The Changing Nature of the Stock Market?

-

John Mauldin

John Mauldin

- |

- November 29, 2024

- |

- Comments

- |

- View PDF

The question on “everyone’s” mind, whether the back or the front, is where will the stock market be in two, three, six years? This week, in what I hope is a short Thanksgiving letter, I will talk about why that is simultaneously one of the most important and irrelevant questions you should be thinking about as we come into the holiday season.

I am in Dallas staying in several Airbnb’s with Shane, my family, eight kids and significant others, 9.5 grandkids and their friends. Family and friends trump stock markets. Big time!

Tuesday night I met with a group of old friends, and the word “old” is now becoming operative, at Bob’s Steak and Chop House to discuss the state of the world. Without naming names, you have one of the most famous bears in history, an historic commodities trader (that even Soros gave money to trade back in the day), a cautious and famous former hedge fund manager (who literally owns some of the largest gold nuggets in the world on display here in Dallas), a successful lawyer who is now involved in running local public health institutions, and a new entrant who has been reading me for years and wanted to talk to me about our news Transformative Age service. (I am annoyed that Mr. Bear did not tell me he was one of the few famous Texas politicians that I did not know. I was not properly fawning.) A few friends were missing and out-of-town but it was one of the things I live for: great conversations, deep interactions and fabulous food.

We talked about what is on everybody’s mind today and then went around the table talking about what we think would be the most important thing we would notice in 10 years. I love tables where I am the actual optimist, although two were relatively sanguine.

I tell you all this because that is the background in my mind as I write this letter. I’ve been planning to write about my thoughts on the stock market and how we should approach it for some time, and as I wake up on Wednesday morning it’s time to do it. Interestingly, with the exception of Mr. Bear, most of us were in the stock market in one form or another. Even Mr. Cautious was 40% long with a lot of multi-family real estate and gold. I could see nods from around the table. Philosophically, not much different than me. I just use alternatives rather than real estate. Even a rather dire crowd is still Long America!

The Changing Nature of the Stock Market?

It’s easy to talk about the market being overvalued. But we are investing ever larger amounts of money in roughly half the companies that we did 30 years ago. What happens when you have more money chasing fewer goods? The classic answer is inflation. But it happens in stocks, too. We all have the challenge of parsing through a smaller menu to find the right meal for our own individual portfolios. Not an easy task. But there are things that can help us find the perfect feast for our own tables. Let’s set the background.

Not unlike my table, people want to know if they should be long, short or cautious in the stock market. My answer is what stock market? In 1996, there were 8,090 listed companies (source is vary). CNN tells us there were only 4300 last April. Part of that is from public companies legitimately going out of business or being merged, but just as many going private. I’ve been on public boards, and I can tell you it is a pain in the derriere. The number of private companies in the US backed by PE firms has grown from 1,900 to 11,200 over the last two decades, according to JPMorgan data.

Of those 4,300 public companies, most are small and struggling for attention. Many will go out of business. Some will become fabulously large. Choose wisely.

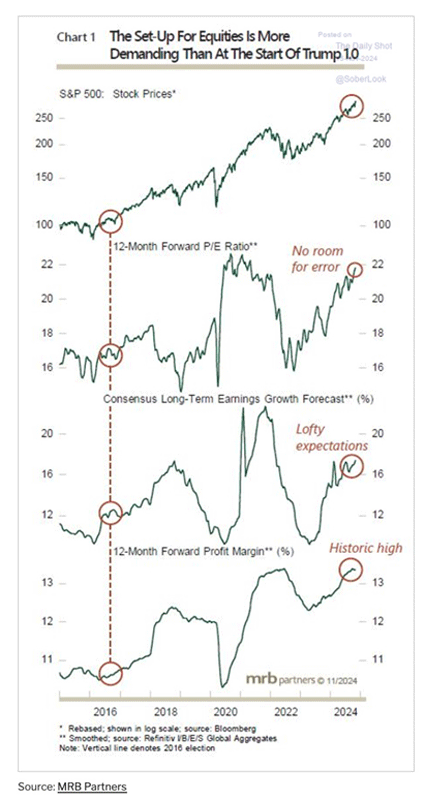

Mr. Cautious pointed out that the forward price to earnings ratio of the S&P 500 for 2025 is 22. Historically very high. Take out the Magnificent Seven? It is only 16, fairly middle-of-the-road.

Let’s look at a few thoughts from my friends on the topic:

Andy Kessler, now famous for being a Wall Street Journal columnist, was once a fabulous high-tech analyst and trader/hedge fund manager. Some of my best dinner meetings ever. This week he moaned about the confusing signals the economy and markets are giving us:

“There are so many mixed signals. Stocks are up, signaling an economic boom. Oil is down as if we’re headed toward a recession. Home prices are up as if rate cuts will continue. Gold is up, suggesting inflation is back. The dollar is strong as if Europe, Canada and China are ailing (spoiler alert: They are.) Still, something’s got to give.

“Core inflation is rising and has been over 3% since April of 2021. Long bonds are signaling that the Fed needs to stop cutting rates.

“… Palantir stock is up more than 250% for the year on artificial intelligence hype and is now worth roughly $145 billion. It’s a great company but is ahead of itself. The stock is selling at 483 times after tax operating earnings. And 55 times sales. Buyer beware.

“How can this happen? I’m worried that our market plumbing is broken. There used to be human traders at exchanges, and then at Nasdaq terminals. Now trading is dominated by opaque high-frequency trading outfits. And quant funds. And it seems that institutional investors are taking a back seat to retail trading at brokers such as Robinhood. Hypesters can breathe on a stock and it goes up. That’s not healthy.”

Wolf Richter tells us the “inventory of new single-family home jumps to the highest since 2007 and unsold spec homes jumps to highest since 2009 as sales suddenly plunge.”

And stock market valuations are high. Adam Tooze sent this set of charts:

Source: Adam Tooze

Old friend Grant Williams when asked about the stock market offers:

"I kind of mourned the change in capital markets as a means to allocate capital over the long-term, to productive use, that will provide a steady long-term return on capital and will help grow a business. That’s what this was all about when I got into it 40 years ago, and I don’t recognize it anymore.

“I don’t have any of the conversations I have today that I had 20 years ago, 30 years ago, 40 years ago—none. All people want to know about is the stock price. And that comes down also to CEOs of companies. The business is the stock price these days.

“And once you do that, once you change, this business to be about the stock price, you change every incentive that has been developed over hundreds of years of capitalism about how to build a sustainable business, how to reinvest profits, and grow a business."

Wow, should we all walk away from the stock market? Not if you are Ed Yardeni, who I might point out has been spot on right for the last four years. As opposed to 98% of us whose expected recessions and/or all sorts of impediments.

“With economic growth robust and the stock market at a record high, we’re living the Roaring 2020s now. The economy’s resilience has been remarkable considering the headwinds it has faced. While the outlook under Trump 2.0 involves lots of moving parts, we don’t see the net effects of his policies jeopardizing the Roaring 2020s’ continuation. In this scenario (with our 55% subjective probability), Trump 2.0 might boost productivity and economic growth, keep inflation subdued, shrink the federal government, slow the growth of government spending, and narrow the federal deficit. Among the biggest of the many challenges ahead: not inciting the Bond Vigilantes…”

He actually sees the government deficit as a boost to the economy. Go figure. But then again, he has been right. Inflation is coming down, more or less, unemployment is still historically low, GDP growth is near historical averages, the dollar is strong, earnings are growing and compounding. He cites a myriad of positive data.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

As opposed to Mr. Cautious who literally read from his iPhone his recent deck of things that are bad in the world. I ordered another glass of wine at 23. I stopped counting at about 40.

There Is No Such Thing As the Stock Market

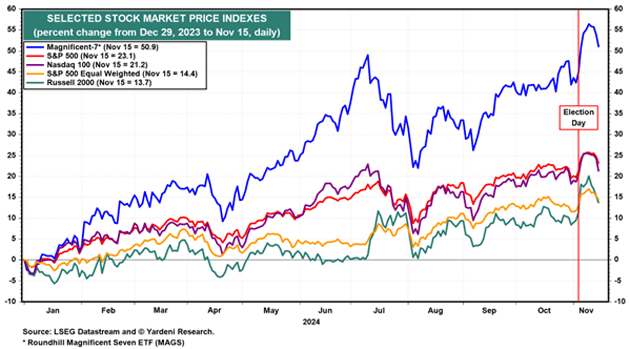

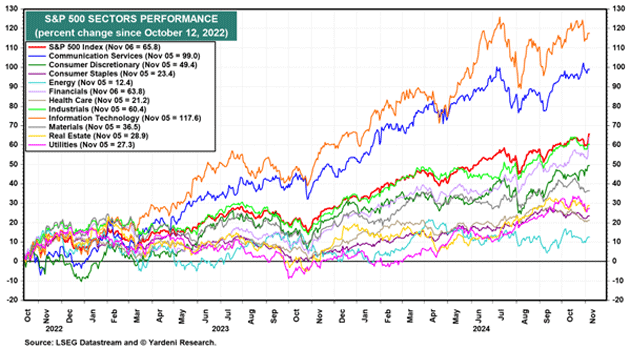

Nobody literally invests in the “stock market.” We have a market of stocks. Admittedly, only 4300 of them in the US but all vastly different. You can break them into lots of categories. From Ed Yardeni:

Source: Ed Yardeni

There are literally more ETF’s that there are stocks today. Remarkably few people (percentage wise) invest in individual stocks as opposed to ETF’s or through a money manager. While I own a few stocks, the large bulk of my portfolio is through money managers. I prefer to spend my time thinking about money managers rather than the far more difficult process of picking stocks.

|

Longtime readers know I expect a significant crisis within the next 4 to 6 years. We have no idea how it will play out. So how do I position myself today? I have a deep down belief that the Republic will survive. Like Warren Buffett, I am long America. How to play that?

History tells me that high and growing dividend stocks will be on the other side of the crisis and still thriving. What will the price be? I have no idea they should still have significant value. In a crisis, your job is to get as much buying power as possible from one side to the other side. I think the best American companies are one of the best ways to do that. And historically, the best American companies are the ones that pay you to own their stock: through dividends.

I’ve chosen to let David Bahnsen manage my high and growing dividend stock portfolio. But I know many of you like to personally manage your own portfolios. I get that. Noting that I have a conflict of interest, I want to bring to your attention a recent white paper by Kelly Green, who is now the editor of Yield Shark, the first Mauldin Economics publication besides my own letters. She does an outstanding job of finding solid dividend-paying companies and combining them into a portfolio. The whole team is justifiably proud of her. Let’s look at a few of her quotes and charts to illustrate my own preference for dividend paying companies.

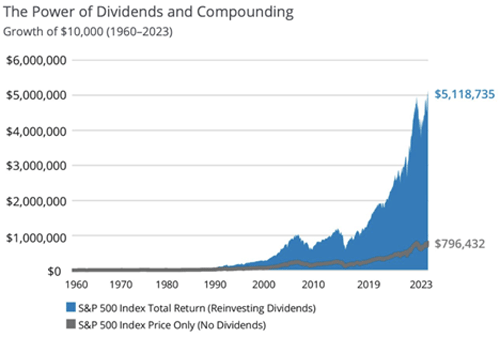

“A $10,000 investment in the S&P 500 in 1960 would have grown to $5.1 million in 2023 with reinvested dividends. That figure plummets to just $796,000 if dividends had been taken as cash.”

“The compounding effect of dividend reinvestment offers far greater potential than fixed-income interest compounding.”

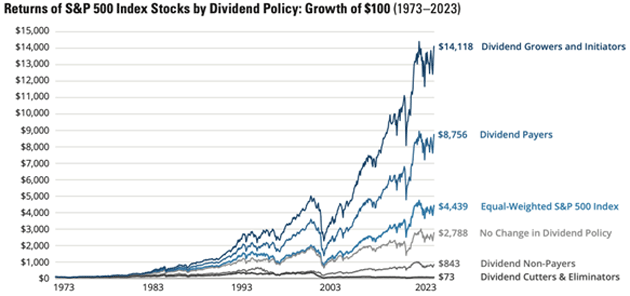

Note that there have been several “end of the world” crises since 1960 or 73. Dividends stocks did not escape a bear market. But in general, if you pick what Kelly would call a dividend aristocrat or what David Bahnsen will select as his best-of-breed dividend stocks, your volatility would be roughly half of the normal stock market and would come back faster.

More from Kelly:

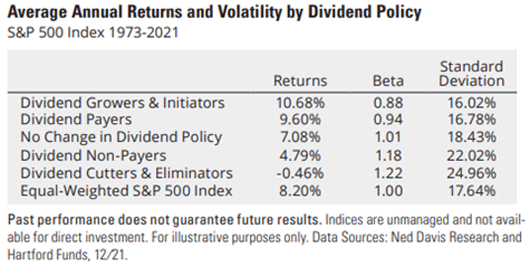

“In the years 1973 to 2021, dividend growers and initiators had an annualized return of 10.68%. That significantly outperformed non-dividend payers at just 4.79%, and did so with less volatility.”

This combination of higher returns and lower risk is especially relevant in today’s unpredictable economic climate marked by fluctuating interest rates and geopolitical uncertainty.

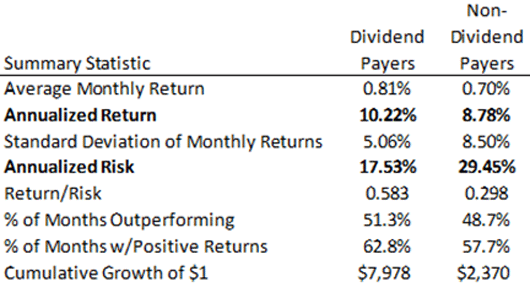

The table below shows how dividend payers have half the annualized risk of non-dividend payers. This means these dividend payers experience far fewer sharp swings than non-payers, reinforcing their stability.

