The Uncertainty Recession

-

John Mauldin

John Mauldin

- |

- April 11, 2025

- |

- Comments

- |

- View PDF

You probably noticed we are having one of those “weeks when decades happen.” Notice also, however, that we are still here. Your investments and businesses may be bruised but you’re still in the game.

Fast-moving events are hard to cover in my letters. Anything I say could be rendered laughably wrong by the time you read it. I had to backtrack a couple of times while writing this one. But we know some things with relatively high confidence, and that’s where I will focus today.

As of my deadline, the president had limited his so-called “reciprocal” tariffs to a flat 10% rate for 90 days for every country except China, with the implied threat that the tariffs can come back after 90 days if no deal is done. China was raised to 125%. This was a little relief but the China tariffs alone still present giant problems for many US businesses, and potentially to the broader economy. And 10% on everyone else is still a big increase in many cases.

(By the way, did you notice how undisturbed the markets were with the concept of 10% tariffs on everyone? If that had been the first tariff announcement, there would’ve been a great deal more reaction. Are we really relieved by tariffs of only 10%?)

We don’t know how negotiations with other countries will go in this 90-day period, or if they will happen at all. The prospect of being effectively cut out of the US market (25% of global buying power) should bring most to the table. Getting to zero tariffs with as many partners as possible would be a good thing, in my view. Open markets and all that. And maybe it does take a little shock and awe to get the leaders of countries to contemplate such arrangements.

Nevertheless, that still leaves the world’s two largest economies in an open trade war. Whatever the larger objectives, there’s going to be a lot of collateral damage. And we are all in the battle zone.

Let me be very clear. There are no winners in a trade war: only various degrees of loss.

What is all this intended to accomplish? And does that goal make sense?

The US exported $144 billion in goods to China in 2024, while $439 billion went the other direction. So, from a narrow (Navarro) point of view, China has more to lose than we do. But that’s the wrong way to look at it. China signaled Thursday night it would not raise their tariffs above 125% because it would be pointless. Tariffs at this level will already effectively shut down US exports by making our goods too expensive.

Frankly, even 50% pretty much closes off most trade either way. The only way a US company would buy a Chinese product at a 50% tariff would be if there’s no other source or it is a minor part of the overall cost. And the same thing works in reverse.

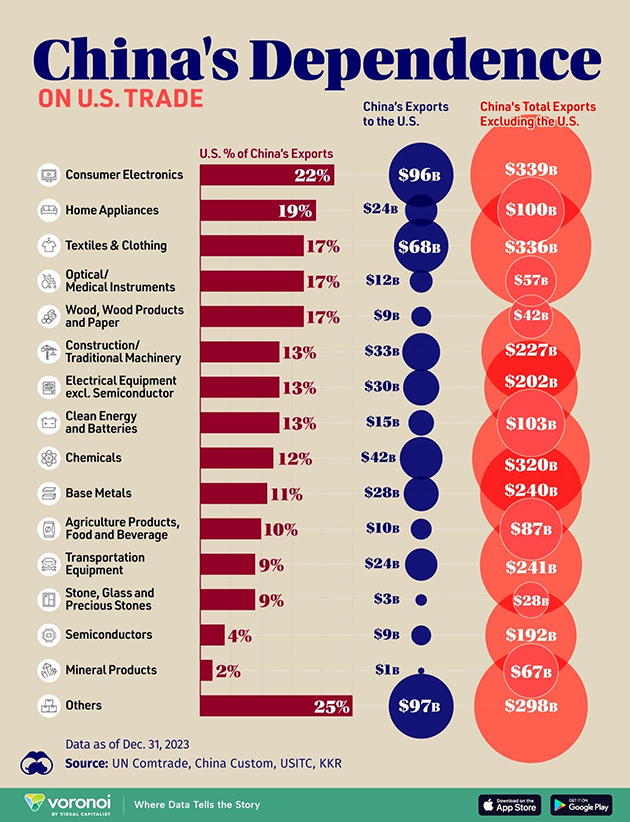

Look at the chart below (h/t Peter Boockvar). US trade does not dominate any Chinese export sector. Consumer electronics and home appliances are in the 20% range. That would certainly be a loss to a Chinese company, and they would have to close production lines and lay people off. Or, which they seem to be doing, reduce the value of the Yuan so that Chinese products are cheaper for the rest of the world.

