Pyramids of Crisis

-

John Mauldin

John Mauldin

- |

- November 30, 2018

- |

- Comments

- |

- View PDF

This Is Nuts

From Pyramid to Rectangle

Redefining Retirement

Demographic Problems and Opportunities

Puerto Rico, Cleveland, and Boca Raton

In an increasingly divided world, we all share one great desire: self-preservation. Not just humans, either. The survival instinct exists in almost every living thing. Humans simply have greater ability to do something about it.

In fact, we have been doing something about it for many thousands of years. An inverted pyramid of geniuses and giants, modern medicine, nutrition, sanitation, and assorted other innovations has extended our lifespans and helped more of us live to ripe old ages. That’s wonderful… but it’s also a problem many of us still don’t fully understand.

I have mixed feelings myself. At 69, I truly believe I’ll live well past 100 and stay as healthy and independent as I am now. But sometimes I wonder. For instance, in the past few weeks I had a growing adverse reaction to a new (to me) medicine. It made me tired and slowly lowered my blood pressure to a dangerous level. I didn’t recognize it and just thought the years and miles were finally beginning to take their toll. Finally, in consultation with my doctor, we figured out what was going wrong, changed course and the major symptoms improved quickly. But for about a month, I felt much older, almost invalid at times. It was kind of like the Hemingway line, “How do you go bankrupt?” The answer: “Slowly, and then all at once.”

Of course, I’ve helped my elderly parents and others but this poignant experience gave me new awareness of my own age. It also increased my determination not to go gently into that good night. And, to today’s topic, it helped draw my attention to aging and demographics as they relate to my series on debt.

Aside from death, aging brings financial and cultural problems. We are simply not prepared for a world in which old people outnumber the young. But it may be coming, thanks to life extension at the upper end and falling fertility rates below. National pension systems—what we call Social Security in the US but similar elsewhere—are not designed for that combination. They presume a high ratio of working young to retired old citizens. That is no longer happening and is increasingly hard to ignore.

Today I want to review these issues, and then tell you about a new initiative to help you live well and even prosper in this new, longer-lived world.

This Is Nuts

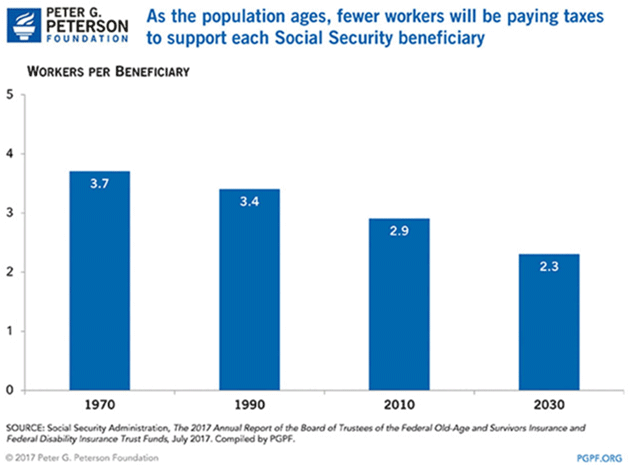

A dwindling minority of us has long warned that demographic changes are making Social Security unsustainable. Here’s a chart I shared earlier this year in The Pension Train Has No Seat Belts.

Source: Peter G. Peterson Foundation

The chart doesn’t show the full progression. In 1940 the Social Security system had 159.4 workers per beneficiary then went off the rails quickly. By 1945 the ratio was down to 41.9 and a decade later was in single digits. A variety of measures, from higher tax rates to (slightly) raising the retirement age, have flattened the trajectory but it is still slipping lower.

We usually think this is a result of the Baby Boom generation turning 65, and that’s a big part of it. But rising life expectancy is equally and maybe more important. People now live longer, which lowers the ratio and means they collect more years of benefits than previous generations.

Let’s stop here and think about this “retirement” concept. It is, in the history of man, relatively new. For millennia, the idea that a physically able person of “non-royal” blood would simply stop working and enter a life of leisure was unthinkable. You worked as long as you could, declined quickly and then died. Very simple and, more to the point, financially sustainable most of the time.

Note also, in much of the world “retirement” is still a dream. Even the elderly are expected to contribute something to the community, as long as they are able. What we have in the developed countries is still not the norm globally.

It was not coincidence that the modern concept of retirement developed alongside the Industrial Revolution. Technology made food production far less labor-intensive, reducing the need for less-productive older people to contribute. Societies around the world decided to let the oldest members take some final time off before their end. A good and humane practice, I think, one I think we should continue as long as we have the elderly.

However, it has limits. I don’t know of anyone who, when the retirement systems were created, thought it made sense for average people to spend the last 30% or 35% of their lives in retirement, at the broader society’s expense. They would’ve expressed that concept in words along the lines of, “That’s nuts!” And yet we are trying to do it. No surprise, the seams of our retirement dream are beginning to unravel.

From Pyramid to Rectangle

The problem is not simply that there are so many Baby Boomers. It is that we have so many Baby Boomers and they’re living longer than previous generations did. Not in every single case, obviously, but the aggregate difference is dramatic.

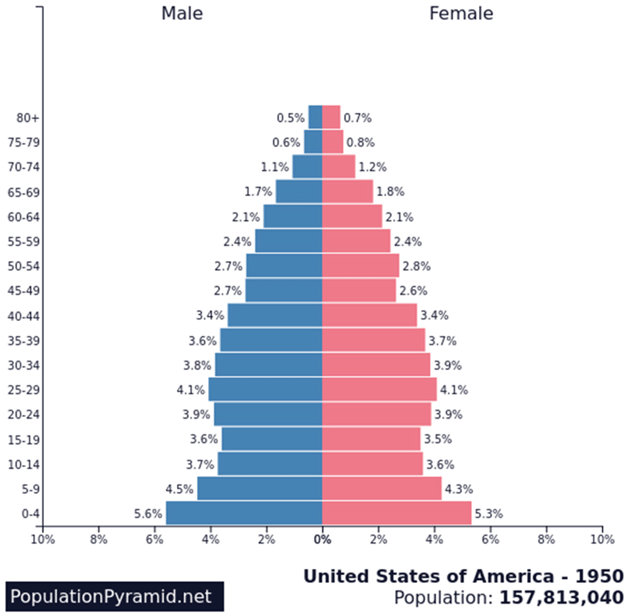

We can illustrate this with “population pyramid” charts, which show age distribution in graphic form. Here’s the US in 1950. That widest bar at the bottom is the beginning of the Baby Boom, including me.

Add up the male and female sides of the top four bars and we see 8.4% of the population was over 65, and 1.2% was aged 80 or above. Now, let’s roll forward 50 years to the year 2000.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

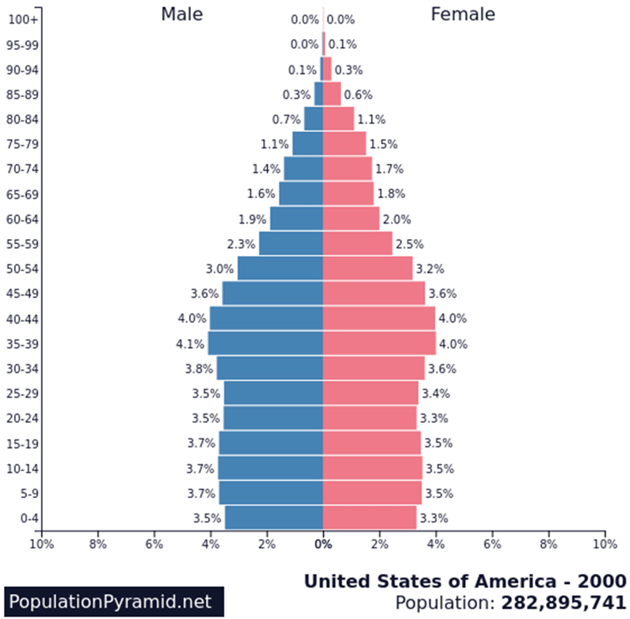

Notice a few things here. First, the pyramid’s base is narrower because there are relatively fewer children. That bulge in the 35-54 brackets is the Baby Boom. But for our purposes, look especially at the top. The 65+ share of the population went from 8.4% in 1950 to 12.3% in 2000. The 80+ category—all in one bar 50 years earlier—now gets split into five bars and is 3.2% of the population, almost tripling since 1950.

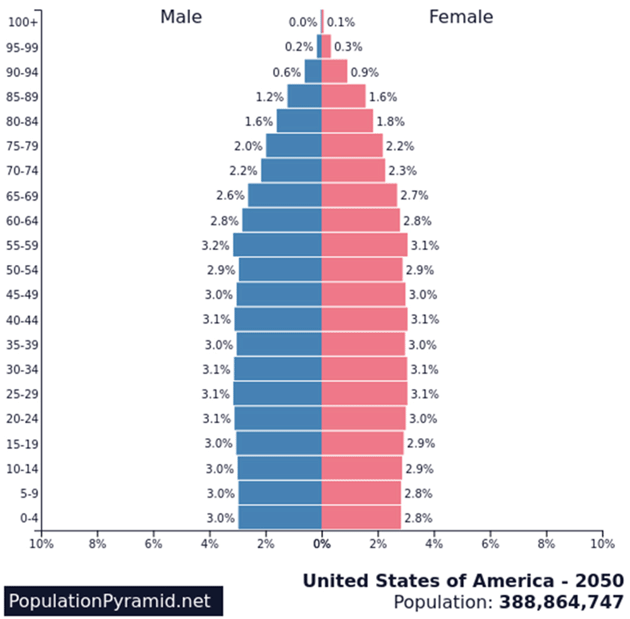

But wait, that’s not all. Here’s the same chart projected forward to 2050.

If this estimate is right, then in 2050 some 22.3% of the US population will be over 65 and 8.3% will be over 80. Both would be huge increases since 2000… but I think the chart is probably wrong, and not in a helpful way, at least in terms of paying for unfunded liabilities.

You see, the current mortality tables don’t include the age-extending technologies I believe are coming in the next decade. Lots of folks aren’t going to die on schedule and, absent a major fertility increase to grow the younger population, those top rows will widen further. The pyramids are becoming more like rectangles.

That means by 2050 the working-age population will be less than half the total, and yet have to support its children and elders? I don’t think so. Something will break first.

The most likely (and most benign) candidate is a redefinition of “working age” at the upper end. There’s nothing magical about retiring at 65 or 67. Those were legislative choices, rooted in times when few people lived that long and most of those who did were physically incapable of going much longer. That is rarely the case now. I’m knocking on 70 and still work as full-time as I ever did, and I’m surrounded by friends my age and older who are just as active or more active than I am.

What should have happened, years ago, was an increase in the Social Security eligibility age to 70 or beyond, to reflect rising life expectancy and better health. People would have known to expect it and been able to plan accordingly. That didn’t happen so now we have to scramble for solutions.

Though it’s not all that popular, I wouldn’t oppose means testing (no Social Security income over X income level) as part of a “solution.” Whatever we do is going to disappoint many folks. The only question is whom.

Redefining Retirement

This certainty that major changes are coming, but uncertainty about what they will be, greatly complicates retirement planning. Preparing for it would be far simpler if you could know in advance when you will get sick and die. That means you must either

- Save too much and possibly check out with a surplus, or

- Outlive your savings, then fall back on Social Security and the kindness of family for your final years.

The first option is obviously better, but is it feasible? For most people, no, even at today’s life expectancies. A surprising number of people die with negative assets, i.e. debt, having never repaid money borrowed earlier in life.

Longer lifespans make this harder. Say you finish your education and start making money at age 25. If you retire at 65 your career was 40 years, during which you probably had to buy a house, help children with college, maybe repay your own student loans and otherwise live a normal and hopefully comfortable life. You use whatever is left for retirement savings.

Now, is it mathematically possible to save enough in those 40 years to fund another 30 or 40 years of retirement? Probably not. Sure, you might build a business or invent a new technology, but the average working person can only save so much of their income, and basic retirement living costs will consume most of it in less than 30 years. Then what? Traditional “retirement” will grow increasingly out of reach, available only to the very highest-earning tier of the population.

At the other end, outliving your savings will be as easy as ever but the likelihood that Social Security will be there for you, in anything like its current form, is diminishing rapidly. Extended lifespans further complicate the problem.

This is what my British friends call a “sticky wicket.” The good news is we will soon be living longer. The bad news is we will soon be living longer. Since the technology is coming regardless, we need ways to reconcile the costs and benefits. It is not at all clear how we will do so. My editor and long-time friend/associate Patrick Watson and I have been discussing this for years. He expects some kind of Soylent Green solution. My sunny nature makes me more optimistic; I think we’ll find better answers that reduce the costs and spread the benefits widely.

Demographic Problems and Opportunities

It is easy to look at the gap between revenues and entitlement spending by the middle of this decade and see problems. Too many people above 65 and too few people paying taxes.

At Mauldin Economics, we think a lot about those problems, but we also look at some of the opportunities. The growing number of us of in our 70s and 80s will mean more healthcare spending, more need for revolutionary new healthcare products and services, and major opportunities to find and fund solutions to those problems.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

My associate Patrick Cox covers the extraordinary biotechnologies under development, and he has introduced me to some of the most fascinating scientists in the sector. I talked with two medical researchers today. Both are optimistic about not just increasing our lifespans but prolonging our health spans. Others think we can someday reverse the aging process. I think it is highly likely a major medical journal will use the words “age reversal” within the next few years.

It’s hard to describe how fast this technology is progressing in not just the fight against aging, but against all diseases. I believe cancer will be defeated in the next decade. By the mid-2020s there will be therapies to at least slow down the aging process, and some could be called the “fountain of middle age.”

Those obviously have the potential to be great investment opportunities. But hundreds of lesser-known diseases and problems are going to get cures, too. I have been reviewing a new Parkinson’s disease therapy, not yet public, that shows great potential. I could go on for hours...

However it happens, we are entering a period unlike anything humanity has ever seen. Along with my publishing team, we have been dreaming about a new division that focuses not only on biotech and healthcare investments but also on how to put the best research to work in your life, helping you live longer to enjoy your investments and the things they can buy.

To that end, we’re launching a new division called Health & Wealth Research. Led by Patrick Cox and Senior Healthcare Analyst Chris Wood, it will be a central source for information on healthy living, life extension technology, and related investment opportunities.

Dr. Mike Roizen from the Cleveland Clinic will be a major contributor with both tips on keeping your body healthy and information drawn from the depth of his research experience. I think he told me he has over 200 published papers on a wide variety of topics, not to mention 30 million books sold.

The Health & Wealth Research website is almost ready. Watch for an email from me with more information soon.

If you just can’t wait, you can sign up for our new weekly letter (free) by going here. It’s called A Rich Life and will be written by Chris Wood (really a top-notch analyst—I’m thrilled we have him) with contributions from Dr. Roizen and Patrick Cox.

Sign up today and you’ll receive the inaugural issue on December 3.

Puerto Rico, Cleveland, and Boca Raton

Shane and I will be leaving for Puerto Rico at the end of next week then we’ll fly to Cleveland to go through the Executive Wellness Program at the Cleveland Clinic with the head of the program, the above-mentioned Dr. Mike Roizen.

Taking care of yourself is more than just working out and eating the right foods. It is also making sure you get regular medical care and checkups. Everyone should have a thorough full-body checkup at least every two years, along with regular blood tests (and, as I just learned, check your blood pressure regularly). I can hear my mother saying, “Prevention is 90% of the cure” (and I think Shane says this as well).

I will be traveling to Boca Raton in late January for the Tiger 21 conference, so if you’re going, let me know so we can be sure to meet.

My friend and partner, Steve Blumenthal of CMG, was here this week for planning sessions, meetings, and interviews as we laid out a fairly aggressive travel schedule for next year. Stay tuned, I may be coming to a ZIP code near you.

As I wrote those opening thoughts on the human drive for survival, it occurred to me that more than a few people worry about artificially intelligent machines “waking up” to threaten our survival. Until we see machines worrying about their own survival, I think they will really be just very useful tools and not actually self-aware. We can worry about being replaced when they start worrying about the future upgrade replacing them.

Until then? I have other things on my mind. Whether some computer with artificial intelligence can pass a “Turing Test” and simulate human behavior is trivial compared to even a virus’s survival instinct. Call it the Mauldin Test for true intelligence.

And I think with that comment, it is time to hit the send button. This appears to be one of the shortest letters I have written in some time. And to make sure it stays that way, I will wish you a good week and pleasant journeys.

Your ready for that age reversal breakthrough any day now analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Put Mauldin Economics to work in your portfolio. Your financial journey is unique, and so are your needs. That's why we suggest the following options to suit your preferences:

-

John’s curated thoughts: John Mauldin and editor Patrick Watson share the best research notes and reports of the week, along with a summary of key takeaways. In a world awash with information, John and Patrick help you find the most important insights of the week, from our network of economists and analysts. Read by over 7,500 members. See the full details here.

-

Income investing: Grow your income portfolio with our dividend investing research service, Yield Shark. Dividend analyst Kelly Green guides readers to income investments with clear suggestions and a portfolio of steady dividend payers. Click here to learn more about Yield Shark.

-

Invest in longevity: Transformative Age delivers proven ways to extend your healthy lifespan, and helps you invest in the world’s most cutting-edge health and biotech companies. See more here.

-

Macro investing: Our flagship investment research service is led by Mauldin Economics partner Ed D’Agostino. His thematic approach to investing gives you a portfolio that will benefit from the economy’s most exciting trends—before they are well known. Go here to learn more about Macro Advantage.

Read important disclosures here.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

Tags

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin