3 Ways to Profit Off This Big Tech Misconception

- Robert Ross

- |

- The Weekly Profit

- |

- January 13, 2021

Every new year, I read all the forecasts from the world's top economists and market watchers.

One of my favorite reads is Byron Wien's list of 10 surprises for the upcoming year, which he's done for 36 years.

Granted, a global pandemic didn't appear in the 2020 list. But after last year gave us an entire flock of black swans, I'm just glad to see he's back with a 2021 edition.

While I could spend an entire article debating each of these points, today I want to tackle the last part of No. 8:

"The equity market broadens out. Stocks beyond healthcare and technology participate in the rise in prices…

"Big cap tech… stocks are laggards for the year."

That would indeed be a surprise. But I wouldn't bet on big techs lagging the market this year.

If you read "My Top 3 Predictions for 2021," you know that I expect the opposite—that tech will be the year's top-performing sector.

Today I'll tell you which stocks I believe will lead the sector… and the markets… higher.

You Don't Have to Agree. But You Can Still Follow My Lead

My Yield Shark members know I was bullish even amid the 36% COVID-19 crash in March. A lot of people called me crazy until the market embarked on one of its best runs ever.

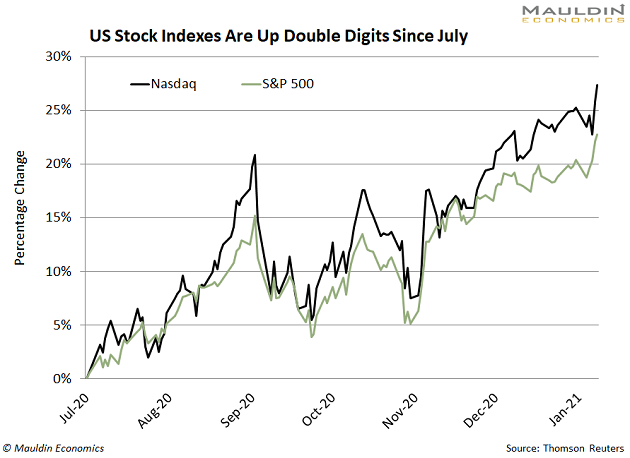

I got similar "fan mail" in September when I told readers to ignore the growing noise about a Tech Bubble 2.0.

They've gone quiet now, too.

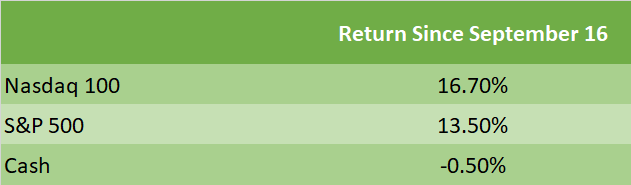

Even with the COVID-19 crash, the Nasdaq 100 is up 185% over the last five years alone. That’s spawned talk of a “Tech Bubble 2.0,” with many people fearful of a March 2020 repeat:

But I’m not only holding on to my tech stocks, I’m adding to these positions every month.

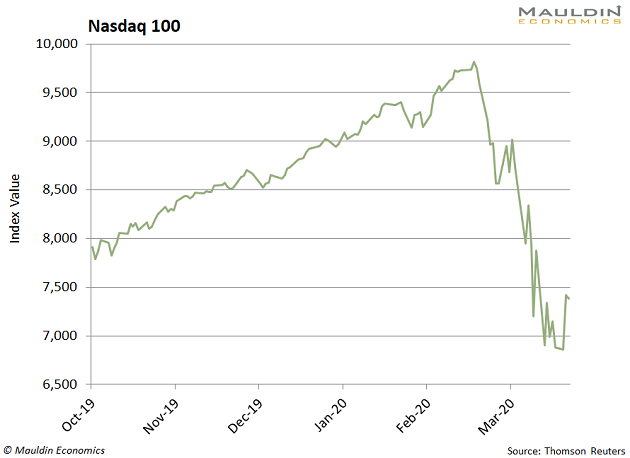

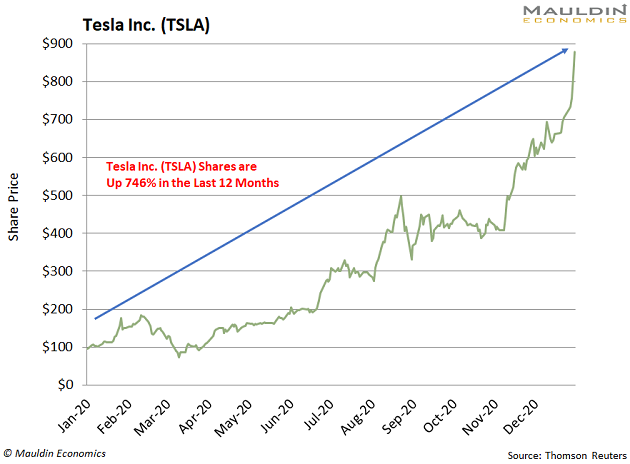

I can hear you now: “But Robert, technology stocks are so expensive! Haven’t you seen Tesla (TSLA)?”

Yes, some technology stocks are overvalued. But if you look at the entire sector, they’re actually reasonably priced.

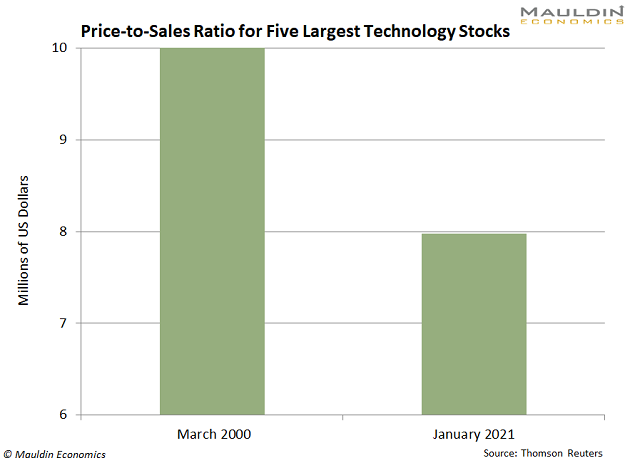

For instance, if you compare today's tech stock prices to their March 2000 peak, they are not expensive:

The five largest technology stocks are 20% cheaper than they were in March 2000.

And that’s with the Federal Reserve’s easiest monetary policy in US history.

Fed to Keep Lending the Market a Helping Hand

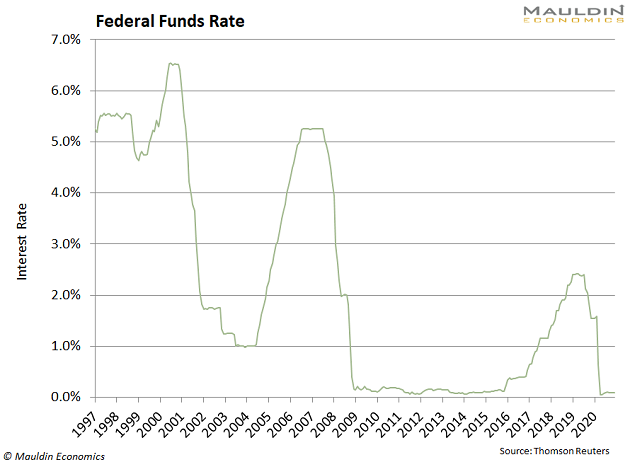

Remember the good old days of earning 5% on a bank savings account?

The Federal Reserve’s easy money policies ended that. That’s because the goal of easy money policies is to push people out of “safe” investments (i.e., money market funds and bonds) and into riskier assets (i.e., stocks).

The Fed’s easy-money policy was not nearly this easy back in the Tech Bubble days. There were certainly excesses. But with interest rates at 5%, it was nothing like what we have today.

That’s why—though technology valuations are inching closer to the highs we saw in March 2000—the historically low Fed Funds rate means valuations should be much higher than the technology bubble 1.0.

Experts Agree: No Bubble Burst, but Rather a "Pop" Higher

While this may seem like an out-of-consensus idea, I’m not alone in this. A recent Bank of America survey showed hedge fund managers have more exposure to stocks than at any period in the last 18 months.

Analysts see more upside, too. Potentially a lot more.

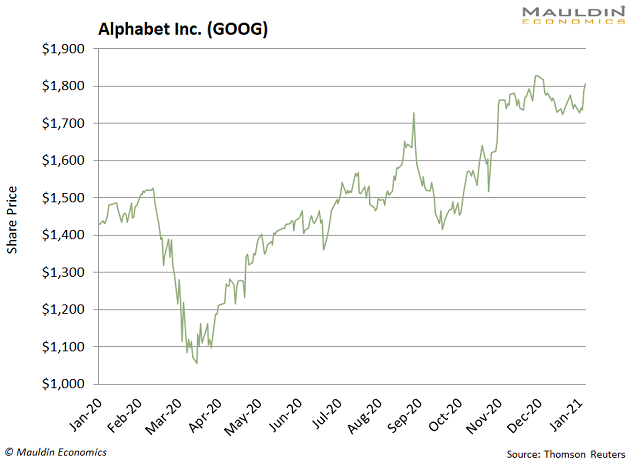

For example, last week analysts at Goldman Sachs raised their price target on Alphabet (GOOG) to $2,250:

That's a pop of about 25% from its recent price of $1,797. And there are plenty of opportunities for dividend-paying technology stocks as well. One such company is Oracle (ORCL).

The IT giant generates over 80% of its sales from cloud-related products. Oracle also secured a bid from TikTok—the wildly popular social media app that’s been all over the news lately.

Oracle will be the app’s “trusted technology provider” in the US. And this is a trusted name for us in another key way…

ORCL pays a solid 1.7% dividend yield. And with a perfect 100/100 score on my proprietary Dividend Sustainability Index (DSI), you can rest assured this dividend is safe.

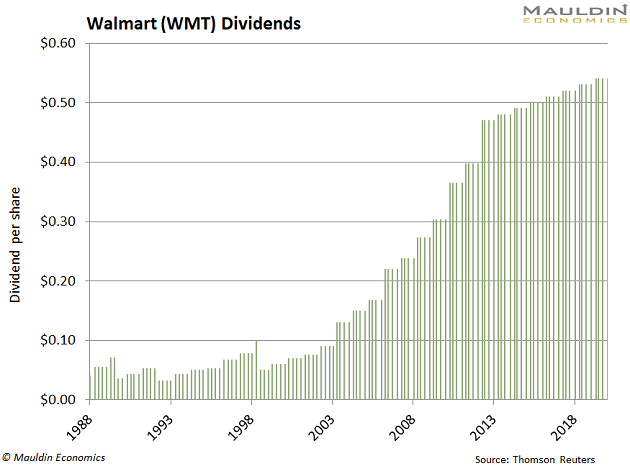

The same can be said for Walmart (WMT). People who don’t consider Walmart a tech company have not been paying attention. The company is the second-largest e-commerce platform in the US, only behind Amazon (AMZN).

Walmart grew its e-commerce sales a massive 74% over the last year. This bests even Amazon’s robust 48% growth. And when it comes to dividend payers, Walmart is tough to beat. This Dividend Aristocrat has raised its dividend for 31 years in a row:

The company pays a modest 1.7% dividend yield, which my DSI tells me is safe AND set to grow over the longer term.

Walmart just paid its quarterly dividend last week, which my Yield Shark subscribers were on board to collect. That brings their total return to around 20% since they added their position back in April.

Bottom line: While technology stocks are on an incredible run, I think this is only just the beginning.

Robert Ross