Source: Peter Boockvar

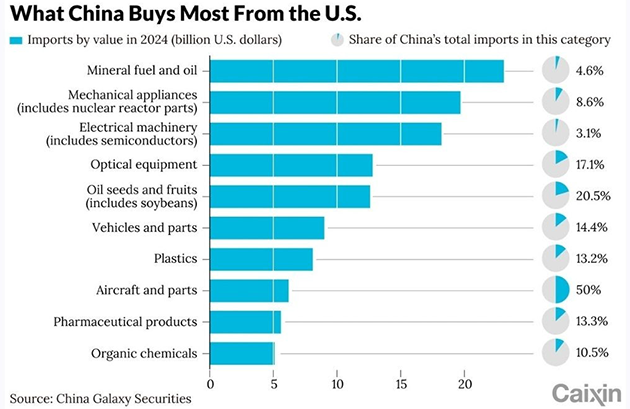

Now let’s look at what China buys from the US.

Source: Scott Lincicome

Some of that can easily be bought from Europe or elsewhere. But some of it is critical. Aircraft and the parts for them aren’t easily replaced. And some of those categories include products that are only made in the US.

Again, trade wars have no winners.

By the way, Beijing has been preparing for this for a long time. The government is ready to provide stimulus, etc. And yes, the country has problems. The real estate market is in the dumpster, not to mention too much debt. But just like US businesses can adapt, so can the Chinese.

Now, will a lot of US-focused Chinese exporters go bankrupt? Absolutely. I wouldn’t want to be manufacturing Christmas trees or toys in China. But the same can be said for some American companies. I am sure you have been reading, as I have, about all the companies that will have to downsize and/or reduce headcount because of the China tariffs. So far, it’s small numbers here and there but they add up.

|

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Further, according to an article in Foreign Affairs titled “Trade Wars Are Easy to Lose,” China has a massive savings surplus.

“…To the degree that the bilateral trade balance predicts which side will ‘win’ in a trade war, the advantage lies with the surplus economy, not the deficit one. China, the surplus country, is giving up sales, which is solely money; the United States, the deficit country, is giving up goods and services it does not produce competitively or at all at home. Money is fungible: if you lose income, you can cut back spending, find sales elsewhere, spread the burden across the country, or draw down savings (say, by doing fiscal stimulus). China, like most countries with overall trade surpluses, saves more than it invests—meaning that it, in a sense, has too much savings. The adjustment would be relatively easy. There would be no critical shortages, and it could replace much of what it normally sold to the United States with sales domestically or to others.

“Countries with overall trade deficits, like the United States, spend more than they save. In trade wars, they give up or reduce the supply of things they need (since the tariffs make them cost more), and these are not nearly as fungible or easily substituted for as money. Consequently, the impact is felt in specific industries, locations, or households that face shortages, sometimes of necessary items, some of which are irreplaceable in the short term.”

Economics and markets are about what happens at the margin. Most US businesses and consumers will be just fine, but a few companies “at the margin” could still affect the overall economy negatively. We simply don’t have any way to calculate what that number would be. But if it was 1–2%? Could that be enough to throw us into a recession along with everything else that is happening? Perhaps. See my thoughts on recessions below.

Ice Cream Tax

The White House seems fixed on eliminating trade deficits. Worse, they want to eliminate not just the total trade deficit, but to have zero trade deficits with every country on the planet. That is the kind of economic quackery only Peter Navarro can imagine.

Here’s Peter Boockvar on that point.

“As a CIO, portfolio manager, analyst, economist, etc…. I continue to go over every single possible scenario in my head that can come of the tariffs and the intended use of them. I got some more help in figuring this out from Peter Navarro yesterday who revealed in a CNBC interview exactly what he wants from all of this. He said, ‘We want the tires made in Akron, we want the transmissions made in Indianapolis, we want the engines made in Flint and Saginaw, and we want the cars manufactured here.’ He does not want US car makers to just be assemblers of parts made elsewhere into a finished product here. This is his real intention from all of this.

“That sounds all well and good, but the big problem is the US will no longer be cost competitive with its exports. High-cost production in the US will price us out of the global marketplace. Domestic production here will just be for domestic consumption as we are also basically incentivizing US manufacturers to produce overseas to feed their overseas customers because it will be much cheaper to do so than produce here and ship it internationally.

