When Inequality Isn’t

-

John Mauldin

John Mauldin

- |

- March 29, 2014

- |

- Comments

- |

- View PDF

Getting Old Has Its Rewards

The Usual Suspects

The Myth of Increasing Income Inequality

South Africa, New York, Europe, and San Diego

“An imbalance between rich and poor is the oldest and most fatal ailment of all republics.”

–Plutarch, Greek historian, first century AD

“In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

“There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

“Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil.”

–Frédéric Bastiat, “That Which Is Seen and That Which Is Unseen,” 1850

“Still one thing more, fellow-citizens – a wise and frugal Government, which shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned. This is the sum of good government, and this is necessary to close the circle of our felicities.”

–President Thomas Jefferson, first inaugural address

Plutarch argued over 1900 years ago that it was income inequality that lay at the heart of the failure of the Greek republics. Other writings of that period demonstrate that the leaders were worried about the distribution of wealth in society. The causes of unequal distribution have certainly changed over time, but it seems to be built into our DNA to obsess over what we have relative to what others have.

That we are living in the most splendid golden age in the history of humanity – if by golden age we mean that for the world at large there is less hunger, longer lives, less poverty, better healthcare, better and more universal education, and a host of other factors that are manifestly superior as compared to 2000, 1000, 200, 100, 50, and even 20 years ago – is patently evident. We are far from the world Thomas Hobbes described in 1651 in Leviathan when he said “[T]he life of man [is] solitary, poor, nasty, brutish, and short.” He would be amazed at the relative abundance achieved by mankind in the last 463 years.

And still, authority after authority the world over, in rich country and poor, from the President of the United States to the leaders of some of the most impoverished nations, describes income inequality as a fundamental injustice and the source of many problems .

We have spent three letters (so far) dealing with the topic of income inequality. The topic is everywhere in our daily conversation and in economic research. I’ve dealt with many of the facts of income inequality in these three issues and will try to conclude the topic this week. We’ve discovered so far that income inequality is a fact; however, income mobility has remained roughly the same over the last 40 years. That is, a person’s chances of rising from a lower stratum of wealth distribution to a higher stratum is approximately the same as it was in 1975.

We have liberals and progressives who use data to demonstrate the correlation between income inequality and recessions or slow growth and then erroneously equate correlation with causation. I think we have sufficiently shown the absurdity of their conclusions. This week we will look at some of the actual causes of income inequality, and in an argumentum ad absurdum I will offer “solutions” that I guarantee can absolutely reduce income inequality just as easily as taking money from the rich and giving it to the poor. In fact my solutions are far more direct, as they affect the causes rather than the effects of income inequality. I must warn you, however, that if you harbor a religious passion for pursuing higher taxes rates on the rich and rely on income inequality as your excuse, you may not be happy with my suggestions or with the rather inconvenient facts I present.

I would like to begin this week’s letter with a quote that might at first appear to have nothing to do with income inequality, but it strikes me that it is at the heart of the argument advanced by those who favor more progressive taxation. Charles Gave argues that there is a correlation (and he sees causation) between the financial repression perpetrated by central banks and the reduction of growth in the developed-world economies. And he links the low-interest-rate policies of central banks to an increased Gini coefficient and income inequality. Those of us who are of a more classical economic persuasion will find this correlation more attractive than we do the supposed one between income inequality and recessions. And we will see that the logic behind Charles’s argument is more compelling.

The simple fact is that there are many correlations to be found in the economic world, and politicians find economists useful in supplying justifications to support almost any policy. The fact that economists might not agree on the data that is used in this way is immaterial to politicians who are simply looking for an excuse to do what they want to do anyway. In this regard, economists perform the same function as shamans and witch doctors in tribal societies, who regard the entrails of sheep or some other unfortunate animal and predict the future, which generally corresponds to what the chief wants to hear. Economists are far more advanced than that, of course. We painstakingly gather data and develop complex computer models to show what our politicians want to hear.

