This Retail Niche Pays 6%-Plus Dividend Yields

- Robert Ross

- |

- The Weekly Profit

- |

- August 7, 2019

Seems like you can’t go a week without reading about the retail apocalypse.

I saw a recent headline that read, “75,000 Retail Stores Will Close by 2026.”

That may very well happen. But the idea that e-commerce giants like Amazon and Walmart will completely destroy brick-and-mortar retail is outrageous.

Sure, e-commerce sales are growing quickly—about 5% every year. But 90% of US retail sales still happen in person.

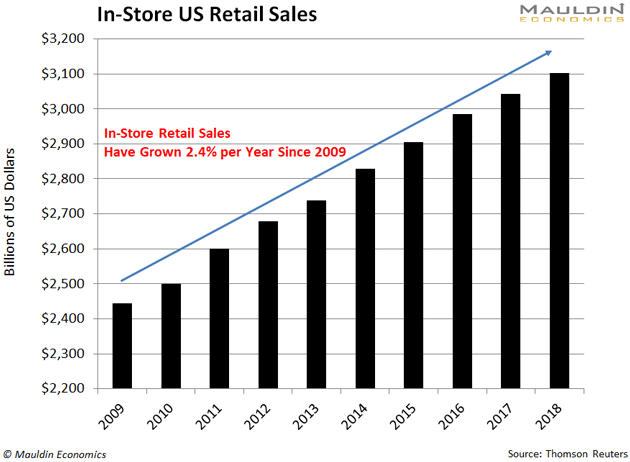

Meanwhile, US retail sales have steadily grown 2.4% annually since 2009. And they’re projected to grow 2% through 2024.

That’s solid and stable growth.

Even better, the companies that rent property to brick-and-mortar retailers are making money hand over fist. And some pay dividend yields as high as 6%. (More on that in a moment.)

Americans Still Like to Buy Clothes in Stores

There’s no way around it: E-commerce has crushed some retail sectors. Think electronics and media. That’s why Circuit City and Blockbuster stores are a thing of the past.

But other areas of retail are flourishing.

Take apparel, for example. A recent survey showed that nearly 70% of Americans still buy clothes at brick-and-mortar stores.

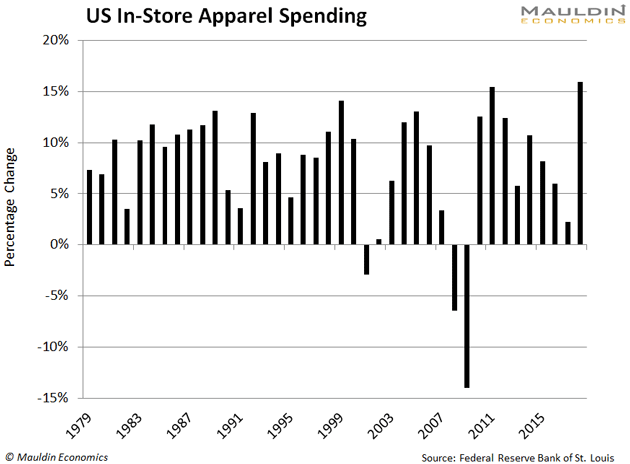

Yes, in-store apparel companies have lost some market share to e-commerce companies. But overall, in-store spending on clothes has been stable, as you can see in the chart below.

In fact, 2018 was the strongest year for in-store apparel spending on record.

Groceries are another stable area of brick-and-mortar retail.

Regular readers know I expect online groceries to go mainstream in the next five years. But right now Americans only buy 1% of their groceries online.

That figure is expected to grow to 5% by 2024. But that still means Americans will buy 95% of their groceries in stores for the foreseeable future.

Spotting Opportunities Others Miss

By now, you probably know that I focus on safe and reliable dividend-paying stocks here at The Weekly Profit.

I often find the best opportunities for my readers by zeroing in on industries other people ignore. Opportunities like a tobacco company with a 5%-plus dividend yield...

A business development company with a 10%-plus dividend yield…

And a gold streaming company that’s up over 40% since I wrote about it…

Now I’m doing the same thing with a special niche in brick-and-mortar retail…

The Best Way to Invest in Retail

A lot of the buildings where traditional retailers operate are owned by special business entities called real estate investment trusts, or REITs.

REITs can own all kinds of properties—not just retail. But here’s the main thing you should know about them: REITs have to pay out 90% of their income as dividends.

That means their dividends are often huge.

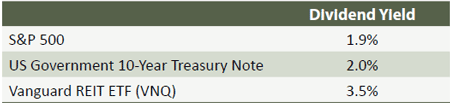

Across the board, REITs usually pay higher dividends than stocks and bonds.

But the dividend yields for retail REITs are even higher. In fact, the 10 largest retail REITs have an average dividend yield of 6.1%.

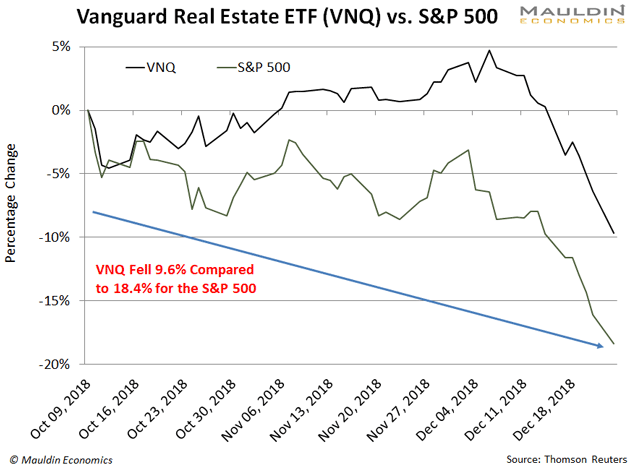

On top of that, REITs are much less risky than most retail investments, thanks to predicable cash flows and high dividends.

For instance, when the S&P 500 fell 18% from October 2018 to December 2018, REITs only fell half as much:

But like I’ve said before, just because a company pays a high dividend yield, it doesn’t mean that dividend is safe.

That’s why I developed a proprietary system called the Dividend Sustainability Index (DSI) to measure dividend safety. In a nutshell, the DSI looks at three key metrics: payout ratio, debt-to-equity ratio, and free cash flow.

And these three retail REITs pass the DSI with flying colors…

Three Retail REITs that Pay (Safe) 5%-Plus Dividend Yields

The first company on my list is grocery REIT Weingarten Realty Investors (WRI).

Remember, groceries are one of the stronger areas of brick-and-mortar retail that I mentioned earlier. And WRI’s biggest tenant is grocery maven Kroger.

WRI pays a 5.7% dividend yield with a low payout ratio of 69%. The company has raised its dividend for six years in a row. And—with such a low payout ratio and strong free cash flow—I expect it to raise its dividend again.

Next on my list is Taubman Centers, Inc. (TCO), an apparel-based shopping center REIT with properties in 11 states. Household names like H&M, Williams-Sonoma, and Urban Outfitters are some of TCO’s biggest tenants.

The company sports a hefty 6.6% dividend yield. It’s also maintained or increased its dividend every year since 1991. And, with a payout ratio of only 70%, I’d expect it to keep this trend going.

Finally, we have Site Centers Corp. (SITC), which owns and operates 33 shopping centers throughout the US.

SITC pays a reliable 5.7% dividend yield. It also has a low payout ratio of 48% and a very healthy debt-to-equity ratio of 47%. This means the company should continue to meet its 5.7% dividend payments for the foreseeable future.

All three of these companies should continue to profit from the stable US retail market. But there’s a fourth REIT that’s actually the best in its class.

Of course—like all of my best stock picks—I have to save it for subscribers to my premium investing service Yield Shark. They’ll read all about it in our next monthly issue.

The Yield Shark portfolio is full of low-risk dividend-paying stocks. And, considering it’s delivered a 9.2% return so far this year, I’d say my subscribers are glad I keep the best for them.

You can sign up for a risk-free trial to Yield Shark by clicking here.

Robert Ross