The Swiss Release the Kraken!

-

John Mauldin

John Mauldin

- |

- January 19, 2015

- |

- Comments

- |

- View PDF

The First Casualty of the Currency Wars

Pity the Poor Swiss

Draghi: Quantitative Teasing

The Cayman Islands, Zurich, Florida, and New York

“Below the thunders of the upper deep,

Far far beneath in the abysmal sea,

His ancient, dreamless, uninvaded sleep

The Kraken sleepeth: faintest sunlights flee….

“There hath he lain for ages, and will lie

Battening upon huge sea-worms in his sleep,

Until the latter fire shall heat the deep;

Then once by man and angels to be seen,

In roaring he shall rise and on the surface die.”

– Alfred, Lord Tennyson, “The Kraken”

"The exact contrary of what is generally believed is often the truth."

– Jean De La Bruyère

“Cry ‘Havoc!’ And let slip the dogs of war!”

– William Shakespeare, Julius Caesar, Act III, Scene I

“No mas!”

– Roberto Duran to the referee at the end of his fight with Sugar Ray Leonard, 1980

If you want evidence that central bankers play by their own rules, regardless of what they say or what conventional wisdom tells us, last week’s action by the Swiss National Bank should pretty much fill the bill. My friend Anatole Kaletsky, in a CNBC interview not long after the announcement, quipped (with a completely straight face) that just as James Bond has a license to kill, central bankers have a license to lie.

Swiss National Bank Chairman Thomas Jordan had assured us just the week before that the Swiss would continue to “hold the peg” whereby the SNB kept the value of the Swiss franc from rising higher than €1.22. “The cap is absolutely central,” he said. And SNB Vice Chairman Jean-Pierre Danthine said publicly only last Monday that the peg would remain a cornerstone of Swiss banking policy.

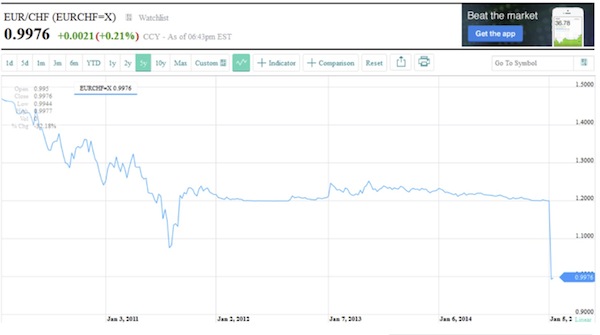

Early Thursday morning the Swiss abandoned that policy. Much of the press coverage in the (largish) wake of their surprise move has focused on the costs to banks and hedge funds around the world, but you have to realize that serious pain is being felt in Switzerland itself. Every bank and business that held non-Swiss-franc debt or investments took an immediate 15–20%+ haircut on its holdings. Swiss investors lost at least 10% on investments in their own stock market and more on shares they held in other stock markets. Forty percent of Swiss exports go to the Eurozone, and the Swiss franc is now over 30% higher than it was five years ago – with almost half that movement coming in one day. Those exporters just got hammered.

And this was not a painless policy decision for the SNB. Citibank estimates the SNB’s losses to be close to 60 billion Swiss francs. Let’s try to add a little perspective on that. The US is (very) roughly 40 times the size of Switzerland in both GDP and population. At today’s conversion rate, the Swiss lost something like $70 billion if Citibank is right. That’s like the US Federal Reserve’s losing $2.8 trillion. That, my friends, will leave a red mark on any central bank’s balance sheet. Not that the Swiss can’t afford it or that they’re going to be out on the corner with a tin cup, but they do have a considerable quantity of euros that are now much less valuable. And dollars and yen and pounds and renminbi. But then again, they are in the privileged position of having a currency that the rest of the world wants, so much that in order to hold it you will have to take a haircut on your deposits at the SNB, a haircut that is going to increase (more on that later).

There are also serious losses in the international banking community. We are just now beginning to learn how many funds and brokerages will have to close.

Do you think that SNB Chairman Thomas Jordan will be going into the local restaurants and getting high-fives and fist bumps? Exactly what do you think his reception will be in Davos (where he is scheduled to appear)? Christine Lagarde, the managing director of the IMF, gave a somewhat frosty reply to my friend Steve Liesman at CNBC when he asked her only a few hours after Jordan’s move (in what was clearly an already-scheduled interview) about her thoughts on the surprise announcement. She was not amused, but she kept her professional stage smile in place. (It was a very good interview.)

In Norse mythology, the Kraken was a sea monster that attacked ships unaware. In Greek mythology, it was a pet sea monster (of either Hades or Zeus) that would be released upon enemies that annoyed its master. It has been an iconic figure in comics and movies for the last 30 years. “Release the Kraken!” is the standard line prior all hell breaking loose.

In an era when central bankers are supposed to be more open, collaborative, and communicative, what would make the Swiss National Bank decide to turn on a dime and shock the markets – to release the Kraken, as it were? Note that in fact all hell did break loose. Rather than delivering hints accompanied by a few well-placed leaks, the Swiss decided it would be best to completely surprise the markets. It will be a long time before we get the full story on what must have been going through their heads as they reached the decision.

I have spent the last few days reading a great deal and talking with friends, trying to understand the “why” of the suddenness of the Swiss action. If we can get some insight into this question, perhaps it will give us a few clues as to upcoming global central bank policy changes in general and the problems facing Europe in particular.

While I do fully intend to try to reduce the length of my letters this year, this one is going to be longer because it will contain a significant number of charts. We’ll look at the data that made Thomas Jordan and his team at the SNB throw in the towel on their peg policy, and I think we should look at it in depth. Just as Roberto Duran walked away from Sugar Ray Leonard at the end of the eighth round of their famous fight in 1980, telling the referee “No mas,” the SNB signaled that it had had all the pain it could deal with.

The First Casualty of the Currency Wars

My last book, Code Red, was all about the currency wars that I expect to dominate the latter part of this decade, triggered by Japan’s massive quantitative easing. Jonathan Tepper and I pointed out that, going forward, it is every central banker for himself. While the world’s central bankers typically matriculated at the same schools and espouse the same beliefs, and while they regularly meet each other at conferences and BIS meetings and freely employ words like cooperation and collaboration in their dealings with one another, the reality is that they are all politically captive to the countries they serve.

While central bankers may espouse independence from their governments, they do live and work in their particular countries and are largely responsible for those countries’ economic well-being. They are going to do whatever they feel is necessary to help their governments and domestic businesses perform as well as they can, while trying to maintain the stability of their local currencies.

Japan is not going to cater to Korea with its monetary policy; neither is Indonesia really interested in helping Singapore or Malaysia; and countries like Switzerland and Sweden carve out their own paths on the flanks of the Eurozone. The US Federal Reserve has made clear on many occasions that it is not responsible for the policy decisions and outcomes of any other country. If you were the Swiss National Bank and looked at the following data, what would you do? The simple fact is that Europe and the Eurozone just don’t make sense; nor, given the recent Swiss action, do they seem to be pursuing the sorts of policies that would improve their condition.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

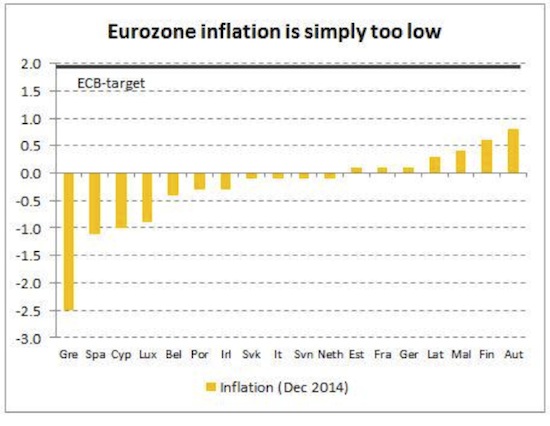

It’s not just about deflation. Switzerland is experiencing deflation and yet has full employment, a balanced budget, and a positive trade balance. Germany, France, Austria, Belgium, the Netherlands, Finland, Sweden, and Denmark are all either in deflation or close to it.

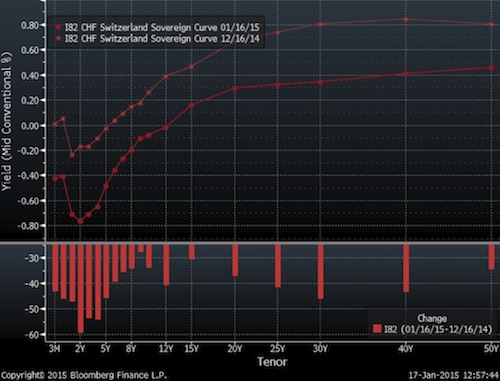

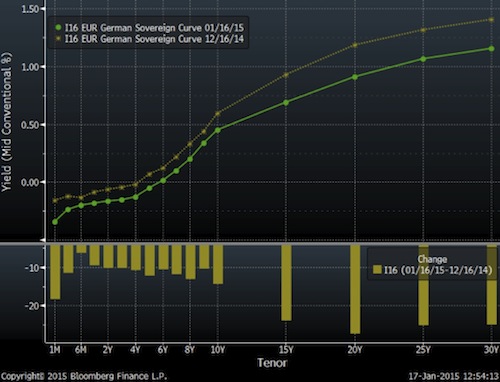

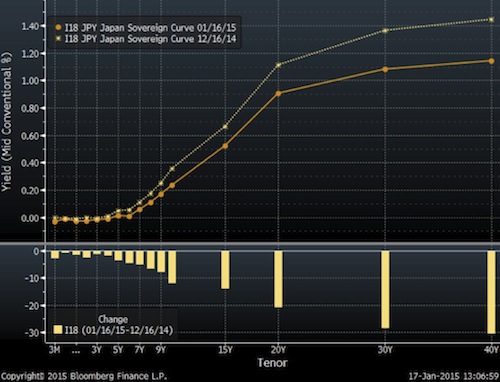

Recent central bank policy has led to the anomaly of negative interest rates. Negative rates began to show up a few years ago and are now pervasive. I’m going to post close to a dozen charts from Bloomberg. You might want to save this letter so you can show it to your grandkids in 30 years when they complain about aberrant economic conditions and volatility. “Kids, you have no idea what we went through back in the mid-teens! It was way wacko back then.”

