NVDA = #1

- Stephen McBride

- |

- June 20, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

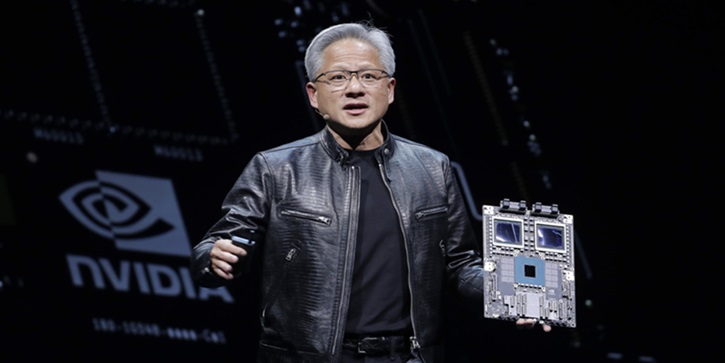

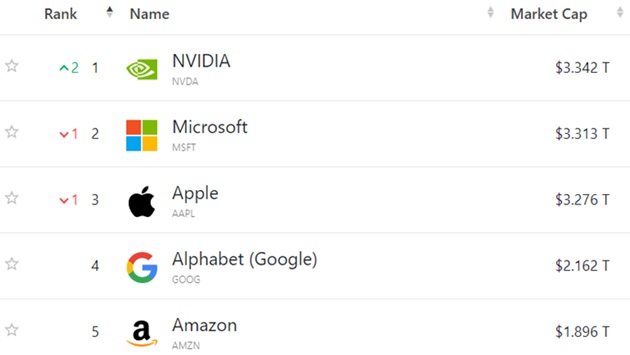

Nvidia (NVDA) just passed Microsoft (MSFT) to become the world’s most valuable company.

NVDA was worth $160 billion when I first recommended it back in 2018.

Now, it sits atop everyone else at a staggering $3.34 TRILLION:

Congrats to RiskHedge readers who capitalized on NVDA at any point along its historic rise.

We’ve taken profits on NVDA twice in Disruption Investor, and I believe it will continue to thrive in the years ahead.

It essentially has a monopoly on the computer chips needed to keep powering the artificial intelligence (AI) boom. And fundamentally, the company is as strong as ever.

But my partner Chris Wood and I are now focused on the next wave of AI winners essential to the great infrastructure buildout. We highlight our top plays in our latest issue, which you can access by upgrading here.

- US stocks are having their best start to an election year ever.

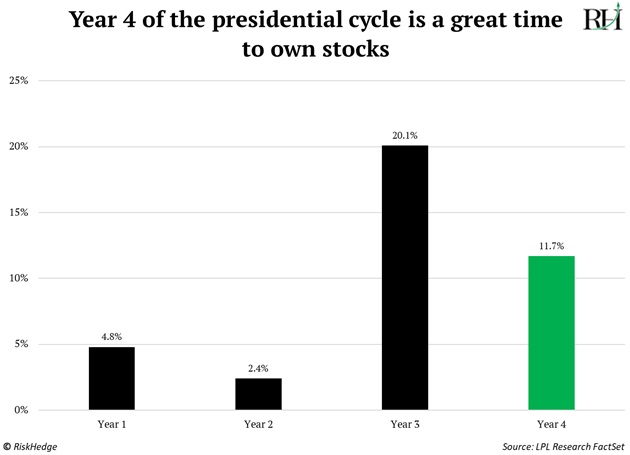

They’ve rallied 15%, already surpassing the average full-year gain in an election year (11.7%).

As you can see below, election years (year 4 of the presidential cycle) tend to be pretty good years for stocks:

Some folks think making stock market forecasts based on election cycles is voodoo. But the historical tendency for stocks to perform well in years 3 and 4 of the election cycle is strong.

It’s one of the main reasons I recommended aggressively buying stocks in January 2023, when Wall Street gurus were almost unanimously bearish. Stocks gained 24% last year, surprising them all.

In the January issue of Disruption Investor, I said we’d see S&P 5,000 for the first time (already happened) and that stocks would finish the year up 20% on the backdrop of a strong economy and earnings.

So far, so good. But I’m surprised at the lack of a significant drop from stocks so far this year. Aside from declining 4% in April, stocks have risen every month in 2024.

Markets aren’t usually this easy or consistent. And remember, in an average year, the S&P 500 suffers a decline of 14%. My guess is we’ll get a correction in that ballpark sometime before November’s election.

If we do, use it as an opportunity to accumulate shares in high-quality, disruptive businesses.

- Google paid its first-ever dividend on Monday…

Of 20 cents a share, for an annual yield of 0.45%.

I see this as Google (GOOG) admitting it’s no longer an innovative tech company

Generally speaking, I don’t believe tech companies should pay dividends.

Why?

Because that money is better spent developing new technologies that add to the revenues and earnings of the business.

But Google’s telling us it’s run out of ideas. It doesn’t know what to do with its money, so it’s returning it to shareholders.

|

This doesn’t mean its stock is doomed anytime soon. Companies that don’t invest enough in the future can coast on their past achievements for a time. And Wall Street only cares about what happens next quarter.

But this move shows Google is retreating from the (innovation) frontier, like a once-great empire in decline.

There are much better opportunities to be found buying up-and-coming disruptors profiting from megatrends. That’s what we’re doing inside Disruption Investor.

- Today’s dose of optimism...

I took my daughter to her first gymnastics lesson on Father’s Day. I couldn’t think of a better way to spend a few hours.

Two things here...

One, I’m a big fan of the stoic idea of “negative visualization.” Basically, imagining what could go wrong so you appreciate the good things in life. It’s often hard to appreciate kids when you’re in the thick of it. But this technique always helps me appreciate these special moments.

Two, there are lots of ways to waste away your days. Spending time with your family is not one of them. Nobody ever regretted spending too much time with their kids.

| Ride a winner. Sell a loser. Great advice. But how do you separate the winners from the losers? The answer: Get someone on "the inside" to work for you. Click to continue reading. |

Being an engaged dad is a secret superpower. It’s no coincidence many of history’s most successful people had gangs of kids.

As Jay Gould, whom Cornelius Vanderbilt called “the smartest man in America,” once said: “Wife and children are what men fight wars and build castles for.”

See you Friday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com