This stock could go to zero

- Stephen McBride

- |

- July 15, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

My friend JC Parets over at All Star Charts has a habit of making me think.

JC tweeted out this chart of the Nasdaq saying, “There’s an argument to be made that this month is a fresh breakout for the Nasdaq… and that this is all just getting started.”

Source: @allstarcharts on X

US stocks have gone up for much of the past 15 years. Most investors assume the bull run must end soon.

But JC is one of the best technical analysts I know, and he’s asking, “What if we’re only getting started?”

I have no edge in predicting the market’s short-term direction. Our RiskHedge “way” is owning great, disruptive businesses that’ll power through any market conditions.

But it makes you think. What if we’re in the roaring 2020s? What if right now is our one golden opportunity to make as much money as possible in the markets?

What if artificial intelligence (AI) lives up to the hype, creates trillions of dollars in new wealth, and allows little disruptor companies to grow faster than what was previously possible?

Our RiskHedge All-Access program is designed to help you profit from the rapid technological changes going on all around us. Among other benefits, when you claim one of the 100 memberships available, you’ll be entitled to six months of free, premium research.

We only open RiskHedge All-Access once a year, at most—and this year’s enrollment window closes very soon. Go here to review your opportunity to join RiskHedge All-Access.

Let’s get after it…

- My worst 2024 “surprise.”

In the January issue of Disruption Investor, to stretch our minds, I called 10 trends that could “surprise” investors this year.

I said biotech could be the best-performing sector in 2024. Nope.

There have been some big winners in biotech this year—including one of or Disruption Investor holdings, which jumped 30%.

But the largest biotech ETF—the iShares Biotechnology ETF (IBB)—has been a dud. It’s flat while the S&P 500 is up 15%. My friend Jared Dillian recently called these stocks “failed science experiments.”

Remember, in biotech, which companies you own really matters. It’s a stock picker’s game.

|

The names you want to own now are those leveraging AI to design new drugs and treatments faster and more efficiently than humans alone ever could.

This traditionally involved scientists in white lab coats squinting through microscopes for eight hours a day… for months, and even years… trying to make a breakthrough. Tough gig.

What if AI could make finding new drugs as easy as running experiments on a laptop and having robots to do all the grunt work? How many killer diseases could we defeat?

We’re about to find out, because “Airbnb for biotech” is here.

“Cloud” labs are sprouting up across America. Inside, AI robots whizz around pouring beakers and running centrifuges… and send you the results once they’re finished.

This slashes the amount of time and money it takes to design new drugs by at least 80%.

Did you know biotech startups design three in every four new drugs in America? But pushing these drugs through clinical trials usually costs a few billion dollars.

That’s why most small firms are forced to sell out to the bigger firms.

AI levels the playing field. Prepare for a tidal wave of disruption to hit biotech.

- My #1 rule for investing in AI: Follow the big money.

ChatGPT creator OpenAI is on track to rake in $3.5 billion this year.

Impressive… until you realize Nvidia (NVDA) is selling $3 billion worth of chips every two weeks.

AI is going to transform our lives and create untold riches (already is). But a lot of money will be lost chasing the “hot new thing.”

I like to keep it simple and only buy businesses making money from AI today. Remember, we’re in “Act 1” of the AI buildout: The infrastructure phase.

The amount of heavy-duty gear needed to power AI tools like ChatGPT is off the charts.

Tens of thousands of Nvidia chips… each using as much energy as the average US household.

Hundreds of miles of wires relaying data back and forth… and millions of dollars’ worth of fans humming 24/7 to keep the data centers from melting.

And we’ll need a lot more of this gear as AI starts driving our cars and designing new drugs.

Investment opportunities abound.

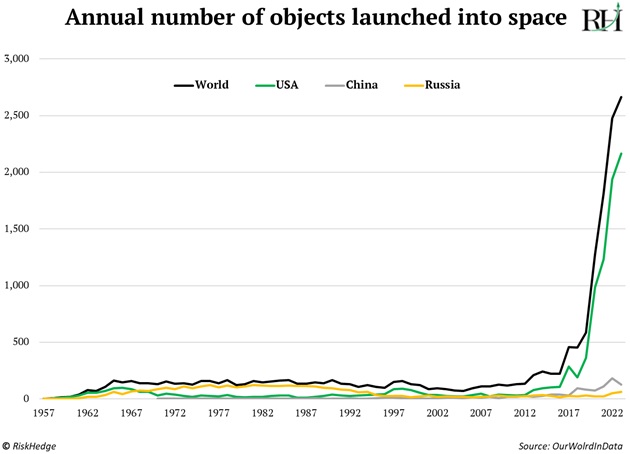

- More objects were launched into space in the past two years than all of prior history.

Look at this vertical takeoff:

Elon Musk’s SpaceX launched 95%+ of those.

It’s the world’s largest space entity… far bigger than the combined might of all the governments that had a 50-year head start.

Starlink—an arm of SpaceX—is firing thousands of satellites into space. These work like cell towers, beaming down high-speed internet from 300 miles above Earth.

Starlink will rake in around $10 billion from selling broadband this year. It’s going to steamroll old-world internet providers like Charter Communications (CHTR), AT&T (T), and Verizon (VZ).

Good. These are some of the most hated companies in America. Cable/internet companies rank dismally on customer satisfaction.

With SpaceX starting to steal millions of customers, these dinosaurs have no chance. I bet Elon will make more money from high-speed internet than all of them in a few years.

Keep in mind, AT&T’s revenue hasn’t grown in 17 years.

Meanwhile… Charter looks like it’s going to zero. Avoid.

- Today’s dose of optimism…

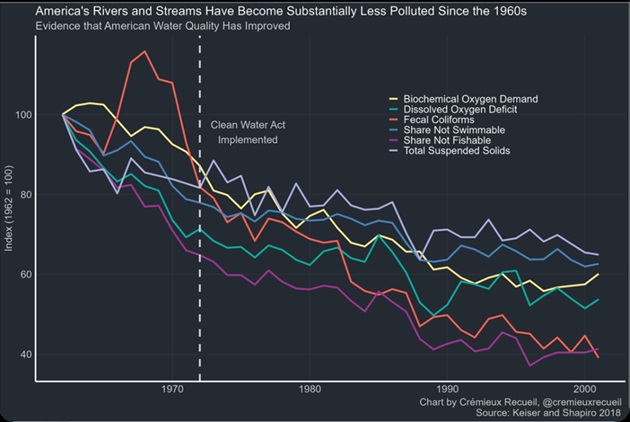

Did you know America’s waterways are the cleanest they’ve been in recorded history?

Pollution in rivers and streams has been roughly cut in half since the 1960s:

Source: Keiser and Shapiro

I bet most folks don’t know this because the corporate media spins a narrative that humans are ruining the planet.

But we know the truth.

Have a great weekend. I’ll see you Monday.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com