“I'll add again what I said yesterday, lowering the cost of doing business in the US is the path to more manufacturing jobs and presence as what we make here we can ship to the about 75% of global GDP that takes place elsewhere and to the 96% of the world's population that doesn't live here. Wanting to make every single piece that goes into every finished product in the US will cost us billions of dollars of lost export opportunities at the same time US consumers pay through the nose for domestically made goods.”

The “logic” behind Navarro’s vision is that the mere existence of a trade deficit is somehow unfair to the United States. It is (in his view) clear evidence of an unfair situation that must be ended immediately.

Again, this is nonsense. I am not at all concerned that people in Madagascar aren’t buying many American goods. I’m just glad they are willing to sell us large amounts of the vanilla that enriches so many food products at a very reasonable price, and which we can’t grow domestically. I don’t want to punish them. Nor do I want to punish American consumers by imposing new taxes on one of life’s greatest pleasures—vanilla ice cream.

If you want to focus on a number, think not about the trade deficit, but about our total exports. If that number is large and growing (which it is), then our manufacturing sector is probably in a good place. It means they are efficiently producing globally competitive goods. Could it be better? Yes, and we should work to make it happen.

The Uncertainty Recession

There is one way in which the seemingly chaotic Trump strategy may make sense. That would be if the punitive tariff rates plus the market fireworks were part of a “crazy man” negotiating method. (Much of the world considered Bush 2 to be a bit of a cowboy and adjusted their foreign and defense policies accordingly.) The intent would be to force concessions on the other party by making them believe the alternative is unthinkable. The Art of the Deal becomes The Art of Stress. Except the stress is on everybody, US consumers and foreign and domestic companies alike.

This week’s sudden turnaround kind of supports this idea. Trump announced the reciprocal tariffs on April 2, setting them to go into effect a week later. When that day came without any kind of reversal, markets around the world threw a tantrum. Then, mid-tantrum, Trump announced his 90-day pause. Markets turned on a dime. They gave some back the next day. Now we will see what happens during this “time out.”

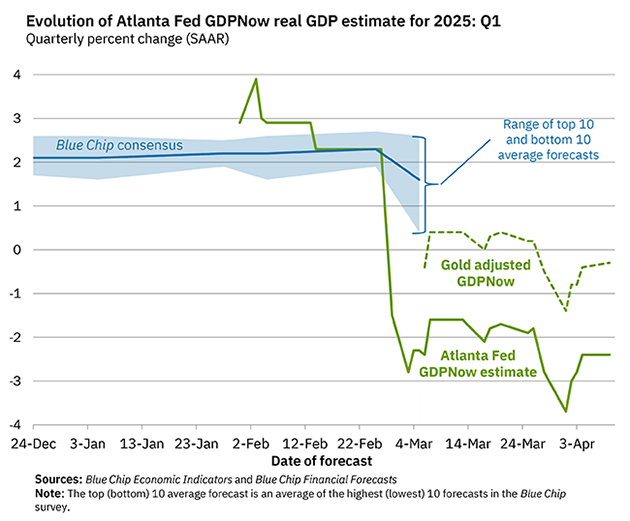

Before the pause announcement, Goldman Sachs said a 2025 recession was more likely than not. Afterward, they lowered the probability to 45%, which is still uncomfortably high. The Atlanta Fed’s GDPNow model estimates -2.4% GDP growth in the first quarter, or -0.3% in an alternative calculation that excludes the recent spike in gold imports.

I have been following the Atlanta Fed GDPNow since it was first published in 2014. Their original model currently projects a first-quarter downturn of -2.4%. I know, it doesn’t feel that way, and it isn’t. It turns out that there was such massive gold buying in the first quarter by traders afraid that the tariffs would affect gold, they pulled their purchases forward.

Mathematically, an import, any import, is negative to GDP. There was enough gold bought in the first quarter to actually reduce their forecast GDP number by a negative 2.1%! The Atlanta Fed staff added a dashed line to show their estimate without the gold imports. That is the first time I can recall them putting what amounts to an asterisk on their chart.

Source: Federal Reserve Bank of Atlanta

But what that means is we could have statistically negative GDP growth in the first quarter simply because of gold buying, which I think most everyone would agree is not really negative for the US. By the way, we know that many businesses also pulled their import buying forward which will also have a negative effect on first-quarter GDP. We just don’t know how much yet.

Formal recessions are typically called after two or more consecutive quarterly growth declines. Whether you account for gold or not, the economy at the end of March was somewhere around the zero bound at best. The uncertainty for many businesses and consumers is certainly higher now than it was at the end of March. I don’t think the business climate will improve, especially for capital investments, until there is some clarity.

Again, recessions happen at the margin. It is very possible that we can have an actual recession in the second quarter. I called it "The Tariff Recession" last week. Many serious analysts that I follow have moved their recession odds above 50%. If you have read them a long time, that means they think it is more likely than not, but they want to cover their… bases.

Formal recession or not, these are not the kind of conditions that will inspire Americans to buy more imported goods. It’s more the opposite: People will be looking for ways to cut spending. That will make the next 90 days tough for US businesses that depend on imported components or materials. Travel and vacations are certainly down from foreign tourists. Canadian tourism is down 10%, which is a big piece of our tourism industry. Layoffs and bankruptcies are likely. At the same time, all kinds of growth decisions will come to a screeching halt. Few businesses will sign contracts to buy new equipment for new capacity until they know where this is going—and that’s going to take time.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Further, 30% of the products that are on the shelf at Home Depot originated in China, whether directly or through other vendors as of 2019. That may have changed some but it is still a lot. And 70%+ of Walmart products come from China. That’s some serious supply chain problems. Walmart nation is not going to be happy to see empty shelves or everyday higher prices.

I talked with John Burns, who consults with the largest homebuilding companies in America. I was worried about the home construction business which is 3–5% of US GDP. It turns out that Chinese products are not that high a percentage of new construction costs. Some can be substituted for, like windows. A large window manufacturer told him they would simply stop selling aluminum windows, since the aluminum is sourced from China, and move to wood windows. Businesses will adapt. They always do. But it is not going to be seamless and it will be a bumpy ride.

The president seems to realize this. He mentioned this week the possibility of exempting US businesses from some tariffs. But how will that work? Who gets it, how do they apply, how long will it last? Complicating/delaying every business decision may not relieve the broader, uncertainty-driven paralysis.

Let me say very clearly that I don’t want Democratic administrations choosing winners and losers (think Solyndra) nor do I want Republican administrations picking and choosing which US industries get tariff favors. Barring some overriding national security purpose, all US businesses should be treated the same. And for the record, Bush and Biden and Trump and other administrations that decided steel is a national security issue are wrong. Those protectionist policies cost 5 to 10 times more jobs than they save.

Also, unless China blinks (which I don’t expect), American companies that export to China are now dead in the water. That was $144 billion last year, which thanks to Beijing’s new 125% tariff rate will probably drop to zero. China was our third-largest export market. Underline “was.”

I really hope all this comes together in some beneficial way. But the ambiguity and uncertainty have costs which won’t improve with time. The clock is ticking.

Businesses can adapt but we need some level of stability. Keeping everything up in the air for months is a really good way to start a recession.

Washington, DC, Dallas, and Puerto Rico

I will be in Washington, DC, April 21–24 at a conference hosted by The Alliance for Longevity Initiatives, where I, Dr. Mike Roizen, Dr. Mehmet Oz, and others will speak with staff and members of Congress focusing on health and longevity policies. I will be speaking on a panel about the economic effects of longevity. The conference is already oversold. Sorry.

Theoretically, I will be in Dallas the next week for the opening of our Dallas longevity clinic. Then hopefully shortly thereafter we will open clinics in Puerto Rico, West Palm Beach, and Columbia, Maryland. I intend to be at the openings for all of them. And a lot more over the rest of the year. I see some travel in my future.

The Strategic Investment Conference starts in 30 days. We have a powerhouse lineup for this year, and you really want to attend. More information here.

If I can find the time, I should do a blog on the day-to-day ups and downs of launching a new business. Thankfully, this one has seen many more ups than downs. We’ve had some phenomenally serendipitous meetings. The legal complexities are challenging but we have a fabulous team of attorneys that actually operate in all 50 states that can help navigate us through them. Hiring doctors and nurses and staff is fun but challenging. Designing and building clinics has been an eye-opener for me in terms of the actual costs that have increased over the years since I last did a building project. It is fun to work with a really good team of professionals who forced this old dog to learn new tricks. And in doing so, they will help hopefully many of us live much longer and healthier lives.

And with that, I will hit the send button. Have a great week, and don’t forget to follow me on X.

|

Your not happy with my economic outlook analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin