Buy some and get on with your life

- Stephen McBride

- |

- July 18, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

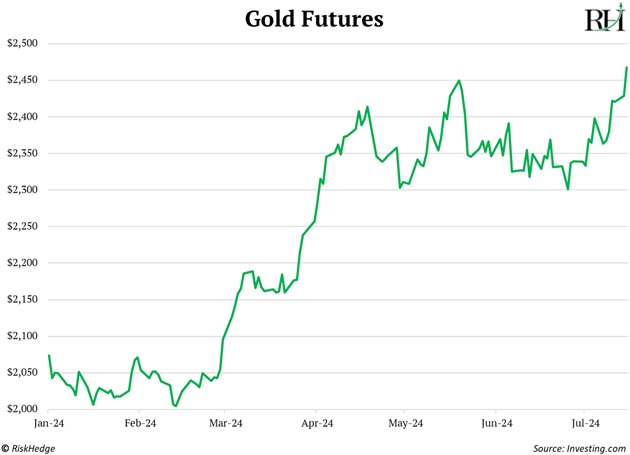

Gold just struck a new all-time high.

It’s at $2,469/ounce as I (Chris Reilly, filling in for Stephen) type, rising 20% in 2024:

That’s right in line with US stocks.

Now, we don’t often write about gold. It’s not “sexy,” and it’s not a disruptor. But it’s a great hedge against political, financial, and social disruption... and you can’t ignore this price action.

Here at RiskHedge, we recommend you own at least a little bit of gold. As Stephen says, “Buy some gold, forget about it, and get on with your life. Hope you never need it, and then pass it on to your kids.”

Simply put, gold is “crisis insurance.” Unlike stocks, it doesn’t require the economy to keep humming to hold its value. Unlike government bonds, it doesn’t require politicians to act long-term prudent to hold its value. And unlike the US dollar—which has lost 25% of its value since 2020—gold has always appreciated over the long term.

Due to its monetary properties, gold is valuable in itself, which is why we encourage you to own at least a little. Especially during times like today. Investors flock to gold during times of fear and uncertainty. And there’s a lot of that right now after the assassination attempt on former president Donald Trump.

Investors are also betting on the Fed to start slashing rates in September, which is good for gold.

The easiest, cheapest, and most secure way to buy gold and hold it in your own personal name is through Hard Assets Alliance. We have a partnership with them that gets all RiskHedge readers free storage for 12 months. Go here for details.

- Can you name the worst-performing stock in the S&P 500 this year?

It’s not Nike (NKE), Lululemon (LULU), or Boeing (BA)...

It’s Walgreens (WBA), down 55%.

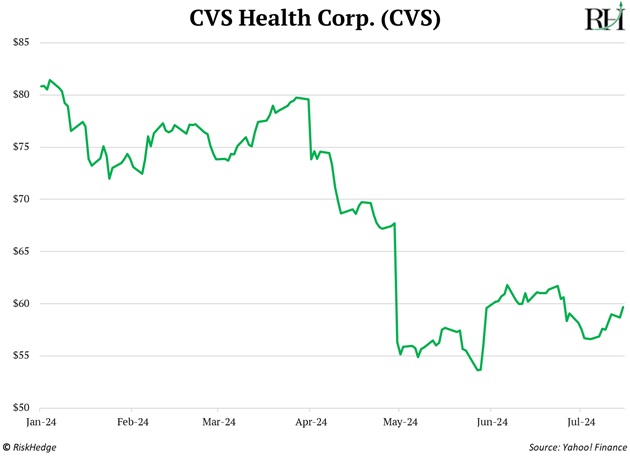

As you can see, fellow drug store giant CVS Health (CVS) is also struggling big time. It’s fallen around 25%:

CVS was one of the five big, popular stocks Stephen said to avoid during his artificial intelligence (AI) summit last November. He called it the “Blockbuster of the health services world”... a sitting duck ready to be disrupted by AI, and soon.

Walgreens falls in the same bucket.

Why?

Drones.

Amazon’s (AMZN) AI-powered delivery drones are already up and running in College Station, Texas.

You can order over 500 different medications online and choose “free drone delivery in less than 60 minutes.” And just like that, your medications show up at your doorstep.

|

No more driving to the pharmacy. No more standing in line.

Sounds a lot like what Netflix (NFLX) did to Blockbuster, right?

Then there’s Capsule, which delivers medications to your door in two hours or less. It’s available in New York, Boston, Chicago, and Los Angeles. Capsule uses AI to help you manage your prescriptions, track your refills, and chat with pharmacists anytime.

- But Stephen and his Disruption Investor partner Chris Wood say the biggest threat to CVS may come from a company called Forward with its “CarePod”...

... a futuristic kiosk that uses AI to scan your body and measure your blood pressure, heart rate, temperature, weight, height, body fat percentage, etc. Take a look:

Source: Forward

CarePod sends your data to a Forward doctor, who reviews it with you on a video call. The doctor can also prescribe medications, order lab tests, or refer you to specialists.

The CarePod is designed to be a convenient and affordable way to access primary care.

Forward is planning to open hundreds of CarePods across the US in the next few years. It already has CarePods in Roseville, California and Houston, Texas. And it has partnerships with employers like Uber, Visa, and Dolby to offer CarePods to their workers.

So, if you’re considering buying WBA or CVS “on the cheap”... don’t.

As Stephen says, “Soon, going to drug stores to pick up medicine will be as outdated as going to Blockbuster to pick up a movie.”

Instead, focus on the top AI companies doing the disrupting, which Stephen and Chris own in their Disruption Investor portfolio. In Disruption Investor, they also include important updates on private AI companies set to IPO and ones leveraging AI to make big breakthroughs similar to Forward. Upgrade here.

- Ethereum ETFs are set to launch Tuesday...

Regular Jolt readers know this is major news, and a huge deal for Ethereum (ETH)—the world’s second-largest crypto.

In fact, Stephen calls it the most important development since he started investing in crypto 5+ years ago. Just look at bitcoin (BTC), which is up over 40% since its ETF launched on January 10.

In less than six months, BlackRock’s (BLK) bitcoin ETF raked in $17 billion in assets. That’s unheard of for ETFs.

And as Stephen’s been saying, just like the bitcoin ETFs, “these new Ethereum ETFs will unlock trillions of dollars of retirement money that were previously off-limits to crypto.”

If you own Ethereum, congratulations.

Stephen will have a lot more to say about this in Friday’s Jolt. Stay tuned...

Chris Reilly

Executive Editor, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com