Here’s the Next Restaurant Dividend to Get Chopped

- Robert Ross

- |

- The Weekly Profit

- |

- June 10, 2020

Even though all 50 states are starting to reopen, restaurants are starving for sales and will be for many months to come.

A recent survey showed that 75% of consumers plan to avoid restaurants this summer. And for those restaurants that can open, many are limited to 50% capacity.

Restaurants tend to be low-profit-margin businesses. They make their money through packing a steady stream of customers into tiny spaces.

Social distancing measures have upended this model. Mom-and-pop restaurants with little cash on hand and severely limited seating capacity are getting hit the hardest.

But even large restaurant chains aren’t immune to this trend.

The 3 Restaurant Dividends Are Out to Lunch

We’ve seen a slew of restaurant dividend cuts in 2020.

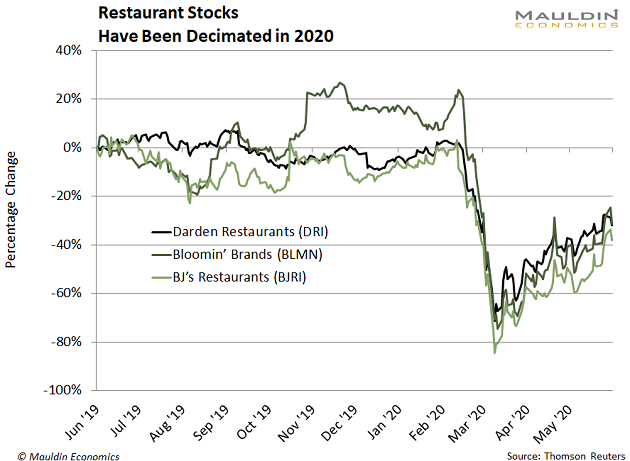

For instance, take a look at Darden Restaurants (DRI). The parent company of Olive Garden, LongHorn Steakhouse, and other sit-down chain restaurants saw its business model crumble during the COVID-19 pandemic.

After the company closed 100% of its dining rooms… and its stock fell 62%... it was forced to suspend its 88-cents-per-share quarterly dividend.

And it’s not alone. Bloomin’ Brands (BLMN) owns a portfolio of casual dining restaurants including Outback Steakhouse and Carrabba’s Italian Grill.

But with new social distancing measures, these chains are struggling. That’s why Bloomin’ suspended its 20-cents-per-share dividend on March 20 after shares fell 78%.

Then there’s BJ’s Restaurants (BJRI). The eponymous restaurant chain saw its stock fall 75% once the COVID-19 pandemic kicked into high gear.

And just like its casual dining peers, it then suspended its 13-cents-per-share quarterly dividend.

These dividend suspensions shouldn’t be surprising, given how COVID-19 kneecapped most of the restaurant industry.

However, the writing was on the wall for these three companies’ dividends long before the coronavirus curtailed Americans’ dining habits.

When You Find Your Dividends in Times of Trouble…

This has been the worst year for dividend investors in the last decade. And we’re not even halfway through it.

For years, I’ve been steering my subscribers away from stocks with less-than-stable dividends. In fact, I’ve never recommended a stock that saw a dividend cut.

That’s because I have a secret weapon that zeroes in on the market’s strongest income stocks. It also tells us to stay far away from stocks whose dividend payouts appear to be in danger.

My Dividend Sustainability Index (DSI) system looks at payout ratio, debt levels, free cash flow, and a host of other factors to see if the dividend is safe.

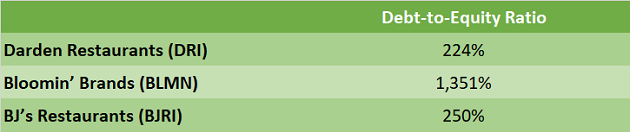

And one factor – debt-to-equity – really stood out in this basket of restaurant stocks.

Generally, a high debt-to-equity ratio means the company is financing its operations through debt instead of wholly owned equity. A high debt-to-equity ratio implies the company is on shaky financial footing.

Typically, any ratio over 80% is a red flag for income investors. As you can see, the three companies that cut their dividends were well above this threshold:

The writing was on the wall for these dividend cuts.

And there’s one company that has yet to cut its dividend that also looks vulnerable…

This +3% Restaurant Dividend Payer Is Overcooked

Almost every major restaurant company has cut or suspended its dividend in 2020.

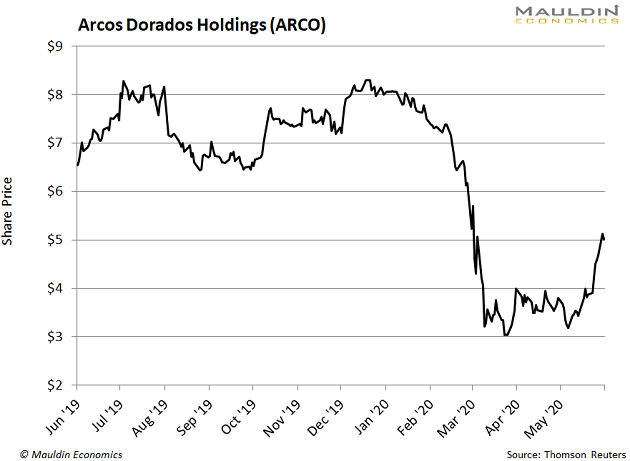

But one—Arcos Dorados Holdings (ARCO)—has yet to slash its payout. The company operates McDonald’s (MCD) chain restaurants throughout Latin America and the Caribbean.

While strictly fast-food restaurants are better positioned to thrive in the coming months than dine-in, ARCO is on shaky financial footing.

Just like its restaurant peers that cut their dividends, ARCO has a heavy debt load. In fact, the company has a debt-to-equity ratio of 519%!

That’s well above the 80% I used to determine if a dividend is safe. And it’s far from the only red flag.

ARCO also has a high payout ratio of 228%. And that’s just too high.

The payout ratio is the percentage of net income a company pays to shareholders as dividends. As a rule of thumb, a payout ratio above 80% is usually not sustainable.

ARCO’s heavy debt load and high payout ratio are two major red flags. Here’s a third…

When I plugged ARCO into my Dividend Sustainability Index, the company scored a whopping 12%.

Since I don’t recommend any company with a DSI score below 80% to my readers, it’s safe to say ARCO doesn’t make the cut. Not even close!

But that’s not to say all restaurant stocks are in poor shape. I just recommended a beaten-down restaurant stock to readers of my premium investing service Yield Shark.

Unlike the overcooked stocks we talked about today, this safe and reliable dividend payer is already up double digits. Plus, it has plenty of room to run. If you want to get the name and ticker of this stock, along with 14 other buy-rated dividend paying stocks, click here.

Robert Ross

P.S. In 2020 alone, 83 S&P 500 companies have cut or suspended their dividends. We’ve been following this trend since April, when I told you casino stock Wynn Resorts (WYNN) was ripe for a dividend cut. (You can read that article here.) A few weeks later, that prediction came to fruition. I’ll keep an eye on ARCO and let you know what happens there, too.