The Trump Inflation Problem

-

John Mauldin

John Mauldin

- |

- November 15, 2024

- |

- Comments

- |

- View PDF

Two weeks ago, I opened this letter by noting the election uncertainty, once over, would give way to a different uncertainty about what comes next. That’s where we are now.

I fully expected a closer outcome that would take some time to resolve. Instead, we have an undisputed president-elect moving full speed ahead. And what we see publicly is a small part of what’s happening behind the scenes. I am reasonably well informed, and I have a lot of friends who are very well informed, but I don’t know anyone who hasn’t been surprised. And it’s not clear how everything will play out. It gives a whole new meaning to the lyrics: “A wheel in a wheel… Way up in the middle of the air.”

Our uncertainty stems from the simple fact that change is hard. Everything Trump wants to do will face powerful opposing forces, and not always Democrats. Many will be other Republicans, or people who supported his campaign. Some people helped Trump win precisely because they wanted to influence his actions. That’s how politics works. The technical term is “logrolling.”

We know the new administration’s agenda in broad terms, but the details are very much up in the air… and the details matter. Policy is personnel and vice versa. Personnel is where the policy happens. Anyone who thinks they know what is coming next year should take a big dose of caution.

Nevertheless, we can still speculate. I’ve been talking about how hard it will be to fix the debt problem, which in my view is the core problem from which most others flow. It’s not just the debt itself, either. The attitudes and structures that let it grow are problems in themselves.

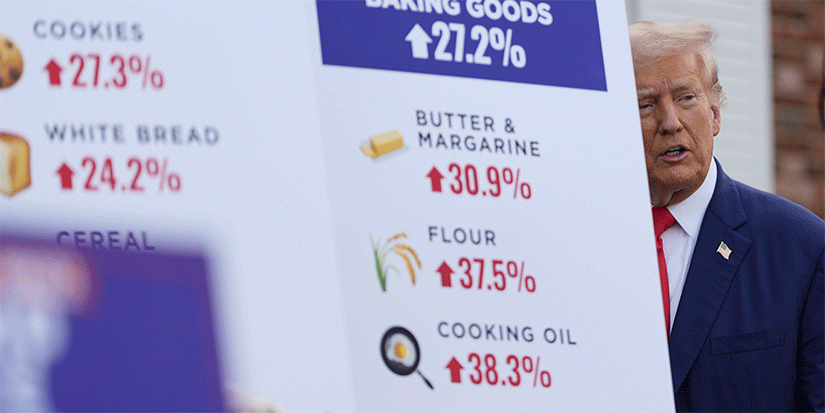

The Trump Inflation Problem

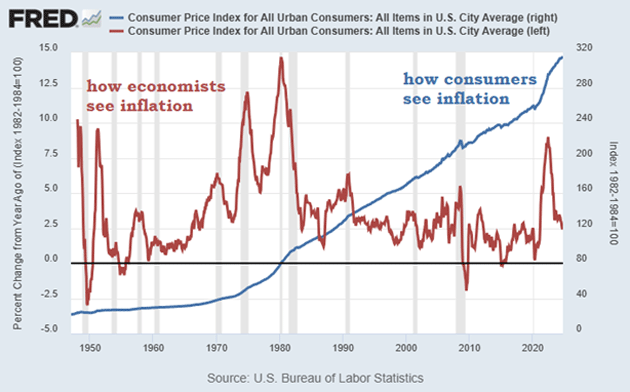

Let’s start with this important thought: President-elect Trump now has an inflation problem. Yes, he inherited it, but that dog will only hunt for about a year. Then it is truly his problem. Here’s a great chart showing the different way economists and the public perceive inflation.

Source: Lyn Alden

In this argument, the perception of the public always wins. Notice that the blue line, how consumers see inflation, except in extreme recessions, never even marginally goes down. Pricewise, we are not going back to the good old days of 2020. Ever.

In the world we have today (how things have changed!), the federal deficit, not the Federal Reserve, is the primary cause of inflation. Deficits are by definition inflationary. Generally speaking, if the deficit is below the increase in nominal GDP, then it truly doesn’t matter in terms of inflation in the short term. And up until 2020, with the advent of COVID and then massive budget deficits, that had been the rule.

In fact, since Volcker, the general trend was disinflationary or even deflationary. Because Fed officials were afraid of deflation (wrongly, I think) they were actually trying to create inflation. QE1, QE2, QE3… Deficits were rising but not necessarily debilitating. Yes, the debt kept increasing and that was and is a problem.

And it is now Trump’s problem. I think his basic instinct of cutting government spending is correct. I was for cutting government spending back in the 1980s. I’ve been on the team for over 40 years.

If Trump is really going to lean into inflation, he will need to do more than cut spending on the margins. He has to figure out how to seriously cut spending and the deficit and put us on a glide path to a more-than-balanced budget. We did that in the 1990s and it can be done today, just with a lot more pain and difficulty.

Like I said last week, only Nixon could go to China. And only Trump could put us on a glide path to a balanced budget. Candidly, I think he’s got the budget cutting part down (see below). But that is only part of the solution. Unless he wants to make serious entitlement cuts, beyond the means testing and raising the age of retirement, he will have to look at the revenue side.

If he doesn’t, and deficits still are in the $1.5 trillion range, he’s going to be dealing with inflationary issues, while at the same time spending political capital on other parts of the government—many of which I completely agree with.

While Trump and team see a great number of problems that need to be dealt with, they need to realize that inflation and the debt and deficits are going to be the true problem. The bond market and even the Federal Reserve seem to realize that. It is now 50–50 whether we even get a rate cut in December. Inflation is not dead. It won’t be long before inflation is Trump’s problem. Just saying…

Glasnost and Revolutions

I love Pippa Malmgren. She is an iconoclastic thinker, geopolitical analyst, and always brings a far different perspective than what I typically see. She sees the current budget cutting initiative from the Trump administration as reminiscent of Russian leader Mikhail Gorbachev and his “glasnost” movement. Glasnost was a Russian word for transparency. And with that set up, let’s turn to Pippa’s letter this week:

“Today, America is having a glasnost moment. It is as radical a revolution. Except, the goal is not to permit criticism. It is to get the raw data, put it in the hands of the most sophisticated data analysis experts in history (Elon Musk, Peter Thiel, etc.), package the evidence in a way no judge or jury could deny, and commence a prosecutorial process.

|

“…So, we are not witnessing the usual passing of the baton back and forth between the left and the right. This is the Tech Bros storming the ramparts. Their goal is to shine a bright light into the darkest corners of government. The cameras will now be trained on the state instead of on the citizens. If you think Elon Musk and Vivek Ramaswamy are going to be running a new, yet uncreated, Department of Government Efficiency (DOGE), you are still thinking old school. It’s going to be more than a department. It’s a philosophy and an AI-led process that they will bring to every aspect of governance and across every agency and arm of government. It’s the ultimate audit. Actually, it’s more like a gang fight where everyone knows the guy who wins is the one with a gun at a knife fight. (JM—Except both sides have far more than guns.)

“Glasnost unleashed a gang fight of epic proportions. As a result, Russia ended up in Perestroika, meaning restructuring. That will happen in the US too. The difference is that America is not the Soviet Union. Americans understand capitalism. They know how to create businesses or policies, restructure them, and adapt to change. Nobody does that better than the USA. But, any time you throw out the old to make way for the new, it’s more than painful. It’s a fight.”

Different Plane?

This week the president-elect said he would appoint Elon Musk and Vivek Ramaswamy to lead a “Department of Government Efficiency.” Their job will be to identify wasteful spending and help the government do its job at the lowest possible cost.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I previously noted how similar efforts, like the 2010 Simpson-Bowles commission, began with high hopes and then went nowhere. I said, “This is something where a majority isn’t enough. You need a supermajority consensus. No such thing was possible in 2010, nor would it be today, in my opinion.”

Reader Andrew Fately said in our community forum that I shouldn’t be so skeptical.

“I wonder if you are not underestimating just what Elon can do regarding efficiency. After all, as smart as you are, and I have been reading and enjoying your stuff for years, Elon thinks on a different plane. $500B to $1 trillion in cuts and the elimination of enough regulations to allow the economy to increase its natural growth rate will go a long way to removing the problem.”

Far be it from me to underestimate Elon Musk, but significantly cutting the budget is sadly not just rocket science. It’s far harder than rocket science because we have let the problem fester far too long, and too many competing constituencies want to keep their benefits and cut the other guy’s. It’s the line that was originally said in the 1930s: “Don’t tax you, don’t tax me, tax that fellow behind the tree.”

A little math: If we are to start reducing the debt, the first step is to stop digging. Right now, the government runs a roughly $2 trillion annual deficit. To balance the budget, we would need $2 trillion in spending cuts and/or revenue increases, not just once but every single year. We don’t have to do it all at once but at least get on that glide path.

Note also, this doesn’t solve the problem; it just keeps an already-giant problem from getting even worse. Our debt is over 120% of GDP, in the zone where Reinhart and Rogoff found default became almost inevitable in other countries. A balanced budget, if we could achieve one, would simply keep the debt stable at that level. That’s a good start but you will still be spending $800 billion in interest. You actually have to figure out how to reduce that debt or the cost of the debt to really make an impact.

Having said that, whatever small steps we can take will help. They might buy us some time to find better solutions. How might we do that?

In FY 2024, which just ended, nondefense discretionary spending was around $948 billion. That includes all the departments and agencies that comprise “the government.” Education, foreign aid, law enforcement, regulation, etc. Some of this is certainly wasteful and counterproductive. How much? I don’t know. But even eliminating all of it isn’t enough to stop the debt from growing.

But we have other knobs to turn. Defense is huge—$849 billion last year—and some of it is wasteful, too. The conflicts in Ukraine and Israel are demonstrating how war has fundamentally changed. Relatively inexpensive drones, cyberattacks, and such are causing enormous damage at much lower cost than the conventional weapons the US relies on. The defense budget could certainly use a rethink. I doubt Elon and Vivek think the military budget is untouchable, but a lot of Republicans (and Democrats!) will oppose defense cuts.

Healthcare is another big chunk of spending. Medicare, Medicaid, and assorted smaller programs are nearly $1.7 trillion a year and growing fast. The US spends far more than other nations on healthcare and is not any healthier. Sensible reforms could really move the needle.

None of this is new. People have known and talked about it for decades. Yet nothing happens because of another big barrier: one man’s waste is another man’s revenue. Much of this “wasteful” spending is also income for certain businesses and workers. Of course they don’t want it cut. And because they see the spending as existential, they fight hard to preserve it.

That’s what Trump, Musk, and Ramaswamy are up against. I wish them luck, and would actually enjoy participating, but it’s going to be tough.

Simply having slim Republican majorities in the House and Senate is not close to being sufficient. The spending impulse is bipartisan and pervasive. Just this week the House passed a bill giving government workers an increased $196 billion Social Security benefit, by a vote of 327-75. Rep. Lauren Boebert screamed about raising the debt ceiling limit. She and two dozen of her fellow Republicans who voted against increasing the debt limit voted for this bill.

Congress actually controls spending bills. The president merely gets to propose or veto a spending bill. I imagine it will be high drama. As Pippa said, any time you throw out the old to make way for the new, it’s more than painful. It’s a fight.

New White Paper

For the last year, I’ve been recommending that you subscribe to David Bahnsen’s Dividend Café. The Dividend Café is a short daily summary combined with pithy market wisdom and commentary, plus one weekend thought piece which will make you a better investor. I suggest you try it out.

I have written a white paper called Why I Am Working with the Bahnsen Group. I go step-by-step through the decision-making process I made in choosing The Bahnsen Group. You should read it not just to see if they are a potential fit for you, but to understand what you should think about when you are choosing your own money manager. Many readers will of course want to use someone else or a different style. I believe this paper will help your decision-making process.

You can also click on this link to request information about TBG’s services and you will automatically get a copy of the white paper.

Dallas, Las Vegas, New York, Austin, and Newport Beach

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

I will be in Dallas the week of Thanksgiving, both for business and family. Then I will be going to the rather large Longevity Fest in Las Vegas from December 13–15 before heading to New York for a few days of dinners and meetings. If you are attending that conference, drop me a note and let’s meet. I will be in Austin the first week of January and then later that month in Newport Beach.

I am running up against deadlines, so it is time to hit the send button. I wish I had more time to edit and think about this letter, as it really is an important topic and there is so much to say. But there will always be another Friday. Thanks for reading me and being my friend. Have a great week!

|

Your trying to figure out the plot analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin