Skip the Pains and Pocket Landlord Gains for Just $7

-

Kelly Green

Kelly Green

- |

- December 7, 2022

- |

- Comments

Landlords grow rich in their sleep.

—John Stuart Mill, 19th-century British political economist and philosopher

My experience as a landlord wasn’t as dreamy as Mr. Mill suggested.

My long-time tenant suddenly turned into my worst nightmare. It took a week and a team of 5 people to clean out and strip down the interior of the house so I could sell it as an “investor special.”

“Landlord” is not a title I will add to my lifestyle again anytime soon.

The reality of being a landlord is way more complicated than Mill claims. And it can require lots of capital.

Luckily, there are investments the individual investor can use to generate income from real estate without the substantial upfront investment.

-

Several publicly traded companies handle all the unpleasant landlord duties and pay dividends to shareholders.

Essex Property Trust, Inc. (ESS) has been in the real estate business since 1971. The company owns and manages residential properties in California and the Pacific Northwest. It owns 253 rental communities with roughly 62,000 apartments.

It has paid dividends and raised its payout at least once every year since going public in 1994. It yields 4.1% based on a share price of $215.

There are other options for a lower cost per share.

UMH Properties, Inc. (UMH) owns and operates 133 manufactured home communities with about 25,300 developed homesites spread across 10 states. And the company owns nearly 2,000 acres of land for future development.

UMH has paid a dividend since 1990 and yields 4.6% at a $17 share price.

Both companies belong to a special type of investment near and dear to income investors—REITs.

Skip the Pain and Hire a Professional

Real estate investment trusts (REITs) were created by Congress in 1960. At the time, real estate syndicates—a pool of investors—had hefty minimum investments which limited access to wealthy investors.

The creation of REITs enabled the small investor to participate in large-scale portfolios of real estate and skip the role of landlord.

REITs simply own and typically operate income-producing real estate assets. At least 75% of a REIT’s gross income must come from rents, interest on mortgages that finance real property, or real estate sales.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

REITs are income investor favorites because they must pay out at least 90% of their income to shareholders.

You can buy REITs that own all kinds of real estate:

-

Residential

-

Leisure and gaming

-

Cannabis

-

Office

-

Healthcare

-

Mortgage

If it requires real estate, there’s probably a related REIT.

Today, though, we’ll continue with a theme I’ve covered before—retail.

The retail sector accounts for over 25% of the commercial real estate market.

And retail is one of my favorite trends right now.

The Return of the In-store Shopping Experience

Last week, I said I would keep a close eye on holiday shopping trends. Since then, the National Retail Federation’s (NRF) released more data.

-

A record 196.7 million Americans shopped in stores and online between Thanksgiving Day and Cyber Monday.

That smashed its own estimate by over 30 million!

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Over 122.7 million people visited a brick-and-mortar store, up 17% from last year.

The number of people shopping online only grew 2%.

Sure, online shopping is convenient. And it was a necessity over the past few years.

These numbers confirm that customers still prefer to handle and test products, then walk away with them the same day.

In the post-COVID world, retailers with a physical and online presence will be successful. And there is a REIT that caters to those companies.

Collect 12.9% from Best Buy’s Landlord

The Necessity Retail REIT, Inc. (RTL) is a fairly new name in the REIT space. Formerly known as America Finance Trust (AFIN), Necessity is focused on holding the real estate of “Where America Shops.”

Its tenants include Home Depot, PetSmart, Publix, Walmart, and of course, Best Buy. These are just a few examples of the high-quality, creditworthy tenants that RTL targets.

RTL’s 1,057 properties span 48 states.

More important, over 90% of its available property is currently occupied with an average remaining lease term of 7.2 years.

With tenants of that size and caliber, we can expect many of them to stick with Necessity and renew their leases.

RTL has huge potential, and it is being overlooked by investors.

-

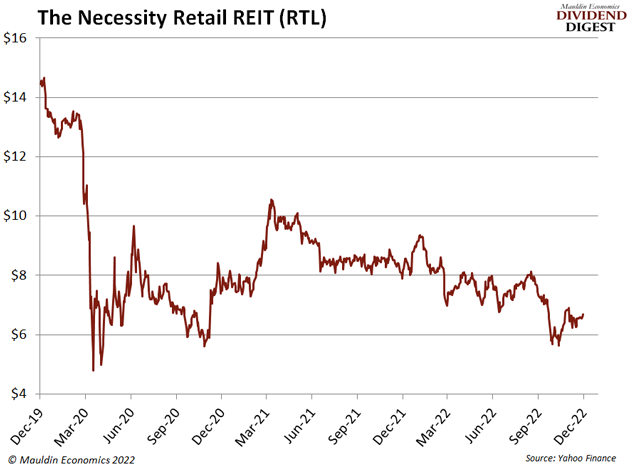

Shares are trading for only $6.75, down 17% this year.

This is after RTL has unloaded empty or underperforming office spaces and added $1.3 billion of big retail space to its portfolio. Management has a clearly crafted goal and is moving in the right direction.

Buying now means you’re getting in on the ground floor. And the best part is, you’ll lock in a 12.9% yield for the ride.

For more income, now and in the future,

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Kelly Green

Kelly Green

Kelly Green