My Top Idea for Generating “Mailbox Money”

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- October 30, 2023

Successful investing has many requirements, one of which is proper evaluation of one investment relative to another. The game is all about getting the highest return relative to the risk.

You can buy bonds or stocks, real estate, or crypto. All these choices need to be evaluated together—again, risk versus return.

Risky biotech stocks should generate a greater return than, say, US Treasuries when adjusted for risk. This seems obvious. And yet, today, many investors don’t really think this through. They fail to weigh and evaluate the different options available to them.

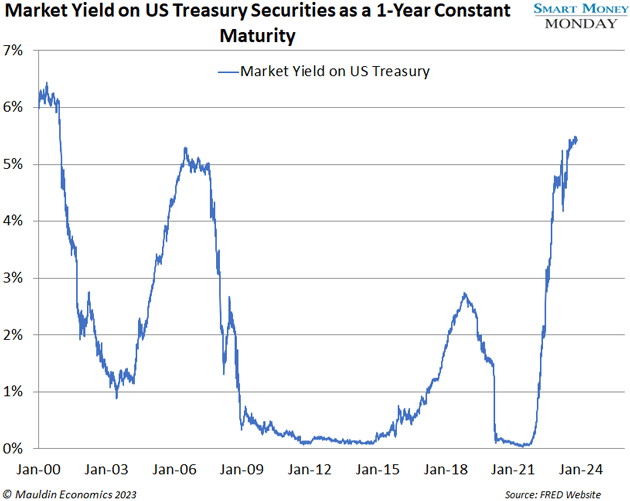

Now, for the first time in nearly two decades, a new item is back on the menu. And investors should be strongly considering it.

A Solid Return with Little Risk

There’s been no yield on low-risk investments for so long that most investors have completely written off the idea.

But now, investors can get a decent return while taking on little risk.

That return is now available—for the first time since 2006—thanks to the Federal Reserve. After a massive run of rate hikes, investors can generate actual returns buying US government securities. The two-year Treasury bill, for example, currently yields 5.02%.

In talking with most investors, experienced and not, my sense is they haven’t adjusted their return versus risk framework with this option in mind.

Just look at the S&P 500. It currently has a dividend yield of 1.74%. So, right now, you get more than a 300 basis point cash spread buying US Treasuries.

That’s probably not a fair comparison since, of course, S&P 500 companies are growing and reinvesting their earnings.

Looking at the valuation of the whole S&P 500, it’s currently trading at 17X forward earnings. Inverting that, the S&P 500 is trading at a 5.8% earnings yield.

So, investors, by owning the S&P 500, are only demanding a small spread—0.8%—over riskless US Treasuries. That doesn’t make much sense to me. The spread should be wider. Which is to say, the S&P 500 earnings yield should be much higher than 5.8%. A higher earnings yield equals a lower S&P 500.

|

Thompson Clark's High Conviction Investor Accepting New Members. |

Real Estate Egregiousness

The spread between the S&P 500 and risk-free Treasuries is strange, but it’s not the most egregious example I’ve noticed.

For that, we turn to real estate—specifically, residential single-family rental real estate.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Others, however, are opting to keep their home and mortgage, then rent it out. The simple math (for them) is all right: “$3,000 a month in rent versus a $1,500 mortgage… great! I’ll make $1,500 a month.”

Unfortunately, it’s not that simple. They’re not looking at maintenance costs, vacancy loss, and other real cash expenses related to renting out a property. Adjusting for those factors, monthly cash flow is probably closer to $1,000 per month, or $12,000 per year.

And outside of not properly evaluating the additional costs and risks, they’re not looking at what other options exist for their capital.

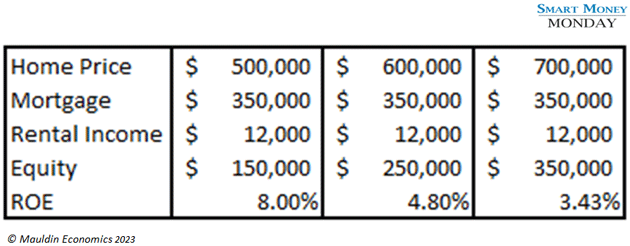

This scenario I’m describing is based on actual homes around me here in Raleigh, North Carolina. Homes with market values of $600,000 or higher are currently renting for $3,000 per month. Using that $1,500 per month mortgage example, the homeowner probably has a $350,000 mortgage.

So, on their $250,000 in equity, they’re generating $12,000 per year. That’s less than a 5% return on their equity.

The scenario gets worse, in a way, when home prices rise. If the home is worth $700,000, their return on equity decreases to 3.4%.

The sale of the home will be tax-free up to the first $500,000 if they’re married filing jointly, so there’s no tax leakage.

As you can probably guess, my suggestion here is that they sell! They’re forgetting the rest of the investment menu. Instead of dealing with late-night calls from annoyed tenants or fixing a roof leak or broken dishwasher, they could be collecting checks from owning risk-free US Treasuries.

Real estate investors love the concept of “mailbox money.” It’s another way of saying “passive income.”

In my example, $250,000 in equity upon sale would generate over $1,000 per month in mailbox money if you parked it in risk-free US Treasuries earning 5%. That’s real mailbox money.

Of course, humans aren’t rational. We all make weird choices that don’t make sense. Will rational investing prevail in certain parts of the single-family real estate world? I doubt it.

My sense is that homeowners who are renting their homes are desperate to preserve that 3% mortgage—no matter the opportunity cost. In addition, they like the status of being a landlord. In their mind, they’re now a “real estate investor.”

Which is true... but I wouldn’t say they’re a good one.

Today, when thinking about investing options, it’s essential to look at what other options exist. And one of the best options today is risk-free US Treasuries.

Thanks for reading,

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark