A Partly Cloudy Year

-

John Mauldin

John Mauldin

- |

- January 10, 2025

- |

- Comments

- |

- View PDF

Weather forecasters tell us what kind of weather we should expect. They can be wrong, but their short-term outlooks are generally reliable. The old joke that economists exist to make weathermen look good is funny because it has a ring of ironic truth.

Other things aside, though, we usually prefer moderate weather. Most of us would be satisfied if every day could be warm, partly cloudy, and a little light rain (like Puerto Rico). That nicely summarizes my 2025 economic outlook, too. I expect to “muddle through” another year. Storms are possible but they won’t do too much damage, and when 2026 gets here, we’ll all be fine.

A lot can happen in 12 months, of course. Today I’ll tell you what I think is coming. I should note that my sanguine attitude is making me very nervous. There are more wildcards this year than in any past year for the 25 years that I’ve been writing my forecasts.

Some big challenges loom over our futures. But right now, I’m talking specifically about 2025. Rough times are coming, yes, but I think we have at least 12 good months before the worst gets here. Let’s look at some of the reasons why things should be okay and then look at some of the potential problems,

Why We Forecast

Before I give you my forecast, let’s start with some thoughts about forecasting. I’ve said for a long time forecasts can be useful even when they’re wrong. Their value is not so much in the accuracy but in spurring us to consider the possibilities.

Tim Harford said the same in a recent Financial Times column. Quoting (my emphasis in bold):

“Here’s the problem with forecasts: some of them are right, and some of them are wrong, and by the time we find out which is which, it’s too late.

“This leads to what we might call the forecasting paradox: the test of a useful forecast is not whether it turns out to be accurate, but whether it turns out to prompt some sort of useful action in advance. Accuracy may help, but then again it may not. Forewarned is not necessarily forearmed…

“Thinking seriously about the future can be a worthwhile exercise, not because the future is knowable but because the process is likely to make us wiser.”

I think Tim is exactly right. When we imagine what could happen, we also think about what we will do if it happens. This prepares us to act more wisely when/if the forecast comes true.

We all know that doctors perform autopsies on patients to find out what went wrong. This may sound odd, but a good forecast is like a preemptive autopsy on a live body, in this case, the economic body. We look at what can get worse as well as what can improve. And then we can think about what conditions would lead to those outcomes. If, as time progresses, some of those conditions begin to manifest, we can adapt.

The wisest response may not be to do something but to not do something. Staying on the same course can be surprisingly tough. Reacting quickly isn’t necessarily helpful. As my old mentor Gary North often said, “Don’t just do something. Sit there!”

That task will be more difficult this year. Aside from the usual hazy economic data and Federal Reserve doubletalk, now every day will bring more speculation about what Donald Trump, et al., will do next. Much of the speculation will be wrong. Some will be meaningless noise, but it will tempt us to react in possibly unhelpful ways. And we really do have to look at the source of those speculations. Some of them are incredibly biased. I can remember decades ago when I would read The Economist for thoughtful analysis. And you still get some of that, but it is sandwiched between obviously biased “journalism” and sensationalist clickbait. And you get it the other way, typically from online media.

Let me just say it: Getting paid for clicks or eyeballs is the enemy of balanced, thoughtful journalism. Reporters get rewarded by their employers when people read their writing. It’s always been that way but is now complicated by sensationalist headlines for clickbait. And yes, like you, I succumb to it. And again, yes, social media is also part of this. 2025 resolution: Pay less attention to “economic journalism” if it is driven by clicks. That means my budget for subscriptions will go up this year so that I can get a more balanced analysis. And by the way, click-throughs are relatively meaningless at Mauldin Economics—just our model from the early 2000s and we haven’t changed it.

The answer, I think, is to distinguish between macro and micro. Avoid getting bogged down in forecasted details that often won’t be knowable for some time. Use that time to think about the broader trends such changes will set in motion. A forecast for a target on the S&P 500 is meaningless. The economy can do well, and markets still fall for a variety of reasons. Or the opposite.

Again, investing for the long term will be hard because the media loves to speculate about details and can shake your faith. There will be constant reports about things that might or might not happen, from people who might or might not be in a position to know. Some of them will have ulterior motives. Knowing what to believe won’t be easy.

The good news: We know, in broad form, what kind of policy changes to expect. That gives us a starting point from which to identify possibilities.

We Need More Good News

The current zeitgeist focuses on the sensational and the negative. We started the Rational Optimist Society to focus on more positive news. Another 2025 resolution: read more good news. Like this from recent Adam Tooze columns. (I recommend reading and subscribing):

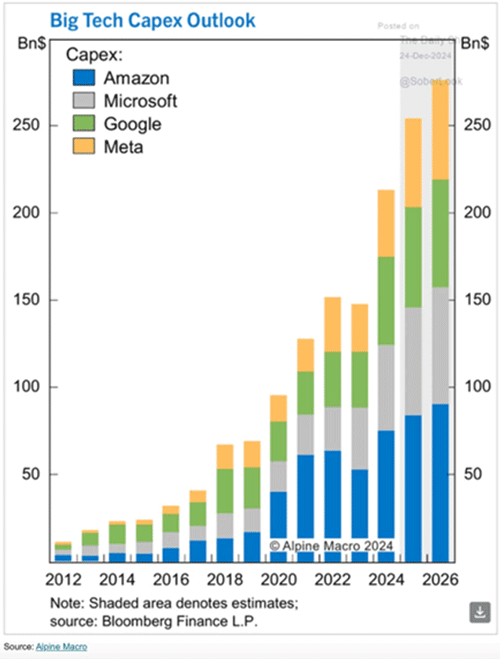

There is an enormous amount of money being spent by big tech, and not just on AI…

Source: Adam Tooze

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Many complain globalization is waning. Is it? Globalization is changing for sure. Onshoring, reshoring, nearshoring, and protecting supply chains are all happening. But if globalization is waning, somebody should tell the shipbuilding industry. It is booming.

Source: Adam Tooze

Much of it is LNG vessels but a good part is container vessels, which means more shipping and globalization. Just from different places.

I could, of course, fill a dozen letters with negative charts. The horrific fires in LA. The geopolitical problems all around the world. But at the same time, US corporate earnings are expected to grow 15%. That’s not shabby. GDP has been running at 3%, well above what I expected two years ago. Consumer spending is holding up. And I have a new grandchild as of Friday morning. There are lots of good things happening.

I will make a few predictions: I believe that high and growing dividend companies will be significantly higher in 10 years. I believe private credit will increase in importance along with other alternatives and should be in your portfolio for the long term. Technological improvements are going to be staggeringly powerful.

“OK” for the Moment

Whatever Trump does will happen in a broader economic context. Before we think about where we’re going, let’s think about where we’ve been.

This time five years ago, we were just seeing initial reports of a new virus in China. It would paralyze large parts of the world economy, leading to deep recession. Governments and central banks responded aggressively, and by 2021, a strong recovery was underway—so strong, in fact, it prompted rising inflation. War in Europe and related energy disruptions pushed inflation higher still in 2022, and the Fed belatedly tightened interest rates.

Many expected this would produce a recession. Some economists like Larry Summers said recession and much higher employment would be the only way to bring inflation back down. But somehow, inflation (at least by the official benchmarks) fell back within sight of the Fed’s target this last year. They finally cut rates in September but are now slowing the rate of cuts even as inflation is not that far from the 3% range.

We forget how unusual all this has been. Take COVID out of the picture, a catastrophic event not of economic origin, and the US hasn’t seen a normal business-cycle recession since 2007–2009.

Would we have had a 2020 recession, absent the pandemic? Maybe. Remember the yield curve inverted in 2019. But in any case, the 2022–2023 rate hikes should have caused another recession. Instead, we had a couple of slightly negative GDP quarters, and that was it. Unemployment barely budged. We have added millions of new workers, even if illegal, and the unemployment rate is strong by any historical standard. The free market seems to be adapting very well in the US. Not so much for the rest of the developed world where the free market is really not as strong.

Of course, an economy that looks “OK” for the moment could be deteriorating in more subtle ways. If so, it’s happening slowly. Barring some 2020-level bolt from the blue, I think we’ll get through this year without a recession. We might even see improvement if new leadership makes the right moves.

But that last part is far from certain.

The T Word

Donald Trump can be inscrutable, but we know what he thinks about tariffs. He promises more of them, and we should believe him. But this still leaves a lot unknown.

This week—in one of those speculative reports I mentioned above—CNN said “four sources familiar with the matter” had claimed Trump was considering declaring a national economic emergency so he could impose sweeping tariffs almost immediately. This caused a brief market flurry, which seemed a little odd. Any conscious trader should know tariffs are coming in one form or another. Why the surprise?

|

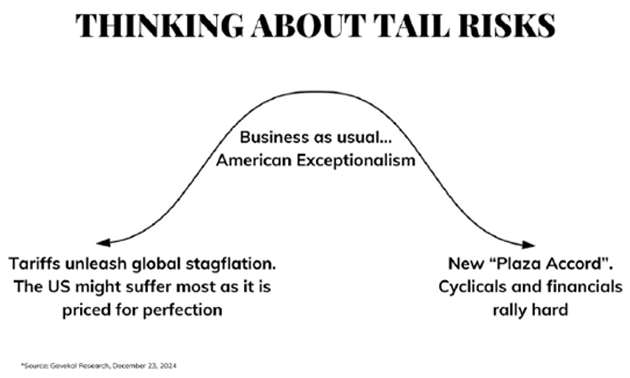

The answer, I suspect, is that some took the story as evidence tariffs would happen sooner and be more severe than expected. No one knows yet. My friend David Bahnsen explained this well in his own 2025 forecast. He describes two extreme scenarios, neither of which he thinks is likely.

“On one hand, some believe that massive tariffs are coming, they will spike prices worldwide, they will spark retaliatory tariffs that will erode appetite for trade, and they will serve as a catalyst to depress economic activity domestically and globally. While I believe this far-left tail risk is highly unlikely to happen, there is certainly truth to the idea that a glut of poorly constructed tariffs would be highly problematic for trade and market functioning. My resistance to this view is not theoretical, but practical. In short, it is based on the low likelihood of the Trump administration actually going through with such.

“The other view, though, a sort of inverse of that same extreme perspective, is that there will be no market impact for Trump 2.0 tariff plans, that they will be entirely used as negotiating tactics that extract better cooperation from allies around domestic policy priorities (i.e. securing more help from Mexico and Canada with crime, drugs, and border security), and that getting better deals with China and other trading partners will be the end result, without much noise along the way. I also see this ‘right tail’ outlook as possible, but unlikely.”

David thinks, and I agree, reality will be somewhere in between. We will see some disruptions, along with higher costs for some goods. As with all taxes (and that’s what tariffs are), much depends on the magnitude.

Source: David Bahnsen

(I typically read multiple dozens of forecasts in December and early January every year. I believe that the most balanced, thoughtful forecast is David Bahnsen’s annual Year Behind, Year Ahead. I strongly suggest you read it. While you’re on that page, subscribe to their Dividend Café to get a balanced and very brief daily view of the markets. And if you are looking to find a truly full-service wealth manager, focused on dividends and alternatives, but offering tax planning and preparation, family office services, financial planning, and more, click on this link. After you read his forecast, think about coming back to this link. And ask them for the white paper I did on why I use TBG myself.)

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

David actually thinks 2025 will bring a welcome improvement in US-Chinese relations. He sees ways to reduce the trade deficit and achieve other US goals without further antagonism. I should note that on Thursday Chinese sources revealed that Trump and Xi are already talking.

Sidebar: I have been through a lot of transitions. This is clearly the strangest. We have a weak current presidency obviously largely run by staff. Normally, a president-elect doesn’t start meddling in foreign policy prior to taking office (with some singular exceptions.)

Suggestion to media and the public in general: Get used to Donald Trump negotiating radical positions in public. No, he is not going to put troops in Greenland. Or Panama. There is 0% chance that Canada will become a state, although there are some states I would be willing to give them straight up for Alberta. In general, use common sense when you read breathless, hyperbolic columns in media.

David acknowledges this (his China call) is an out-of-consensus call. Ian Bremmer, for one, is not so optimistic.

Neither China nor the US wants a crisis in 2025 because both Xi and Trump hope to focus on domestic policy. Xi faces serious economic challenges, growing concerns about social stability, and a military leadership in disarray. Trump wants to avoid any problem that might sink the US stock market and hopes to cut deals that boost confidence in his leadership. With a unified government and consolidated control of his party, Trump is in a better position than Biden ever was to ensure that the US speaks with a single voice.

The problem is that there is no foundation for an agreement that strengthens broader US-China relations. Xi’s government could offer to buy more of America’s agricultural products and energy exports, and it could make life easier for US companies that want to do business in China. In addition, Xi can greenlight more Chinese investment in the US and even play a more actively supportive role in getting to a ceasefire in Ukraine.

Such constructive gestures won’t satisfy Trump and the hawks in his administration, who believe that China’s rise is bad for the US. Trump’s determination to tighten the pressure on China and its stumbling economy will push China’s leaders in the opposite direction.

I respect Ian but would note that Trump did not reappoint the two biggest China hawks from his previous administration: Lighthizer and Navarro (who got a meaningless post). China is a big issue, but there is room for some stabilization. Biden basically continued Trump’s China policy.

This will be fascinating to watch. Leaders on both sides need a deal, and both have different kinds of leverage they can use to push things their way. This is the most important economic relationship in the world, so any changes will matter.

This is precisely what I mean when I say pay attention to what could either drastically improve or negatively impact our base case.

Taxable Gains

Back here in the US, the most important domestic change will likely be in tax policy. Many elements of the 2017 tax cut package are set to expire this year. Naturally, everyone wants them extended, but doing so will add trillions of dollars to our already too-large debt.

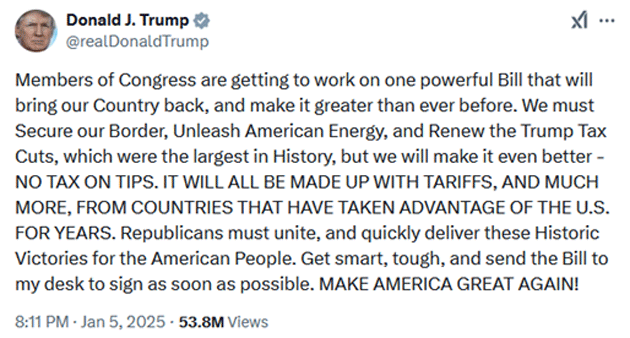

As of last weekend, Trump was saying he expected Congress to roll tax cuts and other items into one giant reconciliation bill—including his campaign promise to eliminate taxes on tips.

Source: X

That’s a lot to do in one bill, particularly for a Congress that’s hardly operating at peak efficiency. I doubt Trump really expects it all at once. Nonetheless, I think this is a peek at his priority list. He wants to control the border, expand energy production, extend his previous tax cuts, and add a new break for tip income. I think it is likely he gets the first three and energy because more sanctions on Iranian and Russian oil are highly likely and, in the short term, will increase oil prices thereby encouraging US production.

Notice also, he seems to think tariffs will generate enough tax revenue to replace that lost revenue. If so, the tariffs will have to be a lot deeper than the optimists expect. And let’s not forget, American consumers will pay these tariffs in the form of higher prices. So it wouldn’t really be a tax cut, but a kind of consumption tax in disguise.

What about the DOGE? Spending cuts could help offset the lost tax revenue. But I don’t think we should hold our breath. Even $100 billion in 2025 is not that much in the grand scheme of things. Absolutely we should do it. I am rooting for a lot more, but it will be extraordinarily difficult. (I talked this week with one of my Alpha Society members who is going to DC to work in the office of personnel management. They fully intend to require federal workers to come into the office. Biden signed an agreement saying they don’t have to, clearly intending to hamper Trump’s agenda. Can Trump change that? Cue the lawyers.) Employment is a big budget issue.

But what will happen, unless the Fed raises interest rates, is a significant drop in the federal government’s interest burden as Treasury bills and notes issued in 2022–2024 roll off and are reissued at lower rates. Add to that higher capital gains tax revenue driven by last year’s strong stock market, and the end of giant spending like Biden’s student loan forgiveness, and we should see some modest improvement. And maybe more down the road if Congress can get serious about entitlement and health care reform.

Sidebar: Treasury Secretary Yellen’s management of government debt is the single worst mismanagement since Alexander Hamilton. Not issuing 30-year notes in the 1% range was criminally stupid. It was stupid when Mnuchin did something similar, but not to the level of Yellen.

We have other challenges, too. For one, Lacy Hunt points to a sharp drop in the world money supply since 2022. The reasons for this are pretty technical but basically come from central banks tightening too much.

Source: Lacy Hunt

With excess capacity relative to demand, we essentially have “too little money chasing too many goods.” If it persists, this will mean lower growth, disinflation, and falling interest rates. At dinner on Monday, Robert Graham, a partner at TBG, asked how long the lag would be before that disinflation takes effect. Lacy said it might be as long as four years. Monetary policy has always worked with a long lag.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

So that’s probably down the road a bit. I think 2025 will be relatively calm, at least in economic terms. We have some time to prepare for worse years ahead. We should all use it wisely.

There are literally scores of topics I didn’t touch on. We will get to them in future letters. I look forward to navigating 2025 with you. Let me encourage you to share my letter with your friends.

Newport Beach, Dallas, and Suggested Reading

I will be in Newport Beach January 20–23 for The Bahnsen Group’s annual client dinner and to meet with their entire team, as well as readers and Alpha Society members. I will be in Dallas when we open our new longevity clinic (called Lifespan Edge) in March, and then travel to dozens of cities as we open other clinics and franchises this year.

My sushi dinner with Joe Lonsdale went fabulously. Sitting with young successful venture capitalists is intimidating. He will be very involved with our Strategic Investment Conference this year. He is just so connected. He is also a brilliant philosophical mind and talented interviewer. I consider his Substack a must-read. The breadth of his writing and the extraordinarily high quality and variety of his interviews mean you will be better able to keep up with what is happening in the real world of tech. He is involved with dozens of companies, as well as being a cofounder of Palantir. He really gets defense, software and AI, and planning for the future. A true Renaissance mind.

I find myself far more optimistic about 2025 than I’ve been for a long time. Not just business-wise, although there is that, but because there are going to be so many really interesting topics to write about. 2025 is not going to be boring. Again, if you have ever thought about recommending me to your friends, this will be the year. I will give you something to talk about.

And with that, it’s time to hit the send button. Let me wish you the best and most prosperous year of 2025. Another resolution: more time for friends. And don’t forget to follow me on X.

|

Your going to need more time analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin