Hot AI startups will go bust

- Stephen McBride

- |

- June 18, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

We’re five months out from the US presidential election. That’s good news if you own stocks.

Since 1928, US stocks were positive 90% of the time during election years. And summertime tends to be the best three months of the year during election season.

Let’s get after it…

- “Dad, what was deafness?”

I hope my son wonders this someday.

It could be closer than you think.

Harvard scientists gave five kids who were born deaf a special “gene-editing” jab in their ears. Within a few weeks, they could hear their parents calling their names and were dancing to music.

Think about the pure joy those moms and dads must feel.

Often referred to as “CRISPR,” gene editing allows scientists to “cut” out bad genes that cause disease and replace them with healthy genes.

Gene therapy was invented around a decade ago. After years of scientists toiling away in labs, we’re finally seeing real breakthroughs.

Doctors loaded up a syringe with gene therapy and injected it into the kids’ ears, delivering a missing gene that causes deafness.

There’s a school for deaf kids a couple minutes from my house. Think about all the little ones who never got to play with all the other children because they couldn’t hear.

Hopefully, this breakthrough will break down those barriers.

And this is only the beginning. A few weeks ago, we talked about a blind kid in Miami who can now see thanks to gene-editing eyedrops.

We’re entering a golden age for biotech. As Matt Ridley (the original Rational Optimist) told me, biotech is the next big transformational disruption.

Investors must pay attention to this industry. But be careful, because which stocks you own really matters.

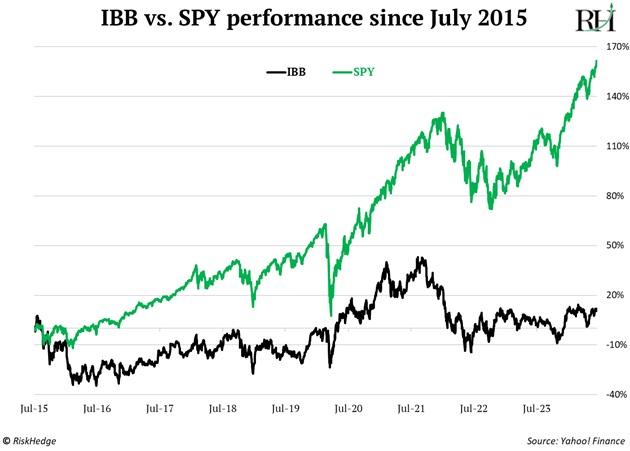

The largest biotech ETF—the iShares Biotechnology ETF (IBB)—has been a total dud over the past decade. It’s flat, while the S&P 500 has more than doubled:

We own a world-class biotech business in the Disruption Investor portfolio. It’s jumped 30% this year, and our research suggests it can double in the next year.

- The hottest artificial intelligence (AI) startups will go bust.

It costs billions of dollars to build and train AI models like ChatGPT.

But as one money manager recently put it to me, these models “are the fastest depreciating assets in the world.”

AI is advancing so rapidly that today’s state-of-the-art tech is obsolete within a few months. If airplanes had improved at the same rate as AI over the past two years, it would take 19 seconds to fly from London to New York!

Startups are ploughing heaps of cash into building the latest and greatest models. Then a competitor comes along and dethrones them within months.

Every investor wants a piece of all the shiny new AI “toys.” I’m talking about private companies like Anthropic… Perplexity… and Mistral.

But they’re likely all zeros.

Investors would be better off just wiring their billions directly to Jenson Huang, Nvidia’s (NVDA) CEO.

AI is the single most important stock market trend for the next decade. But there’s a right way and a wrong way to invest.

You know who’s not bleeding cash? Nvidia.

|

You know why? Because all the hot, cool AI startups are bleeding their cash TO Nvidia.

It’s been the big winner from the AI spending spree so far. Disruption Investor members were early to NVDA, and we’ve made good money.

Now, we’re reinvesting those profits into the next batch of AI infrastructure winners.

We’re building a portfolio of the biggest winners from the AI buildout in Disruption Investor.

- Tesla’s stock has been a dog.

The S&P 500 is hitting fresh highs, yet Tesla (TSLA) is down 50% from its 2021 peak.

Longtime Jolt readers know we’ve avoided owning it. Electric vehicle sales are growing rapidly. Problem is, selling cars is one of the worst businesses on the planet.

But after meeting with one of Boston’s largest hedge funds last week, I think we’re setting up for a “Tesla trade.” (Here’s the view from his swanky office, which overlooks Boston’s airport.)

Today, investors value Tesla as a car company. “Eww. Who wants to own a boring automaker?”

Soon, it’ll be valued as an AI company, which will juice its stock price. The big catalyst could be Tesla revealing its robo-taxi platform on August 8.

Tesla is a leader in self-driving cars. Its tech isn’t quite as good as Waymo’s, which is owned by Google (GOOG). But unlike Waymo, Teslas can drive on all kinds of roads.

Investors are already sniffing out a reversal in fortunes for Tesla. Its stock looks like it bottomed almost two months ago.

- Today’s dose of optimism…

The men were on the verge of starvation. Food rations were so low, they were forced to execute all 30 sled dogs.

Ernest Shackleton's expedition on the Endurance is one of the most incredible survival stories of all time.

Shackleton and his crew were stranded in Antarctica for 19 months after their ship was crushed by the ice. They had to row 800 miles to safety in tiny lifeboats, while being constantly sprayed with freezing water.

Endurance is a story about never giving up even in the harshest conditions.

All 27 men survived on sheer grit and determination!

I’ll see you Wednesday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com