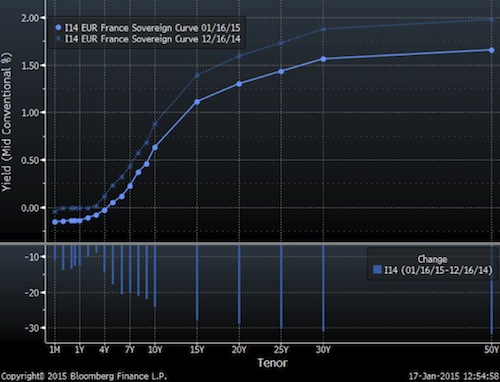

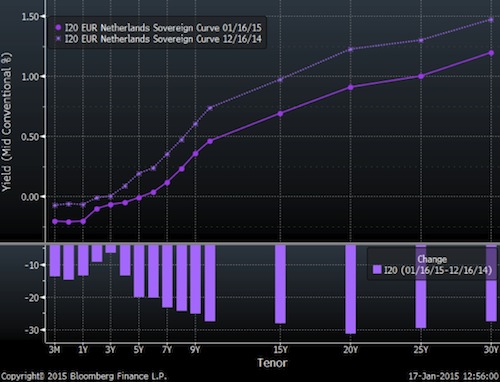

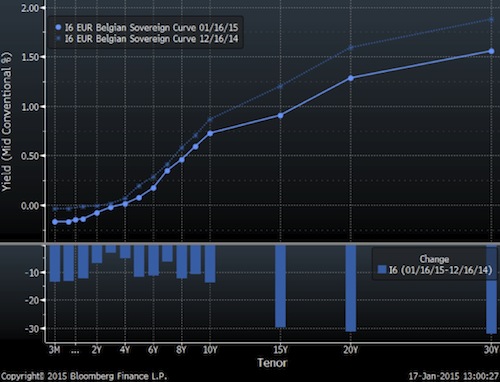

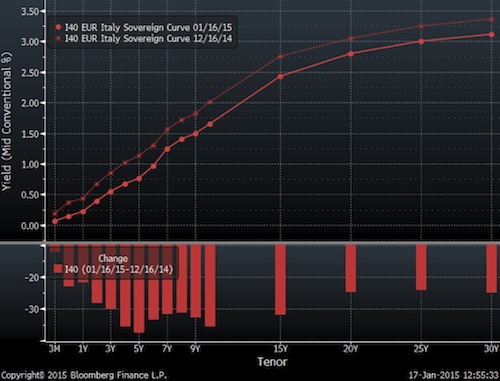

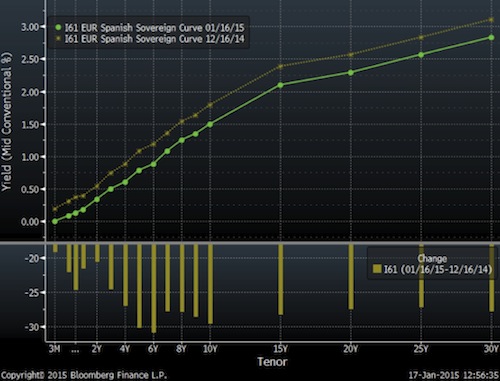

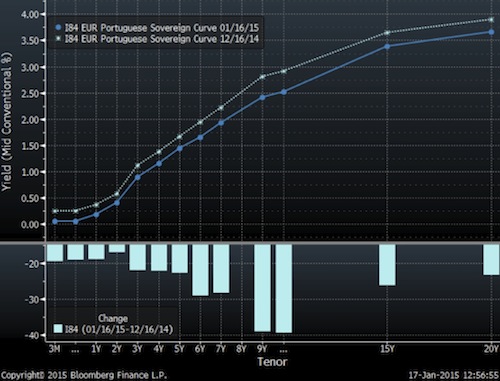

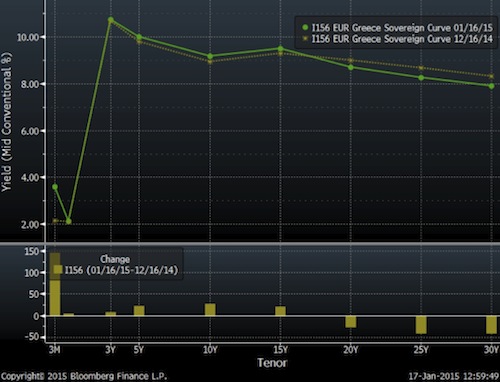

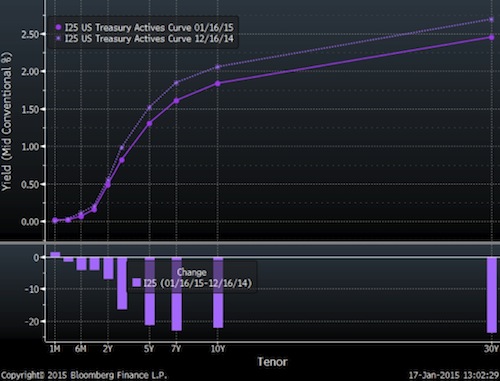

Each chart for a European country compares the yield curve from a month ago to today’s. As you can see, rates have moved strongly downward.

Note in the first chart that Switzerland’s 10-year yield is NEGATIVE (-0.08%).

Germany’s yield curve is negative through six years! Which almost forces you out the yield curve, bringing 10-year rates down to below 50 basis points!

Seriously, can you understand a world where French four-year bonds have a negative yield? Or where their 10-year bonds yield about a third of the US rate?

Netherlands rates turn positive four years out – whoopee.

Belgium, with debt-to-GDP of 101%, has negative rates. Go figure.

Meanwhile, Italy has debt-to-GDP of 133% and growing by 4-5% a year and a 10-year bond yielding less than that of the US 10-year.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

Spain – all positive, but with a 10-year that pays less than Italy’s.

Gotta love the Portuguese 10-year at 2.97.

Ireland has debt-to-GDP close to 125% and lower rates throughout the yield curve than the US rates.

Rates are even falling in Greece … if you want to go out 17 years.

And here are the US and Japan, for reference.

Japan’s 7-year is almost negative (+0.1%).

Not only are the Swiss not holding the peg, they have put out the “Not Welcome” mat, lowering their negative interest rates to -0.75%, with the implication that if that isn’t enough, they will drop them to -1.5%. You want a Swiss safe haven? It will cost you. And the irony is that many will pay it. Losing only 0.75% a year sounds really good if you are Russian. (The Danes moved their negative rates to -0.2% this morning just to make sure no one starts to see them as a rent-free safe haven.)

Then you look around at the rest of Europe, and what you see, mostly, are problems. Where is the growth going to come from? Russian corporations and oligarchs have taken out massive Swiss-denominated loans, as has much of Eastern Europe. More than one million Hungarians are in dire straits. Nearly 65% of the country's household mortgages are denominated in foreign currencies – mostly Swiss francs, according to the National Bank of Hungary. And according to Bloomberg News, more than 40% of mortgages on the books of Poland’s banks are denominated in Swiss francs. When the borrowed currency surges against the borrower’s home currency, the effective cost of that debt balloons.

To help us understand the mindset of the Swiss central banker, let’s turn to a tongue-in-cheek analysis of the problems of the SNB by my friend Charles Gave. (Charles has a wicked-sharp sense of humor at all times, but he’s at his best when skewering economists.)

They [the SNB] didn’t mind pegging the Swiss franc to the Deutsche mark, but it is becoming more and more obvious that the euro is more a lira than a mark. A clear sign is the decline of the euro against the US dollar.

Mr. Draghi has been trying to talk the euro down for at least a year. This should not come as a surprise. After all, in the old pre-euro days, every time Italy had a problem, the solution was always to devalue.

But the Swiss, not being as smart as the Italians, do not believe in devaluations. You see, in Switzerland they have never believed in the ‘euthanasia of the rentier’, nor have they believed in the Keynesian multiplier of government spending, nor have they accepted that the permanent growth of government spending as a proportion of gross domestic product is a social necessity. The benighted Swiss, just down from their mountains where it was difficult to survive the winters, have a strong Neanderthal bias and have never paid any attention to the luminaries teaching economics in Princeton or Cambridge. Strange as it may seem, they still believe in such queer, outdated notions as sound money, balanced budgets, local democracy, and the need for savings to finance investments. How quaint!

Of course, the Swiss are paying a huge price for their lack of enlightenment. For example, since the move to floating exchange rates in 1971, the Swiss franc has risen from CHF4.3 to the US dollar to CHF0.85 and appreciated from CHF10.5 to the British pound to CHF1.5. Naturally, such a protracted revaluation has destroyed the Swiss industrial base and greatly benefited British producers [not!]. Since 1971, the bilateral ratio of industrial production has gone from 100 to 175... in favor of Switzerland.

And for most of that time Switzerland ran a current account surplus, a balanced budget, and suffered almost no unemployment, all despite the fact that nobody knows the name of a single Swiss politician or central banker (or perhaps because nobody knows a single Swiss politician or central banker, since they have such limited power? And that all these marvelous results come from that one simple fact: their lack of power.)

The last time I looked, the Swiss population had the highest standard of living in the world – another disastrous long-term consequence of not having properly trained economists of the true faith.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

“Whatever it takes!” was Draghi’s mantra just a few years ago. He has been promising action for all that time and has basically delivered nothing. As I noted a few weeks ago, he has pushed his “street cred” to the limit. He really has to deliver something at the January 22 ECB meeting, or the markets will simply no longer believe him. If he doesn’t do something significant, I think the euro could rip higher, applying even more deflationary pressure throughout Europe.

(Note that there is really nothing all that bad about deflation unless you have a high level of debt and your budget isn’t balanced. Then you get caught in a debt spiral, which forces you into something that has come to be universally abhorred, called austerity, which in other days and times was simply called living within your means.)

Draghi is not lacking in the desire to be more like Bernanke and Yellen. The problem is that he must win consensus among the board of governors of the ECB. To do any serious quantitative easing without the approval of Germany and its Bundesbankers would create very serious problems for him in Europe.

It now appears that what the ECB will do is compromise. They will go ahead to do QE, but each country will assume responsibility for its own bonds. Under that plan, Germany will not be responsible for French or Italian or Spanish bonds bought by the ECB. The ultimate responsibility will be with the national central banks of the individual countries.

This would create a “silo effect” and have long-term implications. To take one example, as noted above, Italy has 133% debt-to-GDP, and its debt is growing at 3 to 4% a year. Now, if the ECB began to purchase Italian debt, the cost of that debt would fall. Since Italy has to refinance (and purchase new) at least 10% of its debt this year with an average cost of well over 3.5%, it could lower its overall interest cost. But given that the country is in deflation and will likely be in its third straight year of recession, deficits will be higher than forecast, and debt-to-GDP will increase.

As we have noted on numerous occasions, Japan no longer has a functioning bond market without the Bank of Japan. What happens when Italian debt rises in cost to the point that individuals no longer want to buy that debt and the market essentially becomes the European Central Bank? Crazy? I think not. It won’t happen this year or the next or even for a few years after that; but unless Italy gets its budgetary house in order – something that will be difficult given its huge pension and healthcare obligations and poor demographics, debt-to-GDP of 150% or 160% is possible by the end of the decade. That is the level at which Greece became a problem a few years ago.

Now, I understand that all my Italian readers will point out that Italy is not Greece, but they both have to coddle the bond market with a reassurance that those who bought will get paid. And given the track record of Italy over the last century, it is not altogether clear to me that you can approach Italian debt with 100% confidence. I know, it’s different this time; but bond buyers are a fickle lot. You buy government bonds because you want to avoid risk.

Draghi is going to have to fight the perception that he is enabling countries to avoid dealing with their imbalances, even as he tries to improve the terms of trade by forcing the euro down.

The common wisdom is that now the Germans are fighting against assuming Italian debt by putting it on the books of the ECB. But Will Denyer points out this morning that there is reason to think that the various countries might actually want that debt for a time, until it can indeed be mutualized in some distant future. Writing for GaveKal, he says:

The US has just provided a remarkable example of the third option at work. Last year, the US Treasury paid a record amount of interest, roughly US$430bn. But over the same period the Fed remitted almost US$100bn to the Treasury, thanks to a balance sheet bloated by QE operations. If we net out remittances from the Fed, the Treasury’s interest payments fall by almost a quarter. Or, to put it another way, with US$17.6trn in debt outstanding in 2014, this effectively lowered the Treasury’s interest cost by around 50bp. And that is before we factor in any effect on market rates.

But what about the eurozone, where many governments are involved? Normally, any profits made by the ECB are pooled and distributed to member countries in proportion to the central bank’s capital subscription weightings, which are based on population and gross domestic product. That means Germany gets the most, then France, and so on... These outflows pay no attention to where the profits came from. In a QE program today, most of the profits are not going to come from German or French bonds, which yield next to nothing. Most are going to come from the smaller peripheral governments that are currently paying more interest on their debt. We don’t need to do any math to figure out that QE done by the ECB would result in a massive transfer of wealth from the periphery to Germany and France. This is true almost regardless of how purchases are apportioned.

What would make a big difference is if the ECB made an exception to its normal profit-sharing practices, and said that all profits on Portuguese bonds will go back to the Portuguese government, all profits on Italian bonds go back to the Italian government, and so on…. In this structure, all eurozone governments would benefit from QE, at the expense of anyone holding the currency (just as happened in the US, UK, Japan…). The German government would also benefit from any central bank purchases of its debt, but it will no longer also receive a massive transfer of wealth from the periphery.

While everyone is talking about how Germany may demand that credit risk be isolated within each country, that may be a mirage. It may well be the peripheral governments that want the profits from QE to stay within each country – so they can reap all of the regular benefits of currency debasement.

What does this mean for markets? However it is structured, QE is likely to weigh on the euro (that is, if the ECB actually debases its currency on a scale that lives up to lofty expectations). A big QE announcement would also probably lift equity prices, at least initially.

So what caused the Swiss to act? I think it was in part that they looked at the general weakness of Europe and its seeming inability to pursue reforms or to address its imbalances in any realistic manner. Many Eurozone leaders seem to think the European Central Bank has magic in its vaults and simply hope that the Germans can be persuaded to release some of that growth pixie dust. The Swiss look at their own experience and see the continued growth of debt and unfunded obligations in Europe as a real problem.

On top of all the other developments, the European Court of Justice issued a preliminary ruling on Wednesday that allows the ECB to employ quantitative easing. There are rumors that the ECB is going to propose a package that may run as high as €2 trillion – countered by “leaks” that suggest the total will be a fraction of that amount. Frankly, the market has priced in €500 billion already. If Draghi doesn’t deliver a multiple of that, I think we will see a disappointed market.

Was the Swiss banking and business community given a heads-up? Were there phone calls from one desk to another? Clearly, there are communication channels. And the timing of the ECJ ruling and the announcement by the SNB the next day is more than suspicious. (Yes, I know it’s a preliminary ruling, but do you really think it will get changed?)

I think the SNB looked down the road and saw the euro at parity to the dollar (which is where Draghi and the rest of Europe would like to have it), realized how much they would have to spend and ultimately lose to maintain the euro peg, and decided it simply wasn’t worth the cost. That $70 billion loss could turn into a $150 billion loss before you knew it.

Simply removing the peg and taking that much buying off the table will in itself begin to reduce the value of the euro. Will the Swiss begin to move some of their rather large euro holdings to US dollars and other currencies? That move would seem the logical follow-on, and it would push the euro down even farther.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

In 2002 I said the euro would rise to $1.50 and then fall back to parity. We do seem to be on that journey. This is not, of course, a one-way trip; and I would expect the euro to correct upwards at some point before resuming its downward journey.

The interesting question will be, if the ECB starts down the path of QE, at what point will it feel it can stop? Will it depend on an inflation-target number? It doesn’t seem likely that QE can actually deliver inflation in a deleveraging world – and Europe must at some point deleverage. Thus, we could see QE in the Europe for a rather long time.

The Eurozone is simply unbalanced, and a monetary policy appropriate for Italy or Spain is not appropriate for Finland or Germany.

Unless and until its members create a fiscal union and come up with some formula to mutualize their debt, the Eurozone will remain imbalanced and will become increasingly likely to break up. Ironically, if they fail to pursue QE, there will be a crisis sooner rather than later; but a crisis is precisely what they need in order to address the present imbalances. They are not going to substantially reform their labor and budgetary processes except in the act of crisis resolution.

A significant QE package (on the order of €1 trillion or more per year) may be enough to postpone the crisis for at least several years. And perhaps that is all they intend to do, thinking that somehow they can all get a handle on their budgets and that growth will magically ensue in a world where debt has already overwhelmed the markets and governments have grown too large relative to the private sector that is necessary to support those governments. Stir into that mix healthcare and pension obligations that are even larger than those in the United States, and you have a surefire formula for a major crisis at some point in the future.

Traders tend to act as if the current trend will never end. For some odd reason, they trust central bankers, when the truth is that central bankers will lie when they feel it is necessary. As Anatole said, they believe they have a license to lie. But one way and another, the current relative quiet in Europe will not hold indefinitely.

My friend Mohamed El-Erian has this to say about the Swiss National Bank decision:

Following the abrupt removal of the currency peg, Switzerland is now looking at a period of bumpy economic and financial adjustment. Being a relatively “open economy”, in which trade and tourism play an important role, Swiss companies face a considerable competitiveness challenge ahead. The country will also have to deal with issues of currency mismatches, as well as having to battle larger, externally induced deflationary forces.

But the implications extend far beyond Switzerland. Countries with Swiss franc denominated liabilities, such as Hungary, now have to deal with a major adverse valuation shock.

More importantly in terms of global systemic effects, politicians in the core economies within the eurozone – including Germany, Austria, Finland and the Netherlands – will see the SNB’s move as a reaffirmation of the dangers of substituting financial engineering for real economic reform. As such, they will be less willing to accommodate the hyperactivism of the ECB. And while this is unlikely to stop the ECB from doing more, it may increase the legal, reputational and unity risks it takes in doing so.

Then there are the consequences for a global economy which, in the absence of a comprehensive policy response in the advanced world, has ended up overly reliant on central bank interventions. Given that their tools cannot reach directly and sufficiently at what holds back growth and jobs, these central banks have been forced to use the partial channel of financial asset prices to influence real economic outcomes.

To this end, central banks have sought to repress market volatility as a means of encouraging risk taking that would then boost asset prices and thus encourage greater household consumption (via the wealth effect) and corporate investment (via animal spirits).

We are already in a currency war, where Japan and China feel the need to protect their competitiveness. Europe now feels compelled to follow. The furthering of various country’s campaigns in this war is creating massive divergence among the major central banks and an environment in which the dollar is likely to become much stronger than it otherwise would.

If the ECB does deliver massive QE, that course has the potential to set off an even uglier set of events than followed on Japan’s Halloween surprise. We could see a series of emerging-market crises, a rush to global risk aversion on top of divergence, and the USD carry trade might unwind quite forcefully, creating a very ugly feedback loop. The risk of financial shocks to the rest of the world – particularly to Europe’s thinly capitalized banking system and China’s questionably solvent financials – is enormous.

Trouble is, the “appropriate” measures needed to keep Eurozone risks at bay may be toxic for the rest of the world, and the “appropriate” policy for the rest of the world may be toxic for the Eurozone. Europe’s grinding further into deflation until the EMU collapses – by the ballot or by the bullet – is an ugly scenario for the world, but a far less immediate risk than that of a violent unwind in the USD carry trade.

It’s every central bank for itself, and I imagine Draghi, too, intends to surprise. Stay tuned.

The Cayman Islands, Zurich, Florida, and New York

I see Grand Cayman, Zurich, and Florida on my schedule, and New York is also looking likely in March. I am “entertaining” the Mauldin Economics writing and management team starting this weekend here in Dallas. Then in February it’s on to the Caymans. It has been awhile since I was in the Cayman Islands, and this time I’ll take a short hop over to Little Cayman to visit my friend Raoul Pal for a few days. A brilliant macroeconomist and trader, Raoul has now based himself in Little Cayman, although he frequently flies to visit clients. In March I’ll be in Zurich (and maybe some other parts of Europe) and then hop back over the pond to Orlando. I will be in NYC later that month, and DC is calling. Not to mention La Jolla. The present wonderful period of reduced travel is coming to an end.

The quote at the beginning of the letter from Jean de la Bruyère, the 17th century French philosopher, is one of my favorites and got me to wondering what else he might have written. Since research no longer requires a trip to the library but merely a few clicks, I was able to spend a good bit of time with the gentleman, even though he shuffled off this mortal coil some 320 years ago. Besides the usual French Enlightenment thoughts, he had a great deal to say about friendship and other personal relationships. Here’s a nice one: “Two persons cannot long be friends if they cannot forgive each other's little failings.”

But my favorite is: “To be among people one loves, that's sufficient; to dream, to speak to them, to be silent among them, to think of indifferent things; but among them, everything is equal.” (Here are more quotes from him.)

My own happiest times are when I am with family and friends. And I am particularly lucky in the number of friends I have. Old friends are the best, but new friends are wonderful, too, as there is so much to learn and share.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

This weekend my fellow writers at Mauldin Economics begin to show up from around the world. Jawad Mian, whom you will get to know more about, comes Saturday evening, then Jared Dillian on Sunday, along with Olivier Garret and Ed D’Agostino. Tony Sagami shows up Monday from Bangkok via Montana. I think Worth Wray will be here Sunday as well. Later in the week I’ll be joined by my new partners (yet to be announced) in what will become Mauldin Portfolios, a portfolio design and management firm geared to helping you create portfolios for your clients that work in the present challenging environment. We’ll do our best to understand the opportunities and risks in front of us, both those the market presents and the more direct business challenges. Long days, but the cameraderie will be sufficient, as de la Bruyère might say.

He also gave us a thought on book writing: “Making a book is a craft, like making a clock; it needs more than native wit to be an author.” And while that is a feel-good line for those who are published, the truth is closer to this pithy observation from Winston Churchill:

Writing is an adventure. To begin with, it is a toy and an amusement. Then it becomes a mistress, then it becomes a master, then it becomes a tyrant. The last phase is that just as you are about to be reconciled to your servitude, you kill the monster and fling him to the public.

Your hoping to slay a few monsters and fling a few books at you this year analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin