Three Black Swans

-

John Mauldin

John Mauldin

- |

- July 22, 2017

- |

- Comments

- |

- View PDF

Yellen Overshoots

ECB Runs Out of Bullets

Chinese Debt Meltdown

Too Many Planes; Grand Lake Stream, Maine; Colorado; and Portugal

“The world in which we live has an increasing number of feedback loops, causing events to be the cause of more events (say, people buy a book because other people bought it), thus generating snowballs and arbitrary and unpredictable planet-wide winner-take-all effects.”

– Nassim Nicholas Taleb, The Black Swan

“What do you do?” is a common question Americans ask people they have just met. Some people outside the US consider this rude – as if our jobs define who we are. Not true, of course, but we still feel obliged to answer the question.

My work involves so many different things that it isn’t easy to describe. My usual quick answer is that I’m a writer. My readers might say instead: “He tells people what could go wrong.” I like to think of myself as an optimist, and I do often write about my generally optimistic view of the future, but that optimism doesn’t often extend to the performance of governments and central banks. Frankly, we all face economic and financial risks, and we all need to prepare for them. Knowing the risks is the first step toward preparing.

Exactly 10 years ago we were months way from a world-shaking financial crisis. By late 2006 we had an inverted yield curve steep and persistent enough to be a high-probability indicator of recession 12 months later. So in late 2006 I was writing about the probability that we would have a recession in 2007. I was also writing about the heavy leverage in the banking system, the ridiculous level of high-yield offerings, the terms and potential turmoil in the bond and banking markets, and the crisis brewing in the subprime market. I wish I had had the money then that a few friends did to massively leverage a short position on the subprime market. I estimated at that time that the losses would be $400 billion at a minimum, whereupon a whole lot of readers and fellow analysts told me I was just way too bearish.

Turned out the losses topped well over $2 trillion and triggered the financial crisis and Great Recession. Conditions in the financial markets needed only a spark from the subprime crisis to start a firestorm all over the world. Plenty of things were waiting to go wrong, and it seemed like they all did at the same time. Governments and central bankers scrambled hard to quench the inferno. Looking back, I wish they had done some things differently, but in the heat of battle – a battle these particular people had never faced before, with more going wrong every day – it was hard to be philosophically pure.

(Sidebar: I think the Fed's true mistakes were QE2, QE3, and missing their chance to start raising rates in 2013. By then, they had time to more carefully consider those decisions.)

We don’t have an inverted yield curve now, so the only truly reliable predictor of recessions in the US is not sounding that warning. But when the central bank artificially holds down short-term rates, it is difficult if not almost impossible for the yield curve to invert.

We have effectively suppressed that warning signal, but I am laser focused on factors that could readily trigger a global recession, resulting in another global financial crisis. All is not well in the markets. Yes, we see stock benchmarks pushing to new highs and bond yields at record lows. Inflation benchmarks are stable. Unemployment is low and going lower. GDP growth is slow, but it’s still growth. All that says we shouldn’t worry. Perversely, the signs that we shouldn’t worry are also reasons why we should.

This is a classic Minsky teaching moment: Stability breeds instability.

I know the bullish arguments for why we can’t have another crisis. Banks are better capitalized now. Regulators are watching more intently. Bondholders are on notice not to expect more bailouts. All that’s true.

On the other hand, today’s global megabanks are much larger than their 2008 versions were, and they are more interconnected. Most Americans – the 80% I’ve called the Unprotected – are still licking their wounds from the last battle. Many are in worse shape now than in 2008. Our crisis-fighting reserves are low.

European banks are still highly leveraged. The shadow banking system in China has grown to scary proportions.

Globalization has proceeded apace since 2008, and the world is even more interconnected now. Problems in faraway markets can quickly become problems close to home. And that’s without a global trade war.

I am concerned that another major crisis will ensue by the end of 2018 – though it is possible that a salutary combination of events, aided by complacency, could let us muddle through for another few years. But there is another recession in our future (there is always another recession), and it’s going to be at least as bad as the last one was, in terms of the global pain it causes. The recovery is going to take much longer than the current one has, because our massive debt build-up is a huge drag on growth. I hope I’m wrong. But I would rather write these words now and risk eating them in my 2020 year-end letter than leave you unwarned and unprepared.

Because I’m traveling this week, this letter will be just a few appetizers –black swan hot wings, black swan meatballs in orange sauce, teriyaki swan skewers, and the like – to whet your appetite and help you anticipate what’s coming.

Seriously speaking, could the three scenarios we discuss below turn out be fateful black swans? Yes. But remember this: A harmless white swan can look black in the right lighting conditions. Sometimes that’s all it takes to start a panic.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Black Swan #1: Yellen Overshoots

It is increasingly evident, at least to me, that the US economy is not taking off like the rocket some predicted after the election. President Trump and the Republicans haven’t been able to pass any of the fiscal stimulus measures we hoped to see. Banks and energy companies are getting some regulatory relief, and that helps; but it’s a far cry from the sweeping healthcare reform, tax cuts, and infrastructure spending we were promised. Though serious, major tax reform could postpone a US recession to well beyond 2020, what we are going to get instead is tinkering around the edges.

On the bright side, unemployment has fallen further, and discouraged workers are re-entering the labor force. But consumer spending is still weak, so people may be less confident than the sentiment surveys suggest. Inflation has perked up in certain segments like healthcare and housing, but otherwise it’s still low to nonexistent.

Is this, by any stretch of the imagination, the kind of economy in which the Federal Reserve should be tightening monetary policy? No – yet the Fed is doing so, partly because they waited too long to end QE and to begin reducing their balance sheet. FOMC members know they are behind the curve, and they want to pay lip service to doing something before their terms end. Moreover, Janet Yellen, Stanley Fischer, and the other FOMC members are religiously devoted to the Phillips curve. That theory says unemployment this low will create wage-inflation pressure. That no one can see this pressure mounting seems not to matter: It exists in theory and therefore must be countered.

The attitude among central bankers, who are basically all Keynesians, is that messy reality should not impinge on elegant theory. You just have to glance at the math to recognize the brilliance of the Phillips curve!

It was Winston Churchill who said, “However beautiful the strategy, you should occasionally look at the results.” Fact is, the lack of wage growth among the bottom 70–80% of workers (the Unprotected class) constitutes a real weaknesses in the US economy. If you are a service worker, competition for your job has kept wages down.

The black-swan risk here is that the Fed will tighten too much, too soon. We know from recent FOMC minutes that some members have turned hawkish in part because they wanted to offset expected fiscal stimulus from the incoming administration. That stimulus has not been forthcoming, but the FOMC is still acting as if it will be.

What happens when the Fed raises interest rates in the early, uncertain stages of a recession instead of lowering them? I’m not sure we have any historical examples to review. Logic suggests the Fed will extinguish any inflation pressure that exists and push the economy in the opposite direction instead, into outright deflation.

Deflation in an economy as debt-burdened as ours is could be catastrophic. We would have to repay debt with cash that is gaining purchasing power instead of losing it to inflation. Americans have not seen this happen since the 1930s. It wasn’t fun then, and it would be even less fun now.

Worse, I doubt Trump’s FOMC appointees will make a difference. Trump appears to be far more interested in reducing the Fed’s regulatory role than he is in tweaking its monetary policies. I have no confidence that Yellen’s successor, whoever that turns out to be, will know what needs to be done or be able to do it fast enough.

Let me make an uncomfortable prediction: I think the Trump Fed – and since Trump will appoint at least six members of the FOMC in the coming year, it will be his Fed – will take us back down the path of massive quantitative easing and perhaps even to negative rates if we enter a recession. The urge to “do something,” or at least be seen as trying to do something, is just going to be too strong.

Black Swan #2: ECB Runs Out of Bullets

Last week, news reports said that the Greek government is preparing to issue new bonds for the first time in three years. “Issue bonds” is a polite way of saying “borrow more money,” something many bond investors think Greece is not yet ready to do.

Their opinions matter less than ECB chief Mario Draghi’s. Draghi is working hard to buy every kind of European paper except that of Greece. Adding Greece to the ECB bond purchases program would certainly help.

Relative to the size of the Eurozone economy, Draghi’s stimulus has been far more aggressive then the Fed’s QE. It has pushed both deeper, with negative interest rates, and wider, by including corporate bonds. If you are a major corporation in the Eurozone and the ECB hasn’t loaned you any money or bought your bonds yet, just wait. Small businesses, on the other hand, are being starved.

Such interventions rarely end well, but admittedly this one is faring better than most. Europe’s economy is recovering, at least on the surface, as the various populist movements and bank crises fade from view. But are these threats gone or just glossed over? The Brexit negotiations could also throw a wrench in the works.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Despite recent predictions by ECB watchers and the euro’s huge move up against the dollar on Friday, Anatole Kaletsky at Gavekal thinks Draghi is still far from reversing course. He expects that the first tightening steps won’t happen until 2018 and anticipates continued bond buying (at a slower pace) and near-zero rates for a long time after. But he also sees risk. Anatole explained in a recent report:

Firstly, Fed tapering occurred at a time when Europe and Japan were gearing up to expand monetary stimulus. But when the ECB tapers there won’t be another major central bank preparing a massive balance sheet expansion. It could still turn out, therefore, that the post-crisis recovery in economic activity and the appreciation of asset values was dependent on ever-larger doses of global monetary stimulus. If so, the prophets of doom were only wrong in that they overstated the importance of the Fed’s balance sheet, compared with the balance sheets of the ECB and Bank of Japan.

This is a genuine risk, and an analytical prediction about the future on which reasonable people can differ, unlike the factual observations above regarding the revealed behavior of the ECB, the Franco-German rapprochement and the historical experience of Fed tapering.

Secondly, it is likely that the euro will rise further against the US dollar if the ECB begins to taper and exits negative interest rates. A stronger euro will at some point become an obstacle to further gains in European equity indexes, which are dominated by export stocks.

Anatole makes an important point. The US’s tapering and now tightening coincided with the ECB’s and BOJ’s both opening their spigots. That meant worldwide liquidity was still ample. I don’t see the Fed returning that favor. Draghi and later Kuroda will have to normalize without a Fed backstop – and that may not work so well.

Black Swan #3: Chinese Debt Meltdown

China is by all appearances unstoppable. GDP growth has slowed down to 6.9%, according to official numbers. The numbers are likely inflated, but the boom is still underway. Reasonable estimates from knowledgeable observers still have China growing at 4–5%, which, given China’s size, is rather remarkable. The problem lies in the debt fueling the growth.

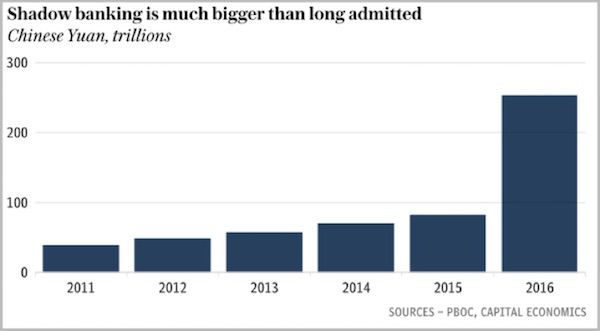

Ambrose Evans-Pritchard reported some shocking numbers in his July 17 Telegraph column. A report from the People’s Bank of China showed off-balance-sheet lending far higher than previously thought and accelerating quickly. (Interestingly, the Chinese have made all of this quite public. And President Xi has taken control of publicizing it.)

The huge increase last year probably reflects efforts to jump-start growth following the 2015 downturn. Banks poured fuel on the fire, because letting it go out would have been even worse. But they can’t stoke that blaze indefinitely.

President Xi Jinping has been trying to dial back credit growth in the state-owned banks for some time; but in the shadow banks that Xi doesn’t control, credit is growing at an astoundingly high rate, far offsetting any minor cutbacks that Xi has made.

Here are a few more juicy quotes from Ambrose:

President Xi Jinping called for a hard-headed campaign to curb systemic risk and to flush out “zombie companies”, warning over the weekend that financial stability was a matter of urgent national security.

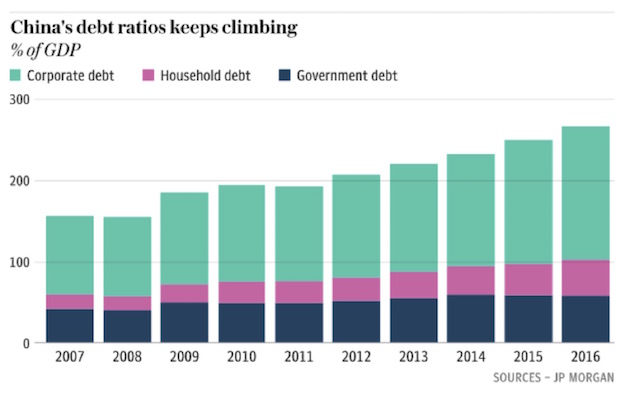

It is the first time that a Chinese leader has chaired the National Finance Work Conference – held every five years to thrash out long-term plans – and is a sign of rising concern as debt reaches 280pc of GDP.

In a move that will send shivers up the spines of local party officials, he said they will be held accountable for the rest of their lives for debts that go wrong. Any failure to identify and tackle risks will be deemed “malfeasance”.

Ambrose then quotes Patrick Chovanec of Silvercrest Asset Management:

“The banks have been selling products saying it isn’t our risk. Investors have been buying them saying it’s not our risk either. They all think the government will save everything. So what the markets are pricing is what they think is political risk, not economic risk,” he said.

A market in which “they all think the government will save everything” is generally not one you want to own – but China has been an exception. It won’t remain one forever. The collapse, when it comes, could be earthshaking.

Chinese growth has been fueled by a near doubling of both GDP and debt over the last nine years:

One reason why so many people are complacent about China is that they truly believe that “this time is different” applies to Chinese debt. Maybe in 10 years I will look back and say that it really was different, but I don’t think so. As is often the case with China, China’s current circumstances are without a true equal in the history of the world.

And if Xi is really serious about slowing the pace of growth (another form of tightening by a major world economy), that move would just add to overall global risk.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

It is very possible that any of these black swans could trigger a recession in the US. And let’s be clear: The next US recession will be part of a major global recession and will result in massive new government debt build-up. It will not end well.

Let me remind you again that we’re hosting another webinar with my friend Marc Chaikin of Chaikin Analytics, on July 25, at 4:15 PM EST.

I’ve long been a fan of the Chaikin Analytics Power Gauge, so last year I told my team of analysts to try it out. A few weeks later they came back to me and said, “It’s great, we’re using it for everything!”

Because we’re so impressed with the Power Gauge system, we’d like to give you the chance to access it, too. You can click here for the free webinar “The Ultimate Stock Checklist & Best Small-Cap Stocks to Buy Today.”

Too Many Planes; Grand Lake Stream, Maine; Colorado; and Portugal

I will have to get on a few planes for one-day meetings this week. In two weeks I will be off to the annual Maine fishing trip, then back home for a few weeks until Shane and I head to the Colorado Rockies (Beaver Creek, actually) for an end-of-summer vacation. In late September we will fly to Lisbon, Portugal, for a series of presentations and meetings. I am really looking forward to going, as it is one of the last countries in Western Europe that I have never visited. (One weekend when I’m in Europe, I am simply going to get on the train and do lunch on Sunday in Luxembourg, then turn around and head right back, just so I can check that spot off on my map.)

I’m in Las Vegas now, speaking at Freedom Fest, but even more importantly meeting with friends. I find it hugely rewarding to be with George Gilder. David Brin arrives today. Steve Forbes is here, and many of us will be celebrating his 70th birthday tonight. I will be debating with Louis Navellier, Keith Fitzgerald, and Peter Schiff on the direction of the markets.

If you are interested in how I am approaching the markets, you can access a special report at my investment advisory website, MauldinSolutions.com, by giving us a few details about yourself. See what I think is the best way to approach markets today, using a variety of trading strategies rather than trying merely to diversify among asset classes. In a recession where all correlations go to one, diversifying your assets will just diversify your losses. That’s the outcome we want to avoid.

You have a great week and take some time to call or better yet meet with friends.

Your trying not to worry too much this summer analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Everyone defines success differently. Your financial journey is unique, and so are your needs. That's why we suggest the following two options to suit your preferences:

-

Level up your research with John Mauldin: If you enjoy Thoughts from the Frontline, you'll love Over My Shoulder subscription for just $14.95 per month.

Each week, John Mauldin and Patrick Watson curate exclusive, high-end research from top economists and financial analysts, sharing privileged insights that retail investors typically can't access. See the full details here.

-

Seeking steady income and long-term capital appreciation? Grow your portfolio with our dividend investing research service, Yield Shark. Edited by seasoned dividend investor Kelly Green, Yield Shark features two portfolios: the "Bedrock Income" portfolio and the "Current Yield" portfolio, showcasing her top high-yield stock picks.

Make dividends a core part of your investment strategy. Click to learn more about Yield Shark.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin