Trillion-Dollar Club—Bravo, Nvidia

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- June 5, 2023

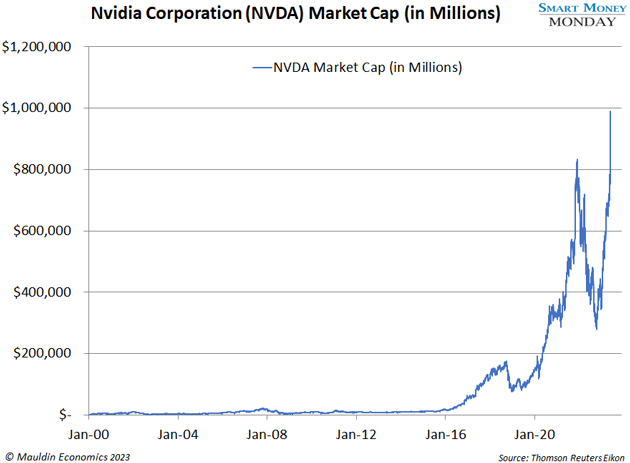

Congrats to the latest tech darling, Nvidia Corp. (NVDA), on hitting $1 trillion in market cap.

Nvidia is the supposed pure-play, must-own company for all things artificial intelligence (AI)—it produces the chips that go into data centers that power AI.

Now it joins the trillion-dollar market-cap club. This exclusive club includes a handful of tech giants, including Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Meta (META), and Tesla (TSLA).

That’s not what I’m most impressed by, though.

The most impressive part is an action taken by management only days before the company hit that major milestone…

Which checks one of the boxes I always look for in any investment.

Stock for Cash

The sign of good management is knowing how to use capital markets. Capital markets are a tool. A company going public must recognize this, and management teams need to know when and how to use it.

More specifically, a company needs to know when its stock is cheap and when it’s expensive.

When it’s cheap and a company has excess free cash flow, it should buy back shares. If the stock is conservatively worth $10 per share but the market price is $5 per share, that’s a great use of capital.

When shares are expensive, many times, it makes sense to issue them—that is, sell them for cash or use them to buy other assets.

$10 in reasonable value per share versus a market price of, say, $20 or $30 or $50 per share… in that case, issuing stock may be a great idea.

Most management teams don’t know either of these things. They are operators, not investors. That’s fine, but it’s not ideal.

Common stock is effectively a currency. It can be used for acquisitions or as another source of capital for high-growth projects. It’s a tool, and smart management teams know when to use it.

Nvidia’s management team appears to fall into the camp of knowing when to use its common stock as currency.

Just a few days before hitting $1 trillion, Nvidia filed a mixed shelf offering. This gives it the option to raise up to $10 billion through the issuance of common stock or other types of securities.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Great Examples of Stock Issuance

Issuing stock isn’t always a bad thing.

Warren Buffett’s Berkshire Hathaway (BRK) has been slowly reducing shares outstanding over the past few years.

But Buffett’s not beneath using Berkshire stock as currency. He used it in 2010 to acquire Class I railroad Burlington Northern Santa Fe (BNSF). He also used stock to buy General Reinsurance, or Gen Re, in 1998.

Sometimes, it just makes sense.

Another way to use stock as a tool is when it’s wildly overvalued. The classic case is AOL’s acquisition of Time Warner in early 2000. It was an all-stock deal, where AOL’s overvalued stock was used to buy Time Warner’s cash-flowing business.

The best and strongest example of properly using stock goes back to the 1960s. That’s when electrical engineer Henry Singleton took over as CEO of industrial conglomerate Teledyne.

From 1960 to 1986, Singleton ran Teledyne. He grew it through acquisitions, but he also grew the value through shrewd capital allocation decisions. He bought stock when it was cheap and issued stock when it was expensive.

A dollar invested in Teledyne stock in 1966 would be worth over $50 during Singleton’s reign. That pencils out to a remarkable 18% compounded annual return.

Back to Nvidia

I’m in no way saying that Nvidia will compound at a 15%+ clip from here. My sense is that it certainly won’t.

But the management team is sending a signal to the market: When our stock is expensive, we will consider issuing stock for cash.

This management talent is one thing I always look for in any investment. It’s not the only thing, of course—the stock must be reasonably priced.

With Nvidia, I can’t make that case. It’ll be fun to watch, for sure, but not to own.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark