Cubicle jobs will be first to go

- Stephen McBride

- |

- July 22, 2024

- |

- Comments

This article appears courtesy of RiskHedge.

Remember when a handful of mega-cap stocks were carrying the S&P 500 higher?

Now the rest of the market has joined the party.

Despite market weakness in the last couple days, almost half of all US stocks hit fresh highs last week.

We recently talked about the importance of “rotation” in the stock market. A few big stocks can’t hold up the market forever. For this bull market to last, money would have to rotate into a lot more stocks.

It’s finally happening.

Five of our disruptor stock recommendations inside Disruption Investor have hit new all-time highs either this week or last week. (Upgrade here.)

Meanwhile, the S&P 500 just closed at its 38th new high of the year.

Let’s get after it…

- Experts are calling it the biggest IT outage ever…

Last night, a global tech meltdown disrupted everything from banks, big media organizations/businesses, hospitals, and major airlines—Delta, United, and American Airlines grounded all flights.

Here’s what happened: A flawed software update by one of the world’s leading cybersecurity firms—CrowdStrike (CRWD)—took down Microsoft’s (MSFT) systems, breaking computers worldwide running on Windows... causing this “Blue Screen of Death”:

Source: Forbes

As one of the leading cyber vendors, CrowdStrike is integrated into many of the world’s largest systems.

While many have speculated CrowdStrike got hacked, it appears the outage was due to a bad software update.

One bad software update crippled a good part of the world...

Think CrowdStrike is important?

We own CRWD in Disruption Investor, and our position is still up around 100% accounting for our Free Ride. This morning’s big drop in the stock is a good buying opportunity.

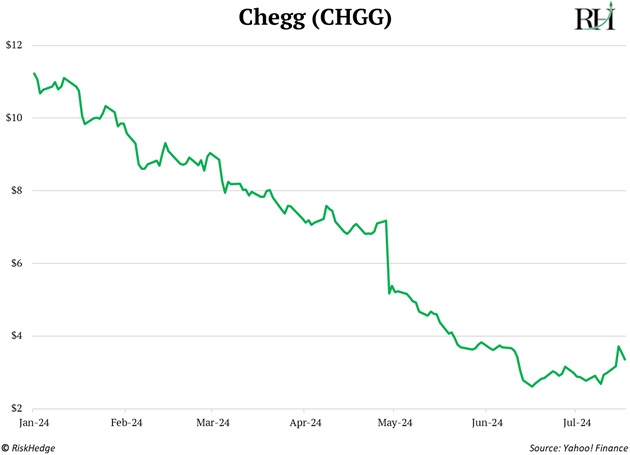

- Seen a chart of online education company Chegg (CHGG) lately?

Next stop: zero?

Chegg was making millions of dollars selling online tutoring and textbook rentals.

Then ChatGPT burst onto the scene and gave everyone with an internet connection access to their own private tutor… for free.

A lot of software companies are sliding toward the same fate as Chegg.

One thing artificial intelligence (AI) is already great at is automating back-office work. Cubicle jobs will be the first to go. AIs can build spreadsheets, manage customer relationships, track payroll, and do thousands of similar things better and cheaper than humans.

Hundreds of companies sell software for these tasks today. Their customers gorged on expensive software tools over the past decade. Stocks like Salesforce (CRM) and Workday (WDAY) printed money for investors.

That’s over. I warned viewers of my AI Summit last year to avoid Salesforce before it suffered its worst one-day drop in history. More of those are coming as the world wakes up to the inevitability that AI will disrupt software.

There will be many winners, too. One business we own in Disruption Investor is using AI tools to reinvent warfare. It recently hit new highs.

Buy the winners; sell the losers.

- Bye textbooks; hello AI.

AI image generators like DALL-E allow you to create all kinds of weird and wonderful pictures with a few clicks.

When I started playing around with them last year, they were cool but unreliable. They’d routinely misspell words and give people 11 fingers.

Now, we have AI video generators that can cook up photorealistic movie scenes in seconds.

There’s a new tool called Dream Machine that someone used to create “restored footage on the Roman Empire.” You can watch the short clip here on X. It’s incredible.

Source: @professeurfle on X

Apple (AAPL) releases a new iPhone once a year. Cutting-edge AI video tools are hitting the market every month!

These video generators are getting so good, so fast… and we’re only on “V1.” This is the worst they’ll ever be.

AI will transform how we teach our kids.

I love history as a subject. I just finished a 600-page book on Saudi Arabia, read like a thriller. But remember how awful history class was?

Staring at a history textbook. Memorizing presidents.

Imagine if we ripped out the textbooks and replaced them with Dream Machine. What was it like to watch gladiators battle in the colosseum? AI will show you.

|

I bet every elite school and college will use these tools within a few years.

If you thought we needed lots of chips to power ChatGPT… wait until you see the infrastructure these AI video generators run on.

I can see schools and colleges building their own data centers.

Continue to invest in companies profiting from the AI infrastructure buildout. It’s just getting started.

If you have any questions, write me at stephen@riskhedge.com.

Have a great weekend.

Stephen McBride

Chief Analyst, RiskHedge

|

This article appears courtesy of RH Research LLC. RiskHedge publishes investment research and is independent of Mauldin Economics. Mauldin Economics may earn an affiliate commission from purchases you make at RiskHedge.com