These 3 Digital Care Stocks Aren’t Going Anywhere but Up

- Robert Ross

- |

- The Weekly Profit

- |

- March 31, 2021

|

We've just opened the virtual doors to our 2021 Strategic Investment Conference! This year's event will be live and all-virtual on five alternating days from May 5–14. Watch 25+ hours of presentations from dozens of rock-star asset managers and economists about what's happening in this new economic, social, and political environment. Your favorite Mauldin Economics experts will also be on hand with actionable trade ideas for you. Pre-order your all-access pass today and save 50%! |

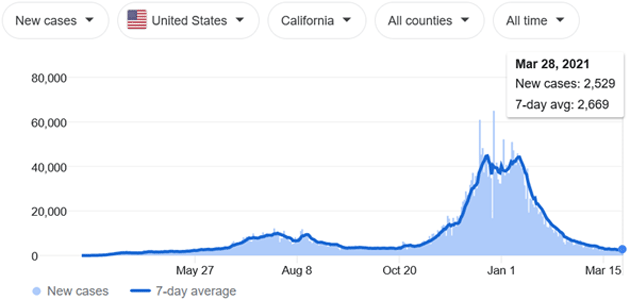

Things are finally starting to calm down here in California.

After a major surge in COVID-19 cases over the holidays, cases are back down to where they were in fall 2020:

Source: The New York Times

We have the successful vaccination rollout to thank for most of the decline. But we also have our front-line workers to thank as well.

I happen to be close friends with one of those front-line workers. He’s a doctor here in Los Angeles and was in the thick of the COVID-19 pandemic for the last year.

I saw him (and some of his fully vaccinated colleagues) over the weekend. Things are much brighter these days as there is finally a light at the end of the tunnel.

But one thing sounds like it won’t change anytime soon.

Even Post-Jab, Your Doctor Is Happy to See You Virtually

All of these doctors are still seeing their patients using telemedicine.

Telemedicine is exactly what it sounds like—contact between a patient and a clinician that doesn’t happen in the same physical space.

At the height of the pandemic, my friend saw up to 90% of his patients this way. That figure has fallen back to “about 40%,” he says. But he attributes that to people still delaying non-urgent medical care.

There is research to support his personal observations.

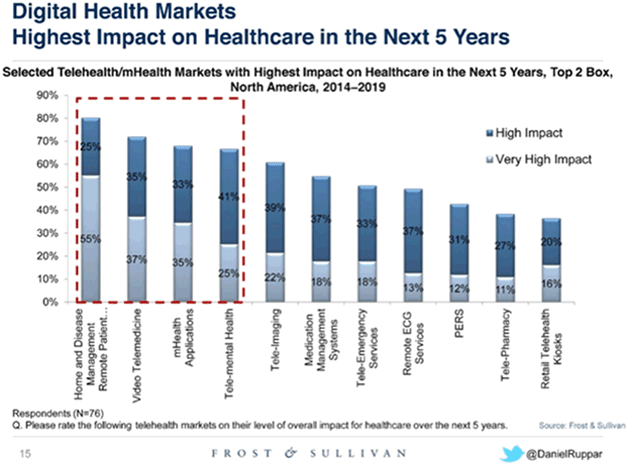

According to research firm Frost & Sullivan, telemedicine services are expected to grow 38% per year through 2025:

Source: Frost & Sullivan

That’s a sevenfold increase in only a few years. And it’s showing up in stock prices.

But telemedicine isn’t limited to video conferencing with your doctor. One such company—which I bought last year in my personal portfolio—called Teledoc Health (TDOC), provides healthcare coaching and virtual assistants for people living with long-term illnesses.

The company’s software allows doctors to remotely track patients’ diabetes and other chronic diseases. So instead of diabetics seeing their doctors once a month for checkups, physicians now get real-time data.

This is just one of the many applications we’ll see for telemedicine companies in the coming years. But the trend is clear…

Virtual visits and remote patient monitoring are quickly becoming the norm.

You could invest in TDOC and see some healthy gains over time.

Or you can get to the heart of the opportunity in healthcare: the insurance companies that cover “virtually” any type of doctor visit.

The Biggest Beneficiary of Modern Healthcare

Only 24% of American hospitals had telemedicine programs in January 2020. But that’s changing fast.

Last March, Congress passed a rescue package that included $200 million to help hospitals establish remote care. US authorities also waived telemedicine restrictions related to government-sponsored Medicare, which has 65.2 million beneficiaries.

This March, Congress passed another relief package that included significant funds for telehealth infrastructure upgrades.

According to Courtney Joslin of think tank R Street Institute, these were “regulatory moves that would have taken five to 10 years.”

This is setting off a domino effect within the $3.5 trillion US healthcare market.

Since March 2020, some 10 million people on Medicare have used telehealth services. This includes video chats, telephone calls, and other remote visits.

That means fatter profit margins (and higher stock prices) for America’s largest insurance companies.

These 3 Insurers Are Dialing Up Big Profits in the Telehealth Boom

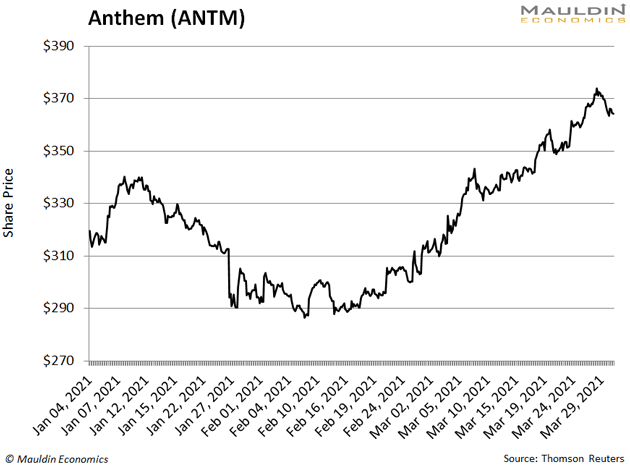

I gave my top insurance company—Anthem (ANTM)—to subscribers of my premium investing service, Yield Shark, back in August 2020. Since then, the stock is up a whopping 38%.

During the pandemic, Anthem opened the virtual care floodgates. This included phone visits and video conferencing for urgent care, mental health, and post-operative follow-ups.

Despite the strong run, ANTM is still a great way to play this trend. The company is investing heavily in this sector, which I expect to translate to strong earnings in coming quarters.

Another “healthy” option is UnitedHealth (UNH). UNH is the largest health insurer in the US. The company’s massive scale means it can deploy telemedicine services across its varied insurance offerings.

Also, be sure to visit CVS Health (CVS) as a way to give your portfolio a health-related boost. While not a traditional health insurer, CVS has ample exposure to managed healthcare through its 2018 acquisition of Aetna.

CVS is especially attractive because this leading drug store chain is in 40+ states and is now offering coronavirus vaccines in 29 of them. This will likely translate into added foot traffic, which could give sales a boost in the coming quarters.

However you play it, the diagnosis is clear: Telehealth providers, and the insurance companies that partner with them, have an incredible opportunity to deliver long-term benefits when it comes to your health and even your wealth.

Robert Ross