Easy money, only in America

- Stephen McBride

- |

- June 24, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

- Making money feels a little too easy right now…

The S&P 500 hit another new all-time high this week.

But underneath the surface, only a handful of stocks are carrying the market higher.

My friend JC Parets at All Star Charts pointed out that just 12 S&P 500 stocks closed at new highs last week.

We’ve seen this movie many times before. It often ends with the winners “catching down” to the rest of the market.

Remember, the S&P 500 dips 14% in a given year, on average. It would be perfectly normal for stocks to pull back here.

I recommend using any sell-off as an opportunity to buy great disruptive businesses on sale.

- I chatted with a financial advisor on my trip to Nashville…

One of his clients threw $5,500 into Nvidia (NVDA) a decade or so ago.

That tiny stake is now worth $1.8 million! And I thought we were early by recommending it in 2018.

Jenson Huang started Nvidia at a Denny’s diner 31 years ago—the same diner where he used to clean toilets. Nvidia just passed Microsoft (MSFT) to become the world’s most valuable company. Only in America.

I love legendary investor Charlie Munger’s “surfing” analogy:

There’s a model that I call “surfing”—when a surfer gets up and catches the wave and just stays there, he can go a long, long time… And, of course, that’s exactly what an investor should be looking for.

| This little-known, incredibly simple way of investing has beat the market for 50 years while letting you sleep easy and profit when others are scared... |

Nvidia first rode the video game wave, and now it’s surfing the artificial intelligence tsunami.

Great businesses riding megatrends can go higher than we can possibly imagine. Even a year ago, nobody foresaw Nvidia surging to $3 trillion.

Full disclosure, I’m talking my book here. Finding great businesses profiting from megatrends is what we do in Disruption Investor.

- Avoid the “widow-maker” trade.

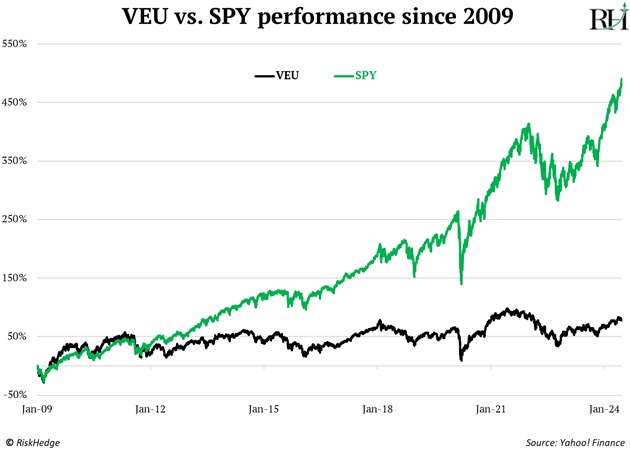

US stocks have trashed the rest of the world over the past 15 years:

It’s become fashionable to predict a reversal in this trend. I even made that call last year. Oops!

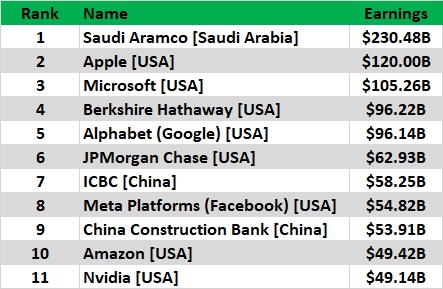

US stocks continue to lead because American businesses are dominating. Look at the world’s most profitable companies. Talk about American exceptionalism:

Pop quiz. Which of these companies was founded in the city of San Francisco?

Answer: Saudi Aramco, which was originally a division of the Standard Oil Company of California.

There are so few great, fast-growing businesses outside America’s shores that I can count them on two hands.

America is still the only country in the world where a poor immigrant kid like Jenson Huang can go start a multitrillion-dollar company. That’s why I expect US stocks to stay on top for a while longer.

Don’t be one of those investors who refuses to own US stocks because they’ve run up so much. The world’s best businesses should be “expensive.”

- A 916,000 lb. box is being hauled toward Columbus, Ohio as you read this…

Inside is a machine that will be used to make cutting-edge computer chips at Intel’s (INTC) new $28 billion chip plant.

I’ve been investing in chip companies for over six years.

My first-ever RiskHedge essay back in 2018 made the case for ASML (ASML), which has a total monopoly on the world’s most important machine.

We’ve made good money investing in chip companies, largely because we recognized each “sub” industry is dominated by one or two giants.

|

Case in point: Only two companies in the world can make cutting-edge chips.

These companies can practically charge customers whatever they want because they’re the only game in town. This allows them to rake in growing profits year after year.

Why are they the only game in town? Because making modern chips is hands down the most complicated, costly, and expensive manufacturing process there is.

Take the tool on its way to Intel’s factory. It’s a machine that makes computer chips at -238 degrees Fahrenheit. The box it’s being transported in is nearly the length of a football field.

And 20 of them will be ferried to Intel’s factories this summer.

Software is competitive because two college dropouts can write code in their parents’ garage to create the next Facebook (META).

But no startup can spend $28 billion on a plant. “Barrier to entry” doesn’t begin to describe it. We’re talking Great-Wall-of-China levels of difficulty when it comes to chips.

That’s why we continue to invest in the world’s top chip companies in Disruption Investor.

- Today’s dose of optimism…

What if I told you America is leading the world in “going green?”

Over the past 15 years, the US reduced C02 emissions by more than the UK… Germany… Italy… Spain… and France combined!

America achieved this by burning less coal and ramping up its natural gas usage, which is much cleaner.

Environmental wingnuts will tell you the only way to stop boiling the oceans is to drive less… stop eating beef… and to only take cold showers.

Source: The Washington Post

Have these climate hardliners forgotten we solve problems with innovation?

The shale revolution gifted America access to decades’ worth of natural gas… which allowed us to (mostly) ditch dirty coal. And we can do even better.

Imagine if we powered every home with nuclear energy, which is 98% cleaner than even natural gas? Climate change solved, overnight.

Have a great weekend. I’ll see you Monday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com