I realize that I argue at the extreme and that most economists are actually well-intentioned and trying hard to figure out how the world works. But they cleave to economic theories in much the same way that people hold religious beliefs to try to explain how the world functions. These theories often predetermine the conclusions economists come to when they analyze data. Maybe someday we will have more precise models and better theories, but until then it is probably best to be somewhat humble in setting forth our conclusions.

Now, let’s devote a few moments of our attention to six paragraphs from Charles Gave’s latest note (gavekal.com – subscribers only) (emphasis mine):

I read everywhere that the US budget deficit is contracting because government consumption is falling as a percentage of GDP, now that the worst of the crisis has passed. This would be very good news indeed; however, I am not so sure that this decline is for real. In fact, I believe it is an accounting illusion.

Over a period of time long [interest] rates, if left to their own devices, always converge to the nominal GDP growth rate (this was called the “golden rule” by Economics Nobel laureate Maurice Allais, and [this] is the core belief in Knut Wicksell’s theory). However, a central bank can fight against this natural tendency by maintaining short rates at abnormally low levels, as the Federal Reserve did from the early 1970s until 1980 and again since 2002. During these two periods long rates were conspicuously lower than growth rates, violating the golden rule.

If negative, the difference between long bond rates and the economic growth rate is effectively a subsidy paid by the saver to the government. In short, this difference measures the amount of financial repression taking place in an economy. The fact that it is not paid to the Treasury does not mean it doesn’t exist. It is a tax paid by a nation’s savers – e.g., pensioners in Peoria….

This shows us that US savers have been paying a virtual tax equivalent to between 1% and 2% of GDP almost every year since 2002 – a sign of the “euthanasia of the rentier” central to every Keynesian analysis. The problem is that subsidizing government spending ultimately leads to lower productivity, slower structural growth and higher financial-crisis risk. We saw a similar euthanasia from 1966 to 1980, when the real structural growth rate of the economy was also in collapse…. The re-imposition of that dreadful tax by Alan Greenspan in 2002, only to be further aggravated by his successor Ben Bernanke, is a key factor behind the falling structural growth rate, the financial crisis and the subsequent slow recovery.

Unnaturally low funding costs undermine the structural growth rate of the US economy, because of capital misallocation. The losers in this deal are usually ordinary folk. Pensioners get no interest on their savings, while rich investors use cheap capital to chase up the cost of property, oil, etc. The Gini coefficient rises, as the poor are seldom asset-rich, and real disposable incomes take a hit as prices rise. Sometimes banks are pressured to make up the shortfall with consumer loans to the struggling classes – adding to the bonfire when the inevitable financial crisis comes.

At the end of the day, it is simple. Savings equal investments, so any tax on savings leads to lower economic growth over time. We may be seeing declining ratios in government spending as a percentage of GDP, but this is really an accounting decline. Financial repression means the government is still taxing the savers, leaving less aside for meaningful investment in the future.

Charles’s fellow Frenchman, Bastiat, argued (as I quoted in the opening of the letter) that in economics there is both what we see and what we don’t see. Charles argues that what we see is declining government spending as a percentage of GDP, but what we don’t see is the “contribution” of financial repression and a tax on savers in making up the difference.

With regard to income inequality, what we see is the growing gap between the 1% and the rest of the world. What we don’t see (because it is not often talked about in the New York Times or economics journals) are the natural and real reasons for that inequality. Most of the reasons for income inequality are in fact things we do not want to discourage. While we could devote multiple chapters of a book to each reason (and there is a massive amount of research on each), today we’ll stay focused on the big picture.

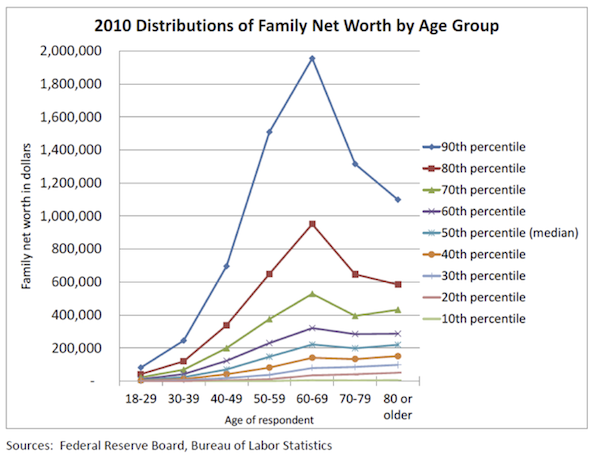

The most significant factor in income inequality, which some research suggests is close to 75% of the problem, is that human beings get older. And the older you get, the more money you make and the more net assets you typically have. Let’s look at a few charts to give us a visual picture.

At every point across the net worth curve, the older you are the more likely you are to be wealthier, up until the time you cross into serious retirement and begin to consume your savings.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

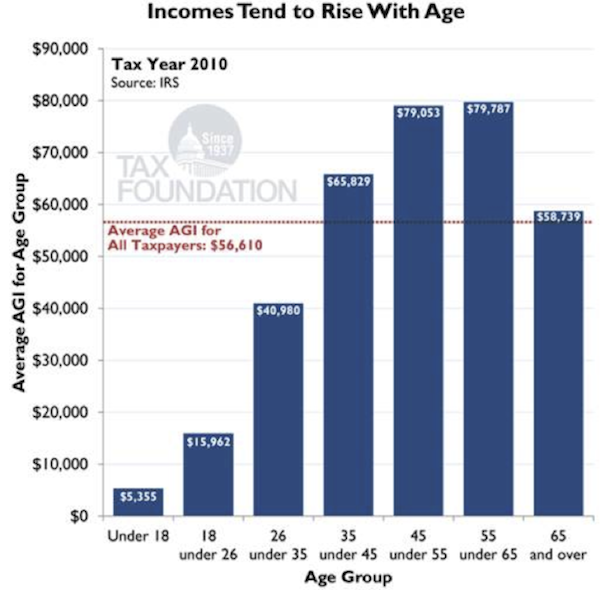

Furthermore, your income tends to rise the older you get (again, up until retirement age). The data shows that the peak earning period stretches between ages 45 to 65. This is not a shocking revelation, but it doesn’t get mentioned often enough in the debate about income inequality.

I think you can make the case that rising income inequality is significantly attributable to Baby Boomers reaching their peak income years. There are other factors, of course, but the demographics are what they are. Boomers are reaping the rewards from investing time and money in themselves and their businesses over 40+ year careers. They are able to develop and capitalize on three factors. (I’m pulling these off the top of my head; there may be more.)

1. Savings compounded over 40+ years in the workforce

2. Skills developed over 40+ years in the workforce

3. Networks developed over 40+ years in the workforce

It therefore seems logical that income inequality should be rising as the pig in the US population python reaches age 45-65.

The question that goes begging is … what happens next? What happens if medical technology allows Boomers to extend their lifetimes, and perhaps dramatically?

If you really want to start pondering very-long-term issues, what happens when medical technology allows the next generation of elders to live not a mere 10 years longer but to the age of 120 or 150? Will the age at which people are subjected to the Soylent Green solution be 130 instead of 30? Sadly, that will be a problem my kids get to deal with. But I digress.

Academic scholars are beginning to argue that conclusions about income inequality should be adjusted for age-related reasons. You can see one such paper, from Norway, with links to many others, at http://www.arts.cornell.edu/poverty/kanbur/InequalityPapers/Almas.pdf. The authors demonstrate that age factors are significant across a range of countries and that when you adjust for age, income inequality (with the obvious exception of the extreme 1/10 of 1%) narrows dramatically.

(Hopefully we will see a detailed research paper on aging and income inequality written by retired North Carolina State professor John Seater in an upcoming Outside the Box.)

While it may be inconvenient for those who want to blame income inequality on factors deemed politically correct, it should not come as a shock that much of the inequality can be attributed to characteristics that most people hold as positive values.

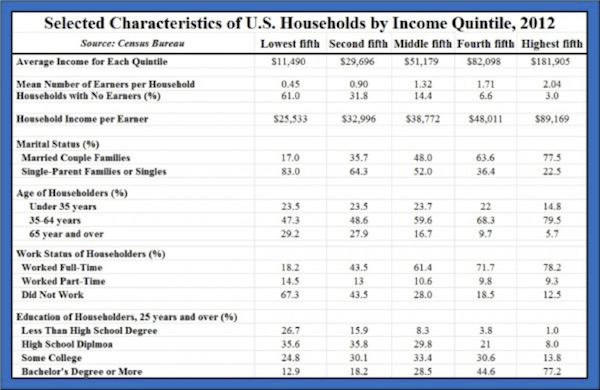

A report from the American Enterprise Institute gives us a good summary. Notice in the chart below that while the income of the highest fifth of the US population is almost 18 times that of the lowest fifth, there is only a 3.5x differential when it comes to the average earnings of the people actually working and making money in the household. It is just that high-income households have more than four times as many wage earners (on average) as poor households.

And married and thus two-earner households make more than single-person households. That seems obvious, of course, but it is a significant factor in income inequality. That doesn’t make the plight of the single working mom any better or easier, but it does help explain the statistical difference. And it does make a difference in lifestyle. Marriage drops the probability of childhood poverty by 82%.

And as we noted in previous letters on income inequality, education is an important factor, too. The relationship between families with higher incomes and the educational attainment of their children is also quite statistically significant.

The AEI report ends on this positive note:

Bottom Line: Household demographics, including the average number of earners per household and the marital status, age, and education of householders are all very highly correlated with household income. Specifically, high-income households have a greater average number of income-earners than households in lower-income quintiles, and individuals in high income households are far more likely than individuals in low-income households to be well-educated, married, working full-time, and in their prime earning years. In contrast, individuals in lower-income households are far more likely than their counterparts in higher-income households to be less-educated, working part-time, either very young (under 35 years) or very old (over 65 years), and living in single-parent households.

The good news is that the key demographic factors that explain differences in household income are not fixed over our lifetimes and are largely under our control (e.g. staying in school, getting and staying married, etc.), which means that individuals and households are not destined to remain in a single income quintile forever. Fortunately, studies that track people over time indicate that individuals and households move up and down the income quintiles over their lifetimes, as the key demographic variables highlighted above change…. And Thomas Sowell pointed out earlier this year in his column “Income Mobility” that:

Most working Americans who were initially in the bottom 20% of income-earners, rise out of that bottom 20%. More of them end up in the top 20% than remain in the bottom 20%. People who were initially in the bottom 20% in income have had the highest rate of increase in their incomes, while those who were initially in the top 20% have had the lowest. This is the direct opposite of the pattern found when following income brackets over time, rather than following individual people.

It’s highly likely that most of today’s high-income, college-educated, married individuals who are now in their peak earning years were in a lower-income quintile in their … single younger years, before they acquired education and job experience. It’s also likely that individuals in today’s top income quintiles will move back down to a lower income quintile in the future during their retirement years, which is just part of the natural lifetime cycle of moving up and down the income quintiles for most Americans. So when we hear the President and the media talk about an “income inequality crisis” in America, we should keep in mind that basic household demographics go a long way towards explaining the differences in household income in the United States. And because the key income-determining demographic variables change over a person’s lifetime, income mobility and the American dream are still “alive and well” in the US.

The Myth of Increasing Income Inequality

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Now let us turn to to a fascinating if lengthy article from the Manhattan Institute. The report is by Diana Furchtgott-Roth, and it’s a treasure trove of data. It is exceptionally well footnoted and uses the same data available to all researchers from government sources. It just offers the data up in a manner that doesn’t play to a progressive/liberal narrative that is looking for an excuse to increase taxes and engage in income redistribution. Let’s look at her introduction:

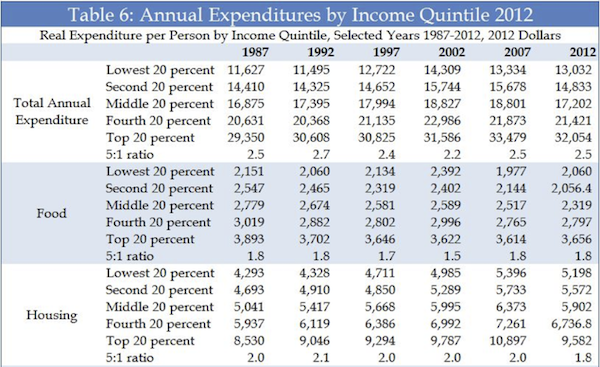

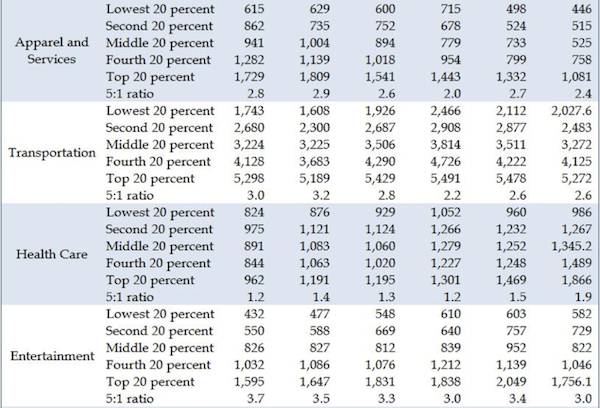

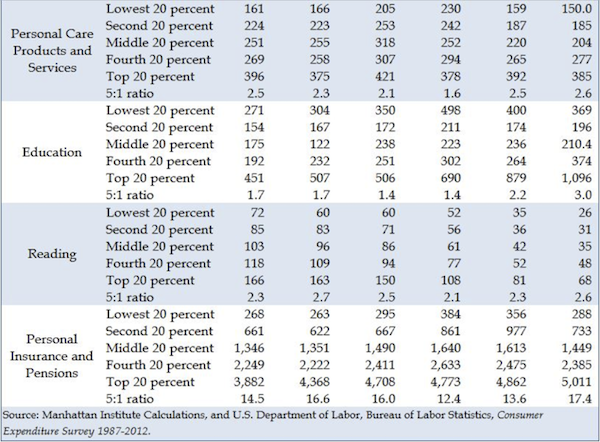

Published government spending data by income quintile show that the ratio of spending between the top and bottom 20 percent has essentially not changed between 1987 and 2012. In terms of total spending, inequality is at the same level as 1987.

Why do other measures show increasing inequality? First, many studies use measures of income before taxes are paid and before transfers, such as food stamps, Medicaid, and housing allowances. Including these transfers reduces inequality.

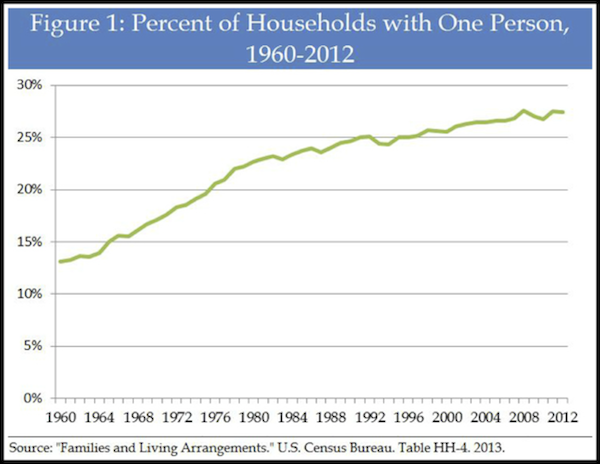

Second, many studies do not take into account demographic changes in the composition of households over the past 25 years. These changes include more two-earner households at the top of the income scale and more one-person households at the bottom. Studies that show increasing inequality are capturing these demographic changes.

Third, some of this increase in measured inequality is due to the Tax Reform Act of 1986, which lowered top individual income-tax rates from 50 percent to 28 percent, leading more small businesses to file taxes under individual, rather than corporate, tax schedules (Joint Committee on Taxation, “General Explanation of the Tax Reform Act of 1986” (H.R. 3838, 99th Congress, Public Law 99-514), May 4, 1987).

A superior measure of well-being that avoids these pitfalls is real spending per person by income quintile. Spending power shows how individuals are doing over time relative to those in other income groups. These data can be calculated from published consumer expenditure data from the government’s Consumer Expenditure Survey. An examination of these data from 1987 through 2012 shows that inequality has not changed. [Emphasis mine]

Is Inequality Increasing?

Ask almost anyone the most important economic facts about income distribution in America, and you are almost certain to hear that income distribution has worsened dramatically over the past generation and over the past decade in particular, with people at the top getting a bigger fraction of total personal income.

But measuring inequality is not simple. The choice of the measure of income, along with the measure of the household unit, substantially influences the results of the inequality measure. Should income be measured before the government removes taxes, or after? Should income include government transfers such as food stamps, Medicare, Medicaid, unemployment benefits, and housing supplements? Furthermore, should wealth measures be included?

In order to measure inequality, disposable income is the most accurate measure. This is what Americans can spend to make themselves better off. Hence, income should be measured after taxes are paid because households cannot avail themselves of tax revenue for expenditures. Similarly, income should include transfer payments because those are available for spending.

The report goes on to give us in detail a number of charts and data in support of the conclusions listed above. Those interested can read it for themselves, and those who wish to argue with it need to offer reasons why the analysis is not valid. Let me offer a couple of interesting observations I get from reading the report.

As noted above, there is a high correlation between income inequality and single-person households. The data from the US Census Bureau shows that the number of single-person households has more than doubled in the last 50 years. Is it any wonder that income inequality in an absolute sense – as measured by household (which is the standard measure cited in the press and used in most academic economic studies) – has risen dramatically during that time?

You can slice and dice the data (and Furchtgott-Roth does) by gender, age, marital status, family status, and so on. None of the outcomes are other than what you would expect them to be.

A few more interesting tidbits:

Another factor that can influence measures of inequality is changes in the tax code. The Tax Reform Act of 1986 lowered the top individual tax rate to 28 percent, and the corporate rate to 35 percent (Joint Committee on Taxation, “General Explanation of the Tax Reform Act of 1986” [H.R. 3838, 99th Congress, Public Law 99-514], May 4, 1987). In 1986, the top individual rate was 50 percent, and the top corporate rate was 46 percent, so small businesses would pay tax at a lower rate if they incorporated and filed taxes as corporations With the implementation of the Tax Reform Act of 1986, the top individual tax rate of 28 percent meant that small businesses were often better off filing under the individual tax code. Revenues shifted from the corporate to the individual tax sector. In the late 1980s and 1990s, that made it appear as though people had suddenly become better off and income inequality had worsened. This had not happened; rather, income that had been declared on a corporate return was being declared on the individual return. This makes any comparisons between pre- and post-1986 returns meaningless.

Finally, inequality appears greater because the cost of living varies substantially in different parts of the country. College graduates tend to move to locations with higher costs of housing, food, and services, such as New York, Boston, Washington, D.C., and San Francisco. College students prefer these cities because they have amenities such as museums, theaters, shopping, and restaurants. As more well-educated people move into these locations, they become more attractive.

What this means for the study of inequality is that high incomes are less valuable in high-cost locations. A $200,000 salary goes further in Mobile than in New York, for instance, and if more $200,000 wage earners move to New York, the distribution of income is more unequal.

Low-income individuals spend a higher proportion of their income on food and clothing, and high-income people spend more on services. The price of food and clothing, nondurables, has been rising more slowly than the price of services, which are disproportionately consumed by higher-income individuals.

I’m going to include one chart from her study, as I find it pretty well demonstrates her point. It turns out if you use actual expenditures on individual items, not much has changed over the last 25 years. There are some significant differences in a few items such as education and clothing, but by and large the ratios among income quintiles for real expenditures per person have not changed all that much. That is not what you would conclude from stories in the press. Note: this is about expenditures and not incomes.

At the beginning of this letter I promised you a “solution” to income inequality. Let me offer this one tongue-in-cheek, as an argumentum ad absurdum.

We simply need to penalize the incomes of older people, take away any advantage there is from being married, reduce opportunities for education, penalize people for working more than 35 hours per week, and of course levy a significant tax on any accumulated savings. This will quickly reduce inequalities of income. It has the slight disadvantage that it will also destroy the economy and create a massive depression; but if the goal is equal outcomes for all, then communist Russia might be the model you are looking for. Except that even there the bureaucrats and other insiders did quite well.

And speaking of insiders and cronyism, that is a serious part of the problem of income inequality. This report from the Heritage Foundation offers some real meat:

While many on the Left – particularly the Occupy Wall Street movement – confuse the two, free-market economics could not be more different from crony capitalism. Whereas the free-market system treats all players equally, from the largest conglomerate to the smallest mom-and-pop shop, crony capitalism rigs the rules of the game in favor of the entrenched big players.

Whereas the free-market system celebrates and encourages competition, crony capitalism is about shielding the powerful and well-connected from competition. Subsidies, which have no place in a free-market system, form a basic staple of crony capitalism, as do waivers and bailouts.

In the long run, Americans pay a heavy price for this marriage of business and government. Crony capitalism forces taxpayers to subsidize well-connected players and restricts opportunities for the rest of us. As Paul Ryan has explained:

Pitting one group against another only distracts us from the true sources of inequity in this country—corporate welfare that enriches the powerful and empty promises that betray the powerless…. That’s the real class warfare that threatens us: a class of bureaucrats and connected crony capitalists trying to rise above the rest of us, call the shots, rig the rules, and preserve their place atop society. And their gains will come at the expense of working Americans, entrepreneurs, and that small businesswoman who has the gall to take on the corporate chieftain.

If you’re really serious about dealing with income inequality, you need to worry about equality of opportunity in education, and specifically about making sure that the education system is radically reformed by taking it out of the hands of bureaucrats and unions. We need to make sure the economic and legal playing field is level by getting government favoritism and bureaucratic meddling out of the way and making the pie larger for everyone. However, as I demonstrated a few weeks ago, a natural outcome of doubling the size of the economic pie over the coming 15 years will be that there is an even greater differential between those who have next to nothing and those who have accumulated the most. The only way to prevent such an outcome is to keep the total economic pie from growing, and that doesn’t seem like a very good economic policy.

I think it is appropriate to close with another quote from the concluding remarks of President Thomas Jefferson in his first inaugural address:

[A] wise and frugal Government, which shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned.

Income inequality will not be solved by taxing the rich at higher levels. At some point, that “solution” would reduce savings and therefore investment and thus shrink the total potential for economic growth. To argue any differently is to argue with basic economics and simple math. The goal should not be equality of income or wealth but equality of opportunity. The role of government should be to make sure the playing field is level and the rules are simple and fair.

What constitutes a level playing field will change over time as society becomes richer and technology progresses, but the principle should remain the same. There is a place for the governments of developed economies and their societies to establish safety nets, including healthcare. But these are safety nets, not substitutes for personal endeavor and achievement.

In summary, in the last four weeks we’ve seen that while income inequality is real, increasing taxes and redistributing income is not the answer if the true goal is to improve the incomes and lifestyles of everyone. If we do that, we will actually make the problem worse rather than better.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

South Africa, New York, Europe, and San Diego

I finish this letter tonight from Cafayate, Argentina. Sunday I start the trek back to Dallas, where I will be for eight hours – and then take off for 12 days in South Africa. That will mean three straight nights in airplanes, a first for me. I will need that vacation resort, with lots of massages and hydrotherapy, to unwind me. I’m going to try something new this trip and post a few pictures and comments to Twitter. Follow me if you like. After South Africa I’m back home for like a day before I have to run up to New York to do some videos. Then it’s back home for a few weeks (or so it appears) before I head to Amsterdam, Brussels, and Geneva. I’ll come home for a few days and then head to San Diego for our Strategic Investment Conference – one of my real highlights of the year. And then I’ll be home for more than two whole weeks before heading to Tuscany for a few weeks of vacation. Whew. I will be ready to relax at the end of all that travel.

I urge you to consider coming to the Strategic Investment Conference, May 13-16 in San Diego. We have the most phenomenal list of speakers of any conference in the country, I think. If you are trying to figure out how to deal with the Code Red world and find opportunities for capitalizing on the misalignment of government policies, both here and abroad, I think you’ll find no better place to do so. You will be with like-minded people (including the speakers, who typically hang around and meet the attendees!) for three days, and we’ll go deep into ways to position your portfolios for what lies ahead.

Also, I will be speaking for Peak Capital Management on April 24 in Dallas. You can find out more and secure a place by clicking on this link.

There are interesting contrasts here in Northern Argentina. The remarkably fertile valley in which Cafayate is situated is surrounded by towering mountains that change colors dramatically throughout the day. During the trip up to Guafin to see my friend Bill Bonner’s vast collection of rocks and sand interspersed with marvelous little fertile valleys, we encountered some of the most rugged and spectacular canyons I’ve ever seen, either in person or photos. It is as if the Andean gods were competing with each other to create the most stark sculptures imaginable in sandstone and granite. It must have been a violent time, as the players with rocks were clearly throwing them in every which direction, including backwards. The locals keep referring to these 10,000-18,000-foot mountains as the “foothills” of the Andes. And yes, off in the distance you can see the snowcapped ranks of the real mountains. This country is different from the green majesty of the Rockies, not to mention the barrenness of the Big Bend country of South Texas.

I doubt that it will be a short or easy trip, but I do need to somehow figure out how to cross the Andes at a few points. That’s on my bucket list. And from talking with fellow travelers (including an enthusiastic David Kotok), I have put Patagonia on that list as well.

Argentina is an odd mix. Beautiful people, and by that I mean beautiful in terms of graciousness and style, hospitality, and (am I about to make a politically incorrect statement?) their almost anti-French way of accepting strangers into their midst. They are industrious and hard-working, and to look around the country you would think it is quite prosperous.

And yet at least a half a dozen times in the past hundred years Argentina has completely destroyed the value of its currency, wiping out generations that were unable to protect themselves from the devastation wreaked by government bureaucracy. Famine, disease, pestilence, and natural disasters have all attacked the human species, but there are times when I think there is no more pernicious or wicked force than human government. Ensconced down here in what is admittedly a hotbed of radical libertarians, I find myself calling into question my optimism about government and the future of our country. A pessimist is someone who sees the problems in every opportunity, and an optimist is someone who sees the opportunities in every problem. For whatever reason, I find myself constitutionally firmly planted in the latter camp, but sometimes I wonder.

I know the problems our country faces. I’ve written about the problems that the rest of the world faces – and yes, we all confronted them every day in the media. Most of the problems are created by well-intentioned people who have decided they know better than you how to run your own life and business. But the road to hell, as my Less-Than-Sainted Dad often told me, is paved with good intentions. It is the unintended consequences of someone’s good intentions (even our own) that always end up biting us in the ass.

It is time to hit the send button, for which you are probably grateful, as I’m in a rambling, philosophical mood, and you need to go on to more important topics. I will report to you next week from Kruger Park, South Africa. Assuming that I can avoid the lions until I begin my weeklong speaking tour for Glacier next Sunday, starting from Cape Town. It is going to be a fascinating two weeks.

Your going out to try to hit a golf ball now analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin