’m passing along a fantastic interview with Marks conducted by David Rubenstein for Bloomberg. Marks’s understated brilliance is on full display here. He makes points that are too important to miss.

In short, Marks argues that we are entering a new investment regime—a sea change—where interest rates will remain higher for longer, so your investment playbook should change, too. As Marks puts it, “Today, you can get equity-type returns, from what we call credit instruments.”

He says you might consider certain fixed-income investments, which in theory carry less risk because they are higher up the capital stack. If a company gets in trouble, stockholders take the first loss. Lenders (including bondholders) typically have more rights and protection.

Marks also calls for the Fed to move to a more neutral interest rate, which he puts at 2%–4%. That is still meaningfully higher than what we’ve grown accustomed to over the past dozen years.

Should all this change your investment playbook?

This is one of the areas the new Mauldin Economics Macro Team and I are focused on. We are developing a framework for how to invest in the sea change. (I’ll share more details soon.)

For now, as you consider that question, think about the magnificent seven (Apple, Alphabet, Meta, Amazon, Microsoft, Nvidia, and Tesla). These companies have accounted for roughly 65% of the entire S&P 500’s gains this year. They are arguably great companies, but they are predominantly tech companies. Will tech continue to outperform in the face of higher rates? No one knows for certain, but history indicates it will not.

Another thing to consider is why bond yields are rising. There are several theories, but here’s one contributing factor that deserves more attention:

Source: Outside the Beltway

This is the US House of Representatives. Regardless of your political persuasion, ask yourself… Does this group inspire confidence? Enough confidence that you’d want to invest with them at near-zero rates?

The US borrows most of its funds from overseas. Foreigners finance our government, and it seems they want a higher rate of return to do that. A massive debt load, ongoing budget deficits, and dysfunctional leadership do not typically inspire lenders to write checks. Why would bond buyers be different?

Howard Marks has written a memo on the sea change. I also encourage you to watch his interview in full. Just click the image below, and if you have any comments, please send them to me on X (formerly Twitter) @EdDAgostino or reply to this email.

Best regards,

Ed D’Agostino

Publisher & COO

Ed D'Agostino

Ed D'Agostino