This reduced volatility equates to a steadier, more reliable path through fluctuating markets. And fluctuating markets is definitely how I would describe the past few years… and the outlook for the years ahead.

Your End-Of-The-Year Homework

What should you do? First, do your homework. You can get Kelly Green’s Yield Shark white paper by clicking here. She goes into the history of dividends which I found fascinating, as well as making the powerful case for dividend stocks.

You can also read David Bahnsen’s short book, The Case for Dividend Growth: Investing in a Post-Crisis World.

Then what? If you like me become convinced that the best way to navigate the coming crisis as well as invest in the stock market is through a well-planned dividend stock portfolio, then you have to decide whether you want someone to do that for you or you want to do it yourself.

Those are two completely different personalities. I have always preferred to pick managers. I think David Bahnsen is the best dividend manager plus giving me a wide selection of alternatives that I know. But if you like to buy your own stocks, you can’t do much better than Kelly Green and Yield Shark.

I should note that this style of investing is different for most people. We all hope to find the next Nvidia or Palantir, preferably before they go up 1000% or even better 100 X. That is very hard. Many choose to hit the easy button and just buy an S&P 500 ETF.

Like what you're reading?

Get this free newsletter in your inbox every Saturday! Read our privacy policy here.

While Kelly and David share a preference for dividend stocks, there are differences in their portfolios. David manages almost $7 billion, roughly half of which is in dividend stocks. That means he has to find companies that he can put at least $100 million into. Fortunately, he has a lot of choices. From time to time, the price of a stock will rise so much that the dividend yield falls, and he switches to another stock. In essence, the price has risen so much that you are being paid multiple years of future dividend yields in the current price. Time to switch.

Kelly has a larger universe of dividend paying stocks to consider since she is not constrained by size. But then you have to act on your own to buy or sell. Those are completely different investor personalities, and both can be correct depending on the individual.

I gave you the link to Kelly’s work above. For information about David and The Bahnsen Group, I’ve been recommending that you subscribe to David Bahnsen’s Dividend Café. The Dividend Café is a short daily summary combined with pithy market wisdom and commentary, plus one weekend thought piece which will make you a better investor. I suggest you try it out.

I have written a white paper called Why I Am Working with the Bahnsen Group. I go step-by-step through the decision-making process I made in choosing The Bahnsen Group. You should read it not just to see if they are a potential fit for you, but to understand what to think about when choosing your own money manager. Many readers will of course want to use someone else or a different style. I believe this paper will help your decision-making process.

You can also click on this link to request information about TBG’s services and you will automatically get a copy of the white paper.

Thankful for America

I write this before Thanksgiving, where I will soon be cooking for eight adult kids and significant others and 9.5 grandchildren. I have a lot to be thankful for. We all do.

But in the theme of this letter, we need to be thankful that we live in an America that has allowed the creation of fabulous companies we can invest in and grow our own wealth. Other countries have their own markets, but no country has ever come close to America’s level of abundance and opportunity. Through 250 years of ups and downs, depressions, wars and numerous catastrophes the American experiment is still the one the rest of the world tries to emulate. For those of us who live here, the sheer chance of birth has made us privileged, if not lucky.

Think of it as The American Dividend. It just keeps on paying and growing every year. Not a smooth growth, as it has ups and downs, but over the last few decades and centuries where else would you want to be in terms of opportunity?

There are scores of fabulous places to live around the world. All have their own charm and opportunities. But I for one am grateful for growing up as a poor West Texas boy that through luck and the grace of God have the opportunity to be writing to you for a living.

Coming back to my dinner last night, we all had to predict what we thought would happen in 10 years. But really? I have no idea what the future will bring, but I hope that on Thanksgiving in 2034 I will be writing this letter to you, grateful you still allow me into your life, enjoying the abundance this country affords, marveling at new technology and hopefully living in a body that is actually growing younger. Yes, a big dream, but this is the country from big dreams.

Have a great week. I am sure more than a few of you will be joining me as we try to lose the weight from this weekend. Good luck to us!

|

Your so grateful to be alive in this era analyst,

John Mauldin

P.S. If you like my letters, you'll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price. Click here to learn more.

Tags

Suggested Reading...

|

|

Did someone forward this article to you?

Click here to get Thoughts from the Frontline in your inbox every Saturday.

John Mauldin

John Mauldin